Mizuho has revised its price target for Adverum Biotechnologies (ADVM, Financial), lowering it from $16 to $12, while maintaining an Outperform rating for the stock. This adjustment follows an update to Adverum's financial model after their second-quarter earnings report. Despite this change, Mizuho's favorable outlook on Adverum's key product, ixo-vec, remains strong. The firm expresses optimism about ixo-vec's market potential but highlights the urgency for Adverum to secure significant funding or establish a meaningful partnership soon, due to its limited cash reserves.

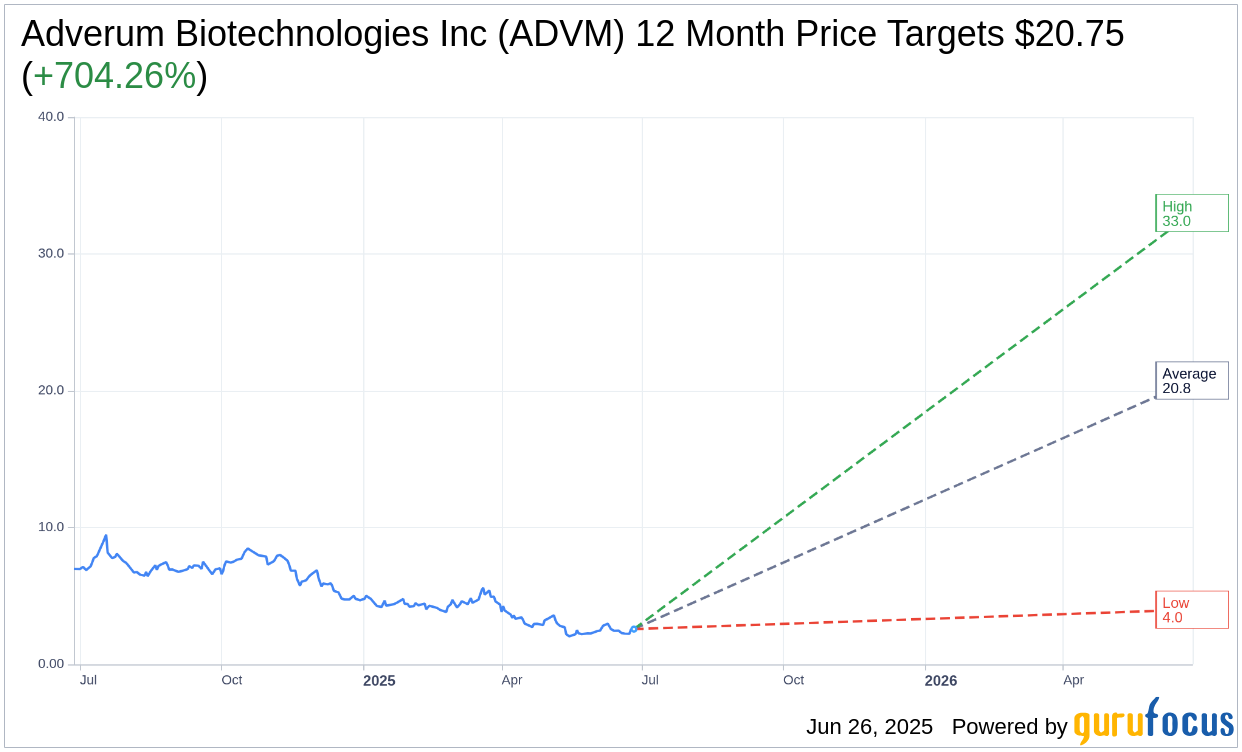

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Adverum Biotechnologies Inc (ADVM, Financial) is $20.75 with a high estimate of $33.00 and a low estimate of $4.00. The average target implies an upside of 704.26% from the current price of $2.58. More detailed estimate data can be found on the Adverum Biotechnologies Inc (ADVM) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Adverum Biotechnologies Inc's (ADVM, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.