On June 27, 2025, Capstone Green Energy Holding Inc (CGEH, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full fiscal year ending March 31, 2025. Capstone, a leader in microgrid solutions and Energy-as-a-Service (EaaS) offerings, has reached a significant milestone by achieving its first full-year positive Adjusted EBITDA, reflecting the company's strategic focus on financial health, sustainable excellence, and cultural revitalization.

Performance and Challenges

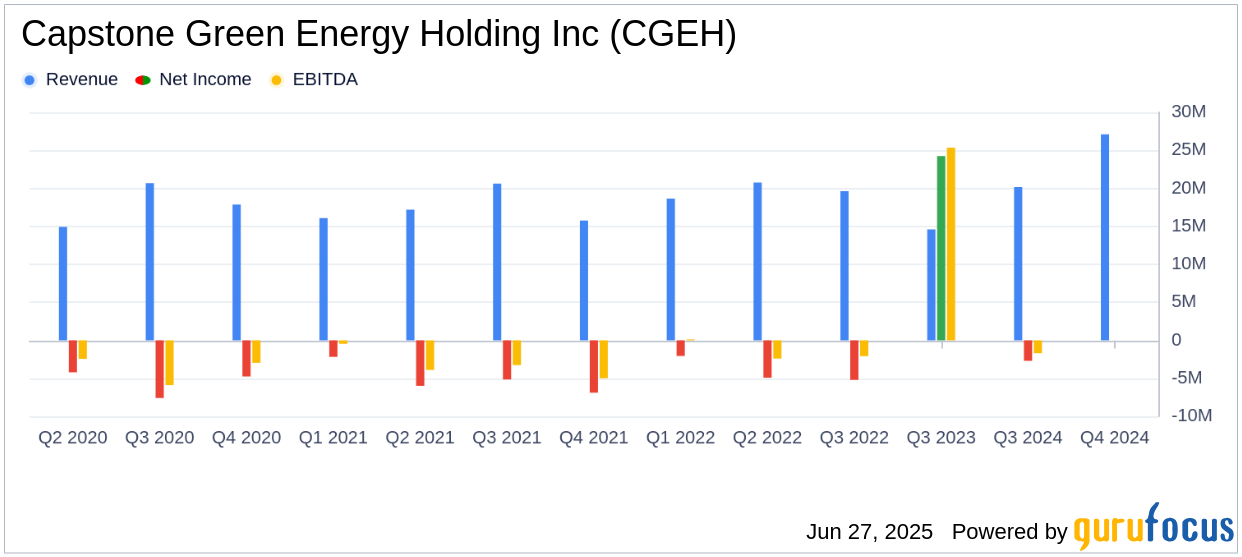

Capstone Green Energy Holding Inc (CGEH, Financial) reported a revenue of $27.1 million for the fourth quarter of fiscal 2025, an increase from $24.3 million in the same quarter of the previous year. However, the annual revenue saw a decline to $85.6 million from $91.2 million in fiscal 2024, primarily due to slow product sales in the first half of the fiscal year, attributed to restructuring hesitancy and instability in Europe. Despite these challenges, the company improved its gross profit and margin significantly, showcasing the effectiveness of its strategic initiatives.

Financial Achievements

The company's gross profit for the fourth quarter of 2025 was $7.5 million, a substantial increase of $4.9 million compared to the same period in fiscal 2024. The gross margin improved by 17% to reach 28%, driven by higher product and rental pricing, increased rental fleet utilization, and cost efficiencies. For the full fiscal year 2025, Capstone reported a gross profit of $23.3 million with a margin of 27%, up from $14.3 million and a margin of 16% in fiscal 2024. These achievements underscore the company's focus on enhancing financial health and operational efficiency.

Key Financial Metrics

Capstone's net loss for the fourth quarter of fiscal 2025 was reduced to $0.1 million from $5.3 million in the previous year. The Adjusted EBITDA for the quarter was $2.8 million, a significant improvement from a negative $0.8 million in fiscal 2024. The company's total cash as of March 31, 2025, was $8.7 million, marking an increase of $6.6 million from the previous year. These metrics highlight the company's successful cost management and strategic financial planning.

| Metric | Q4 FY 2025 | Q4 FY 2024 | FY 2025 | FY 2024 |

|---|---|---|---|---|

| Revenue | $27.1M | $24.3M | $85.6M | $91.2M |

| Gross Profit | $7.5M | $2.6M | $23.3M | $14.3M |

| Net Loss | -$0.1M | -$5.3M | N/A | N/A |

| Adjusted EBITDA | $2.8M | -$0.8M | $7.9M | N/A |

| Total Cash | $8.7M | $2.1M | N/A | N/A |

Analysis and Commentary

Capstone Green Energy Holding Inc (CGEH, Financial) has demonstrated resilience and strategic foresight in navigating the challenges of fiscal 2025. The company's focus on financial health and operational excellence has resulted in a historic achievement of positive Adjusted EBITDA for the full fiscal year. This milestone is a testament to the company's ability to adapt and thrive amidst market fluctuations.

“The Company has taken great strides over the past year. We are pleased with the Company's fourth-quarter results for fiscal 2025, which reflect the improvements in our services and rental business revenues, and lower costs of goods sold driven by our cost-out initiatives,” said John Juric, Chief Financial Officer of Capstone.

As Capstone Green Energy Holding Inc (CGEH, Financial) moves forward, the company aims to elevate its stock positioning and continue its strategic growth, leveraging its strengthened financial foundation and market position. The closure of the SEC investigation with no action taken further clears the path for Capstone to focus on its long-term goals and strategic initiatives.

Explore the complete 8-K earnings release (here) from Capstone Green Energy Holding Inc for further details.