Key Highlights:

- Meta Platforms (META, Financial) may decrease its investment in Llama language models, potentially pivoting towards AI solutions from OpenAI and Anthropic.

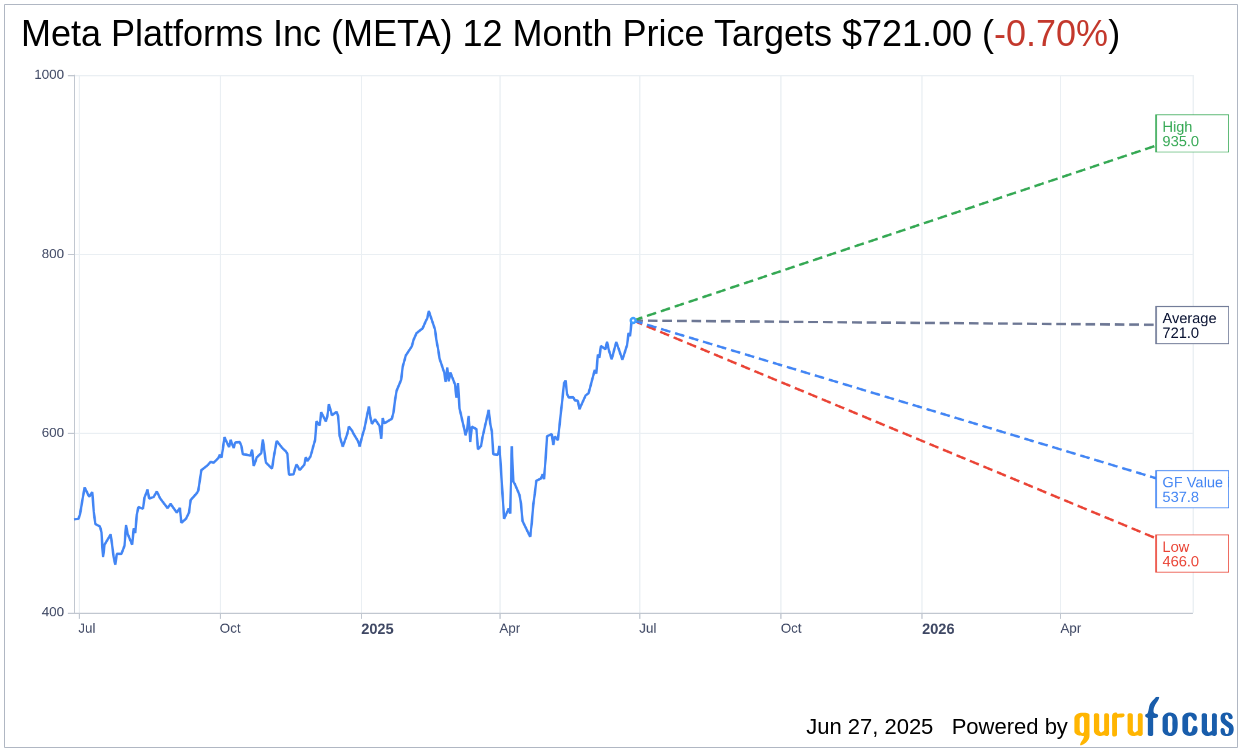

- Wall Street analysts predict a varied performance for META, with a high estimate reaching $935.00.

- GuruFocus metrics suggest META might be trading above its estimated GF Value, indicating potential overvaluation.

Meta Platforms (META) is reportedly considering a strategic shift in its artificial intelligence (AI) investments. The company may reduce funding for its Llama language models, opting instead for proprietary models from competitors such as OpenAI and Anthropic. This marks a significant move from open-source AI solutions to more exclusive, proprietary technologies. Simultaneously, Meta is actively acquiring top AI talent and technology to enhance its capabilities.

Wall Street Analysts Forecast

Price targets set by 61 analysts suggest that Meta Platforms Inc (META, Financial) could reach an average target price of $721.00. This forecast encompasses a high estimate of $935.00 and a low of $466.00, pointing to a potential downside of 0.70% from its current value of $726.09. For a comprehensive analysis and more detailed data, visit the Meta Platforms Inc (META) Forecast page.

The consensus from 71 brokerage firms currently rates Meta Platforms Inc's (META, Financial) as an "Outperform," with an average recommendation score of 1.8. This rating uses a scale where 1 denotes a Strong Buy and 5 indicates a Sell.

GuruFocus metrics provide insight into Meta's valuation, with the estimated GF Value projected at $537.77 over the next year. This suggests a potential downside of 25.94% from the present price of $726.09. The GF Value is GuruFocus' estimation of fair stock value, derived from historical trading multiples, previous business growth, and future performance predictions. For further details, refer to the Meta Platforms Inc (META, Financial) Summary page.