- Seagate Technology (STX, Financial) stands out in growth metrics, rivaling top tech stocks like Nvidia and KLA Corp.

- Analysts provide a mixed outlook with average price targets suggesting potential downside.

- Seagate's "Outperform" recommendation highlights its appeal among investors.

Seagate Technology (STX) has captured the attention of investors as a top contender in growth metrics. Analysts at BMO Capital Markets have highlighted Seagate's potential by evaluating crucial factors such as next-twelve-month EPS growth and return on equity (ROE). With this analysis, Seagate is positioned alongside industry leaders like Nvidia and KLA Corp., signaling robust potential for growth-focused investors.

Wall Street Analysts Forecast

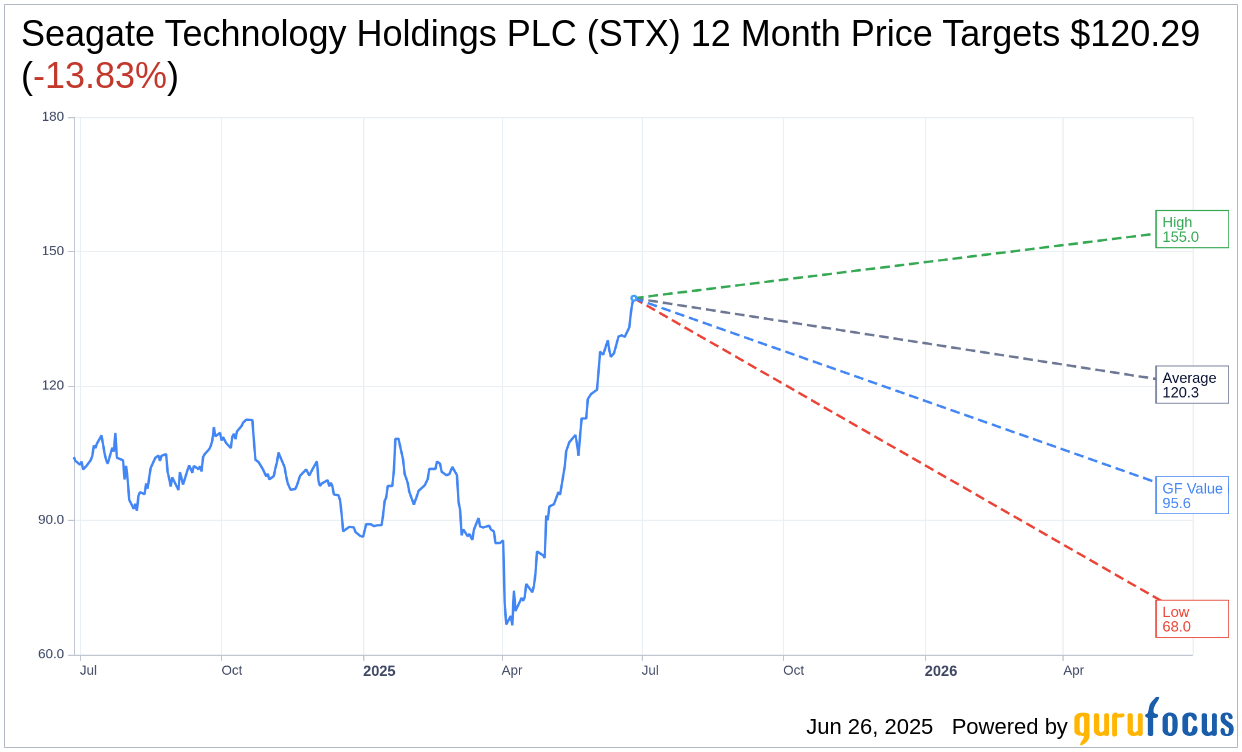

In examining the one-year price targets proposed by 19 analysts, the average target price for Seagate Technology Holdings PLC (STX, Financial) is set at $120.29. This estimate is bounded by a high of $155.00 and a low of $68.00. The current price of $139.60 suggests an implied downside of 13.83%. For more comprehensive insights, visit the Seagate Technology Holdings PLC (STX) Forecast page.

The collective consensus from 24 brokerage firms rates Seagate Technology Holdings PLC (STX, Financial) with an average recommendation of 2.2, placing it in the "Outperform" category. This rating scale spans from 1 to 5, wherein 1 denotes a "Strong Buy," and 5 indicates a "Sell."

According to GuruFocus estimates, the projected GF Value for Seagate Technology Holdings PLC (STX, Financial) over the next year is $95.61, suggesting a potential downside of 31.51% from the current price of $139.595. The GF Value offers an estimate of the stock's fair trading value, derived from historical trading multiples, past business growth, and future performance projections. For further details, refer to the Seagate Technology Holdings PLC (STX) Summary page.