CRISPR Therapeutics (CRSP, Financial) has provided new updates on its in vivo cardiovascular disease initiatives. The company shared advancements for CTX310, a treatment targeting ANGPTL3, with new findings from their Phase 1 trial involving four patient groups. These results build on earlier data from the initial ten patients and four cohorts. CRISPR Therapeutics plans to present the full Phase 1 results of CTX310 at a medical conference in the latter half of 2025.

Additionally, CTX320, which targets the LPA gene in individuals with high lipoprotein levels, is currently in a Phase 1 clinical trial with patient enrollment and dose evaluations ongoing. An update on this trial is anticipated in early 2026, as the company aims to integrate new insights from the evolving Lp landscape into its strategy.

The preclinical CTX340 program, designed to treat refractory hypertension by targeting angiotensinogen, is progressing through studies necessary to enable IND/CTA submissions. CRISPR Therapeutics continues to advance these programs as part of its commitment to addressing cardiovascular diseases.

Wall Street Analysts Forecast

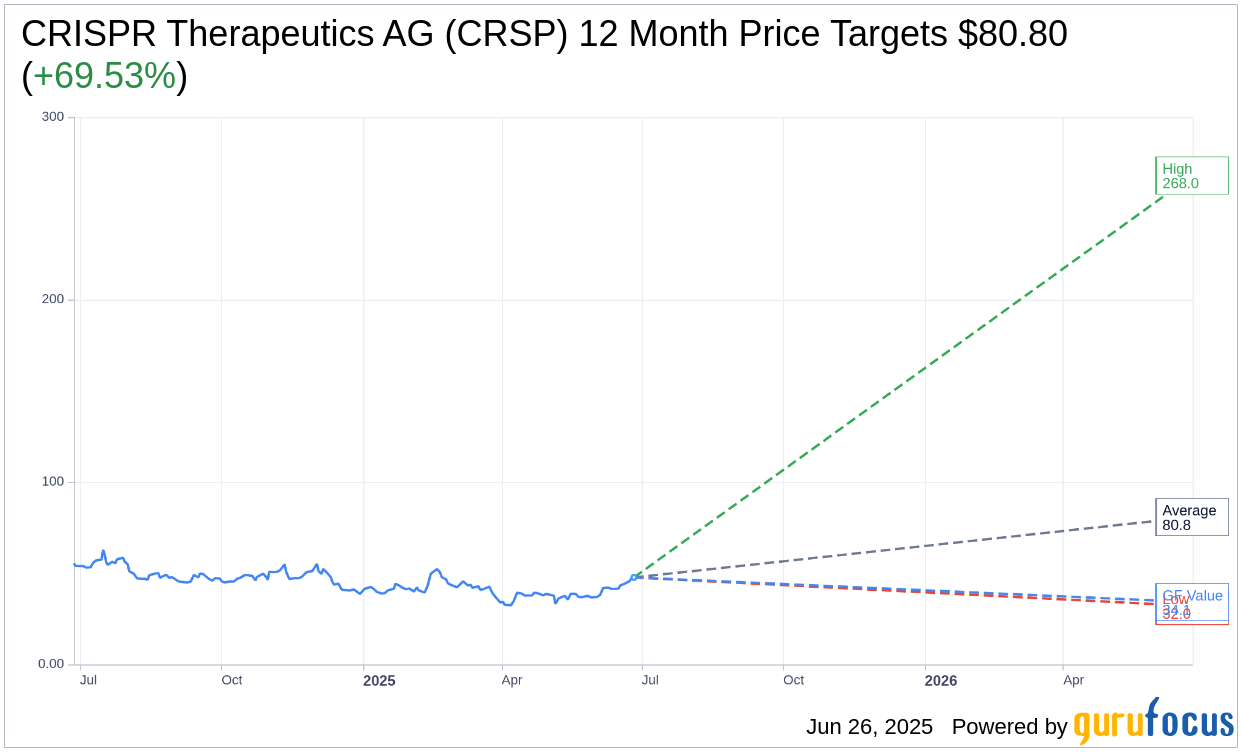

Based on the one-year price targets offered by 24 analysts, the average target price for CRISPR Therapeutics AG (CRSP, Financial) is $80.80 with a high estimate of $268.00 and a low estimate of $32.00. The average target implies an upside of 69.53% from the current price of $47.66. More detailed estimate data can be found on the CRISPR Therapeutics AG (CRSP) Forecast page.

Based on the consensus recommendation from 29 brokerage firms, CRISPR Therapeutics AG's (CRSP, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CRISPR Therapeutics AG (CRSP, Financial) in one year is $34.13, suggesting a downside of 28.39% from the current price of $47.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CRISPR Therapeutics AG (CRSP) Summary page.