Beyond Meat (BYND, Financial) has recently seen a significant rise in its indicative borrow rate, which climbed to 50.87%, marking an increase of 0.43 percentage points. This development is noteworthy as the company continues to attract attention in the borrowing market, indicating changing dynamics in investor sentiment and interest. Borrow rates often reflect the demand and supply dynamics in the options market, influencing how investors and traders approach their strategies regarding the stock. Such changes can signal broader market trends or specific company-related developments that might impact future performance.

Wall Street Analysts Forecast

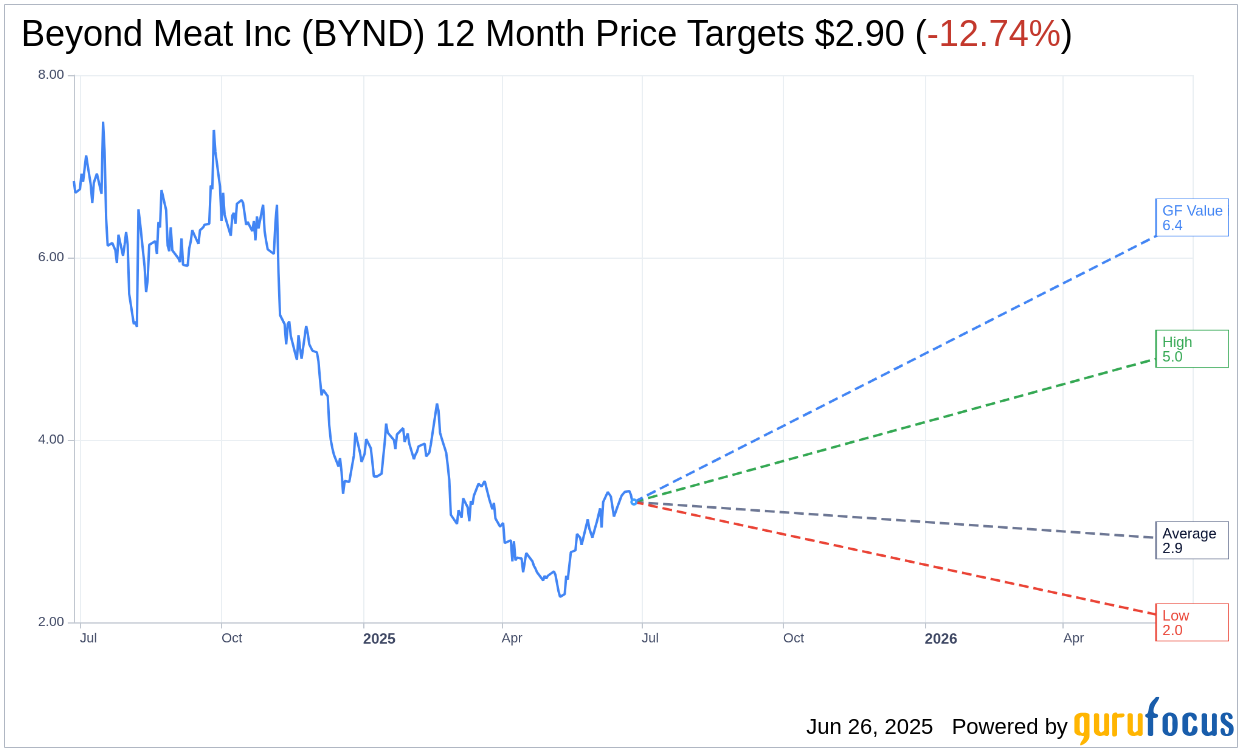

Based on the one-year price targets offered by 7 analysts, the average target price for Beyond Meat Inc (BYND, Financial) is $2.90 with a high estimate of $5.00 and a low estimate of $2.00. The average target implies an downside of 12.74% from the current price of $3.32. More detailed estimate data can be found on the Beyond Meat Inc (BYND) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Beyond Meat Inc's (BYND, Financial) average brokerage recommendation is currently 3.5, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Beyond Meat Inc (BYND, Financial) in one year is $6.44, suggesting a upside of 93.98% from the current price of $3.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Beyond Meat Inc (BYND) Summary page.

BYND Key Business Developments

Release Date: May 07, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Beyond Meat Inc (BYND, Financial) is focusing on improving production efficiency and costs through consolidating its production network and increasing internal production at its Pennsylvania facility.

- The company has launched new products like Beyond Chicken Pieces, which have been developed with a focus on taste, texture, ingredients, and nutrition.

- Beyond Meat Inc (BYND) is actively working on dispelling misinformation about its products and is launching marketing campaigns like 'Real People, Real Results' to improve consumer perception.

- The company has secured a financing facility providing up to $100 million in new senior secured debt, offering additional liquidity to support strategic priorities.

- Beyond Meat Inc (BYND) is seeing positive consumer reviews and accolades for its products, including the Beyond Burger, which has won first place in consumer surveys multiple times.

Negative Points

- Net revenues decreased by 9.1% in Q1 2025 compared to the previous year, primarily due to a decrease in product volume sold.

- The company experienced significant distribution challenges as large retail customers transitioned plant-based meat from refrigerated to frozen aisles, impacting product availability.

- Gross margin was negative in Q1 2025, with a loss of $1.1 million, impacted by lower sales volumes and higher costs.

- Beyond Meat Inc (BYND) is facing macroeconomic headwinds and consumer demand softness, particularly in the US retail and food service channels.

- The company has withdrawn its full-year guidance due to elevated uncertainty in the operating environment, reflecting challenges in predicting demand and market conditions.