Citi analyst Ygal Arounian has increased the price target for Bumble (BMBL, Financial) to $7, up from a previous $4.80, while maintaining a Neutral rating on the stock. The company's recent announcement of reducing its workforce by 30% is expected to lead to annual cost savings of $40 million. However, most of these savings are planned to be reinvested into the business.

The positive sentiment from Citi is also driven by Bumble's updated financial guidance, with Q2 revenue expectations rising by 3% and EBITDA by 11%. Despite these encouraging adjustments, Citi highlights that Bumble's efforts to revive its growth are just beginning. The analyst indicates that achieving sustained and robust growth remains a challenging yet essential task for the company.

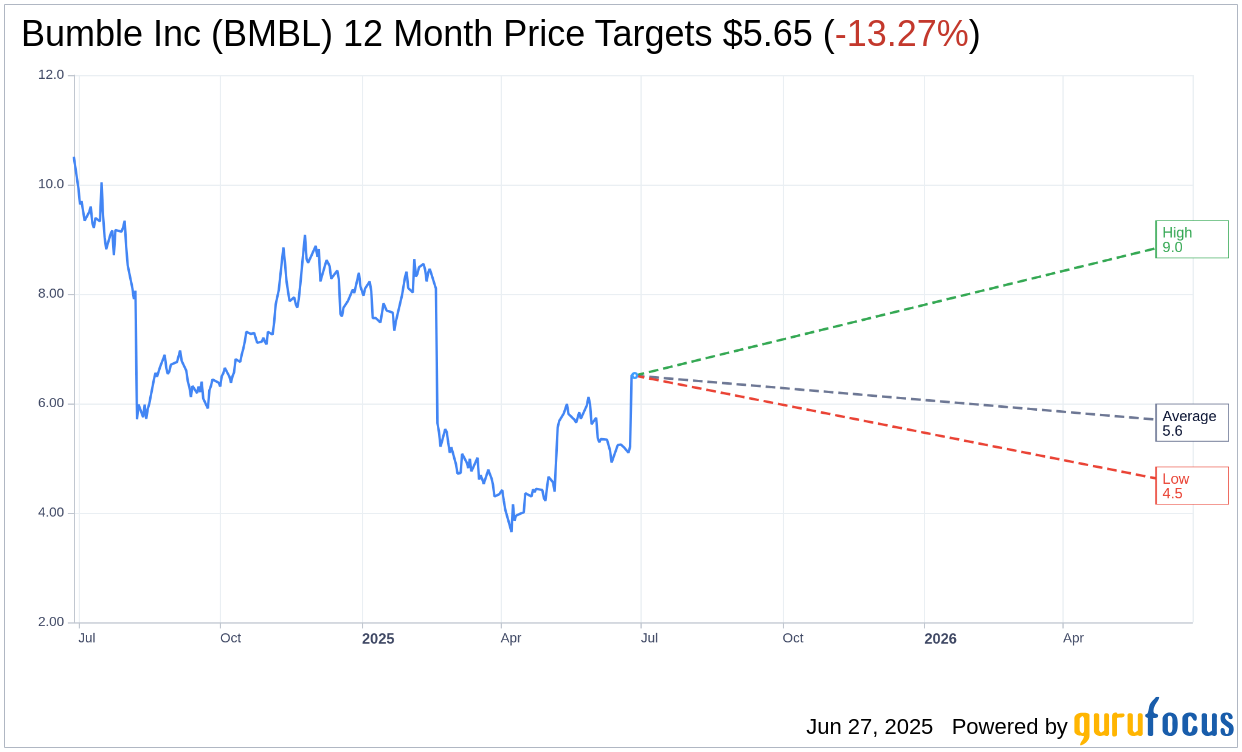

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Bumble Inc (BMBL, Financial) is $5.65 with a high estimate of $9.00 and a low estimate of $4.50. The average target implies an downside of 13.27% from the current price of $6.51. More detailed estimate data can be found on the Bumble Inc (BMBL) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Bumble Inc's (BMBL, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bumble Inc (BMBL, Financial) in one year is $19.99, suggesting a upside of 207.07% from the current price of $6.51. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bumble Inc (BMBL) Summary page.

BMBL Key Business Developments

Release Date: May 07, 2025

- Total Revenue: $247 million, including a $6 million unfavorable impact from foreign exchange.

- Bumble App Revenue: $202 million, with a $4 million foreign exchange headwind.

- Badoo App and Other Revenue: $45 million, including a $2 million foreign exchange headwind.

- Total Paying Users: 4 million.

- Bumble App Paying Users: 2.7 million.

- Badoo App and Other Paying Users: 1.3 million.

- Non-GAAP Operating Costs: $202 million.

- GAAP Net Earnings: $20 million.

- Adjusted EBITDA: $64 million, representing 26% of revenue.

- Cash Flow: $43 million in Q1.

- Cash and Cash Equivalents: $202 million at the end of the quarter.

- Stock Repurchase: $29 million worth of shares repurchased in Q1.

- Q2 Revenue Guidance: $235 million to $243 million, a year-over-year decrease of 13% to 10%.

- Q2 Adjusted EBITDA Guidance: $79 million to $84 million, with a margin of approximately 34% at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bumble Inc (BMBL, Financial) is focusing on improving the quality of matches by removing bots, scammers, and low-quality profiles, which is expected to enhance user experience and trust.

- The company is investing in AI and machine learning to modernize its matching algorithm, aiming to provide more personalized and relevant matches.

- Bumble Inc (BMBL) has identified $15 million in cost savings and is optimizing EBITDA profitability by streamlining costs and processes.

- The company is reducing its reliance on performance marketing, focusing instead on organic growth strategies to attract high-quality users.

- Bumble Inc (BMBL) is expanding its product offerings, including enhancements to its Discover tab and the introduction of a Coaching Hub, which aims to improve user engagement and satisfaction.

Negative Points

- The focus on improving match quality may result in fewer paying members in the short term, impacting revenue.

- Bumble Inc (BMBL) is experiencing a decrease in total revenue, with a year-over-year decline expected in Q2 2025.

- The company is pausing its practice of guiding to paying users, which may create uncertainty for investors regarding user growth metrics.

- There is a $12 million revenue headwind expected due to the discontinuation of operations for Fruitz and Official.

- Bumble Inc (BMBL) is facing challenges in international markets, with similar user complaints about match quality and fake profiles across different regions.