On June 26, 2025, Orion Energy Systems Inc (OESX, Financial), a developer, manufacturer, and seller of lighting and energy management systems, released its 8-K filing detailing the financial results for the fourth quarter and fiscal year ended March 31, 2025. The company operates through segments including Orion Lighting, Orion Maintenance, and Orion Electric Vehicle Charging, with the majority of revenue derived from the Lighting Segment.

Performance and Challenges

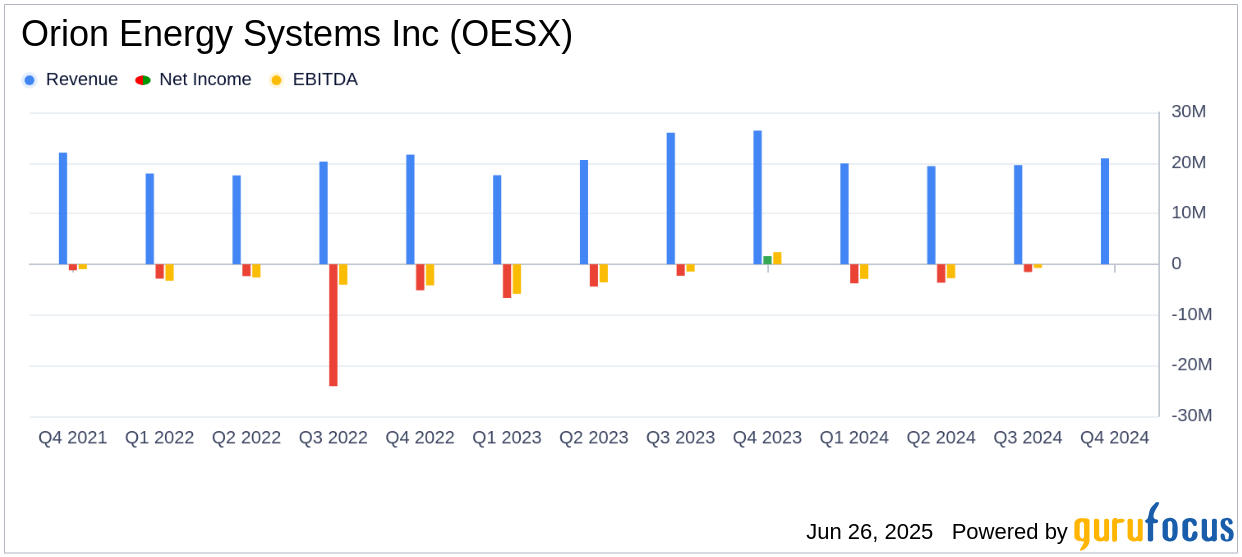

Orion Energy Systems Inc reported a Q4 2025 revenue of $20.9 million, a 21% decrease from $26.4 million in Q4 2024, missing the analyst estimate of $21.18 million. The decline was primarily due to reduced LED lighting revenue and a decrease in maintenance revenue, partially offset by an 18% increase in EV charging revenue. For the full fiscal year 2025, revenue was $79.7 million, down 12% from $90.6 million in FY 2024, missing the estimated revenue of $80.05 million.

Financial Achievements

Despite the revenue decline, Orion Energy Systems Inc achieved a gross margin of 25.4% for FY 2025, an increase of 230 basis points from the previous year. This improvement was attributed to strategic pricing and cost actions across the business. The company also reported positive adjusted EBITDA for the second consecutive quarter in Q4 2025, reflecting operational improvements and cost management.

Income Statement and Key Metrics

Orion Energy Systems Inc's gross profit for Q4 2025 was $5.7 million, down from $6.8 million in Q4 2024. The gross profit percentage increased to 27.5% from 25.8% in the same period last year. The company reported a net loss of $2.9 million, or $0.09 per share, in Q4 2025, compared to a net income of $1.6 million, or $0.05 per share, in Q4 2024. For the full fiscal year, the net loss was $11.8 million, or $0.36 per share, missing the estimated earnings per share of -$0.33.

Balance Sheet and Cash Flow

Orion Energy Systems Inc ended FY 2025 with $6.0 million in cash and equivalents, up from $5.2 million at the end of FY 2024. The company reduced its borrowings on the revolving credit facility by $3.0 million to $7.0 million. The company's working capital stood at $8.7 million, with total assets of $52.5 million and total liabilities of $40.6 million.

CEO Commentary

Orion CEO Sally Washlow commented, “Orion has made solid progress supporting our growth goals with new revenue opportunities while also reducing our cost structure and enhancing margins to drive improved bottom line performance. However, our FY’25 revenue was impacted by a lower level of larger LED lighting project activity as well as reduced sales within our electrical contractor and lighting distribution channel.”

Analysis and Outlook

Orion Energy Systems Inc's performance in FY 2025 highlights the challenges faced due to reduced LED lighting project activity and decreased sales in certain channels. However, the company has made significant strides in improving its gross margin and achieving positive adjusted EBITDA. The company's focus on cost management and strategic pricing has positioned it for potential growth in FY 2026, with an anticipated revenue increase of 5% to approximately $84 million. The company's efforts to expand its LED lighting project pipeline and enhance its EV charging business are expected to contribute to future growth.

| Metric | Q4 2025 | Q4 2024 | FY 2025 | FY 2024 |

|---|---|---|---|---|

| Total Revenue | $20.9M | $26.4M | $79.7M | $90.6M |

| Gross Profit | $5.7M | $6.8M | $20.2M | $20.9M |

| Net Income (Loss) | $(2.9M) | $1.6M | $(11.8M) | $(11.7M) |

| Gross Margin | 27.5% | 25.8% | 25.4% | 23.1% |

Explore the complete 8-K earnings release (here) from Orion Energy Systems Inc for further details.