Investors should take note of these key points regarding Apple Inc (AAPL, Financial) and its recent strategic moves in response to EU regulations:

- Apple is adjusting its business model for EU app developers to comply with the Digital Markets Act.

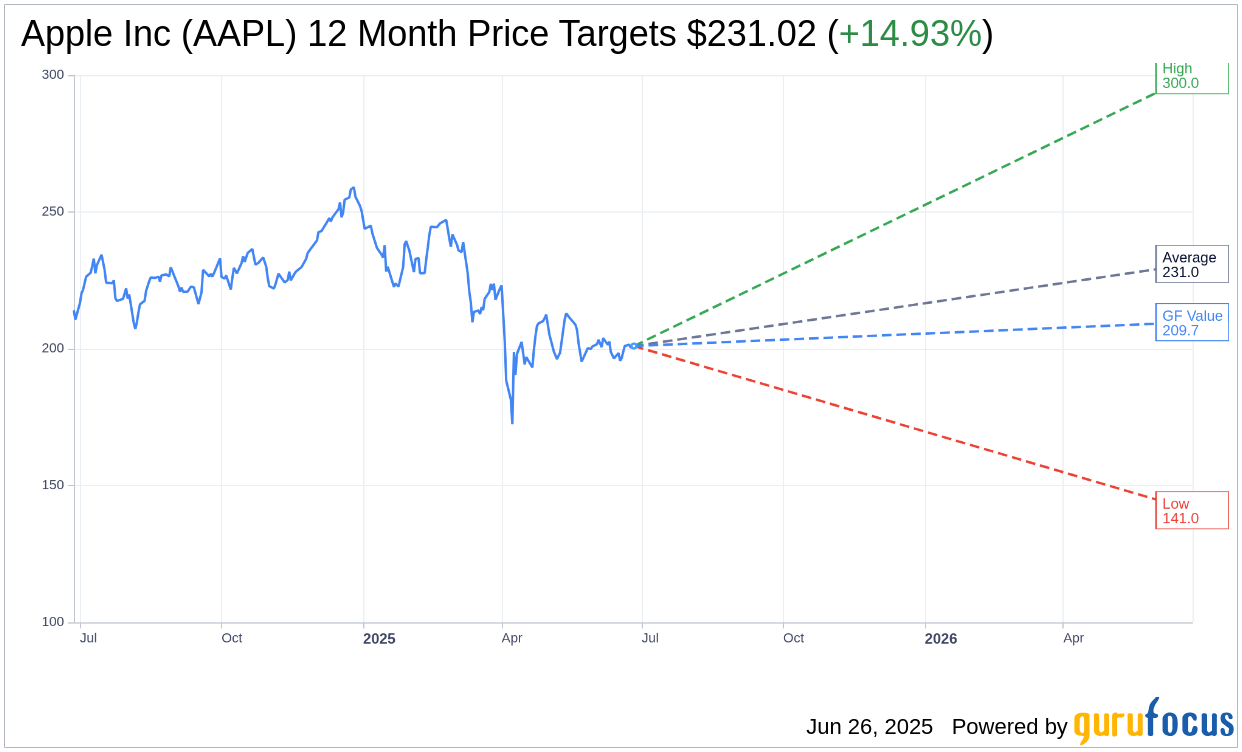

- Analysts project a 14.93% upside with a one-year price target of $231.02.

- The company's "Outperform" status is supported by a strong brokerage consensus.

Apple's Strategic Shift in the European Union

Apple Inc. (AAPL, Financial) is set to implement significant changes in its business approach within the European Union. This strategic pivot allows app developers to promote digital goods through external platforms, aligning Apple with the European Commission's Digital Markets Act. By embracing this shift, Apple aims to sidestep potentially severe fines for previous regulatory violations. A consistent business model for all EU developers is projected for implementation by 2026.

Wall Street Analysts' Projections for AAPL

According to projections from 41 analysts, Apple Inc. (AAPL, Financial) has an average one-year target price of $231.02. This forecast includes a high estimate of $300.00 and a low of $141.00, suggesting a potential upside of 14.93% from the current trading price of $201.00. For a detailed breakdown, visit the Apple Inc (AAPL) Forecast page.

Brokerage Recommendations and GF Value Estimation

Apple Inc. currently holds a consensus "Outperform" rating from 50 brokerage firms, with an average recommendation of 2.2 on a scale where 1 indicates a Strong Buy and 5 implies Sell. This demonstrates a favorable outlook among analysts.

Moreover, the GuruFocus estimated GF Value for Apple Inc. (AAPL, Financial) stands at $209.73, highlighting a modest upside of 4.34% from the current price of $201.00. The GF Value represents GuruFocus' fair value estimation, calculated using Apple's historical trading multiples, past growth, and projected future performance. Further insights are accessible on the Apple Inc (AAPL) Summary page.