- Meta Platforms strengthens its AI capabilities by recruiting top OpenAI researchers.

- Current analyst price targets suggest limited upside potential for META.

- GF Value analysis indicates META might be overvalued at current prices.

Meta Platforms (META, Financial) is making strategic moves in the competitive tech arena by recruiting top researchers from OpenAI to enhance its superintelligence initiatives. This is part of Meta's robust strategy to drive forward its AI capabilities and maintain an edge over competitors.

Wall Street Analysts Forecast

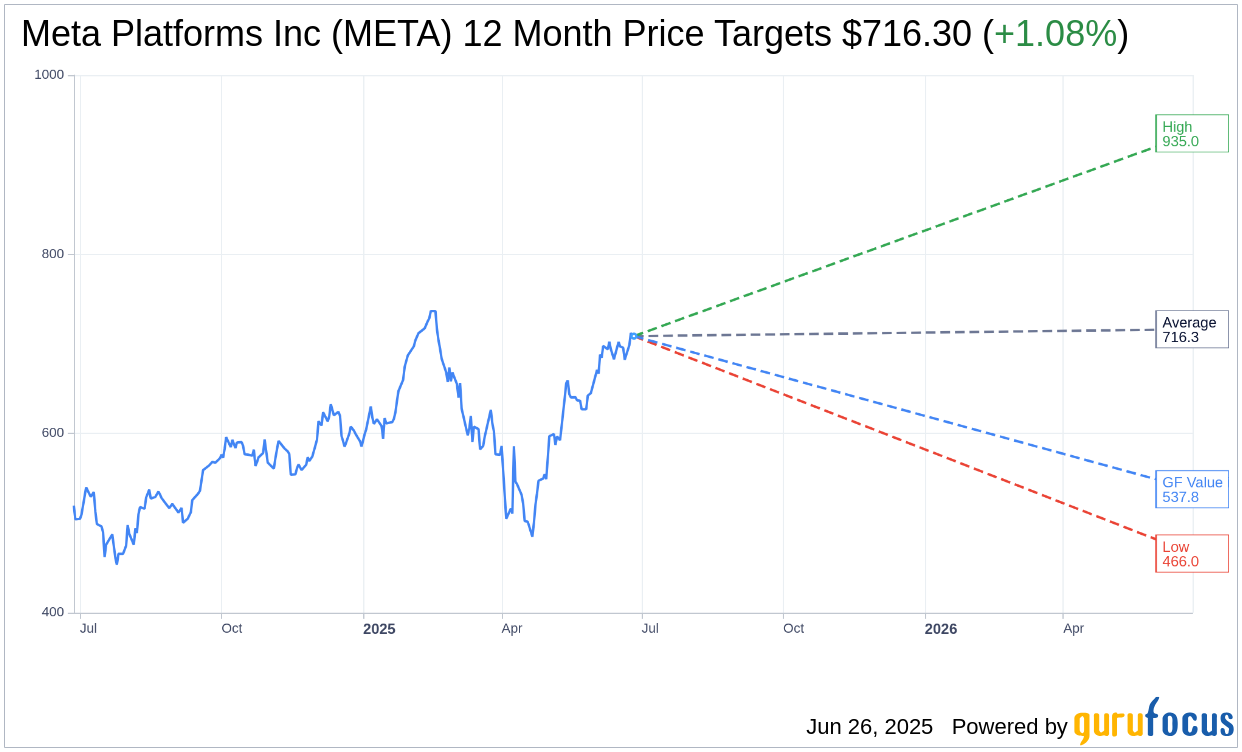

In their latest analyses, 61 Wall Street analysts have set an average one-year price target for Meta Platforms Inc (META, Financial) at $716.30. Prices are projected to range from a high of $935.00 to a low of $466.00. This average target suggests a potential upside of 1.08% from the current trading price of $708.68. For further insights, visit the Meta Platforms Inc (META) Forecast page.

From the perspectives of 71 brokerage firms, Meta Platforms Inc (META, Financial) holds an average brokerage recommendation of 1.8, positioning it within the "Outperform" category. This rating leverages a scale where 1 indicates a Strong Buy and 5 a Sell, signaling positive sentiment among analysts.

GF Value Analysis

According to GuruFocus, the estimated GF Value for Meta Platforms Inc (META, Financial) in the upcoming year is $537.77, indicating a possible downside of 24.12% from its current market price of $708.68. The GF Value is computed based on historical multiples, business growth history, and future performance estimates, providing a comprehensive fair value assessment. Explore more details on the Meta Platforms Inc (META) Summary page.