Summary:

- HIVE Digital Technologies Ltd. (HIVE, Financial) has made significant strides in high-performance computing and Bitcoin mining in 2025.

- The company aims to double its hash rate, with major revenue and EBITDA gains.

- Analysts offer a positive outlook with a substantial target price upside.

Significant Growth and Future Prospects for HIVE Digital Technologies Ltd.

HIVE Digital Technologies Ltd. (HIVE) has marked 2025 as a transformative year, showcasing remarkable progress in its high-performance computing and Bitcoin mining operations. With the company’s ambition to double its high-performance computing business run rate and hash rate to 22 exahash by American Thanksgiving, HIVE is setting a strong pace in the industry. A pivotal acquisition of a major data center in Toronto further underscores HIVE's strategic growth path. This year, HIVE achieved over $115 million in revenue, with an impressive adjusted EBITDA of $56 million and a market capitalization of $350 million.

Wall Street Analysts' Optimistic Forecast

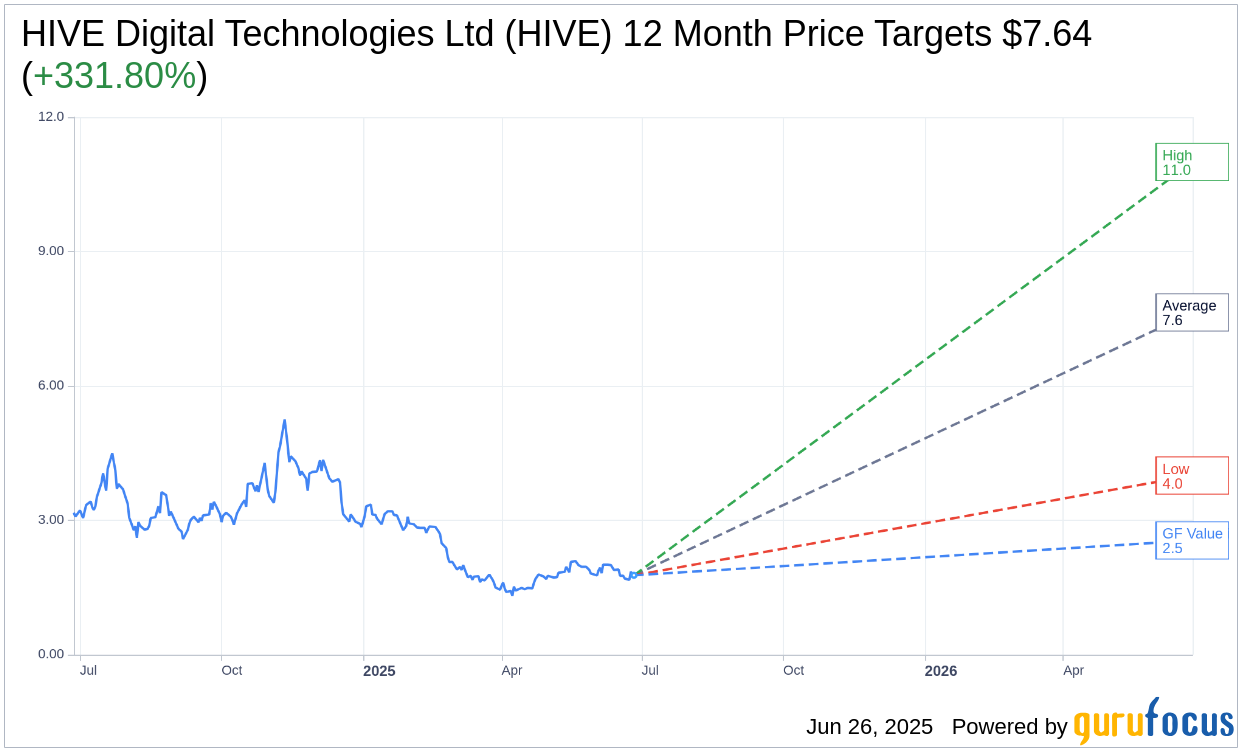

The outlook from Wall Street analysts indicates a promising future for HIVE Digital Technologies Ltd. (HIVE, Financial). According to one-year price targets set by 7 analysts, the average target price stands at $7.64, with the high estimate reaching $11.00 and the low at $4.00. This average target suggests a compelling upside of 331.80% from the current share price of $1.77. Investors seeking more detailed estimates can access additional information on the HIVE Digital Technologies Ltd (HIVE) Forecast page.

Adding to the positive sentiment, the consensus recommendation from 7 brokerage firms rates HIVE Digital Technologies Ltd. (HIVE, Financial) with an average recommendation of 2.0, which translates to an "Outperform" status. This rating utilizes a scale where 1 is a Strong Buy and 5 is a Sell, highlighting analysts' confidence in HIVE's growth trajectory.

Evaluating the GF Value: Future Growth Potential

According to GuruFocus estimates, the forecasted GF Value for HIVE Digital Technologies Ltd. (HIVE, Financial) within a year is pegged at $2.55. This projection suggests a 44.07% upside from the current price of $1.77. The GF Value is a unique metric representing the fair trading value of a stock, derived from historical multiples, business growth trends, and future performance estimates. For further insight into HIVE's market positioning and potential, more comprehensive data are available on the HIVE Digital Technologies Ltd (HIVE) Summary page.