A recent alert from Betaville has caught the attention of investors with a rumor involving Verint (VRNT, Financial). Sources indicate that this speculation has led to a slight increase in the company's stock, which rose by 14 cents, reaching $19.53 during morning trading. Such movements highlight the market's sensitivity to potential developments around the company.

Wall Street Analysts Forecast

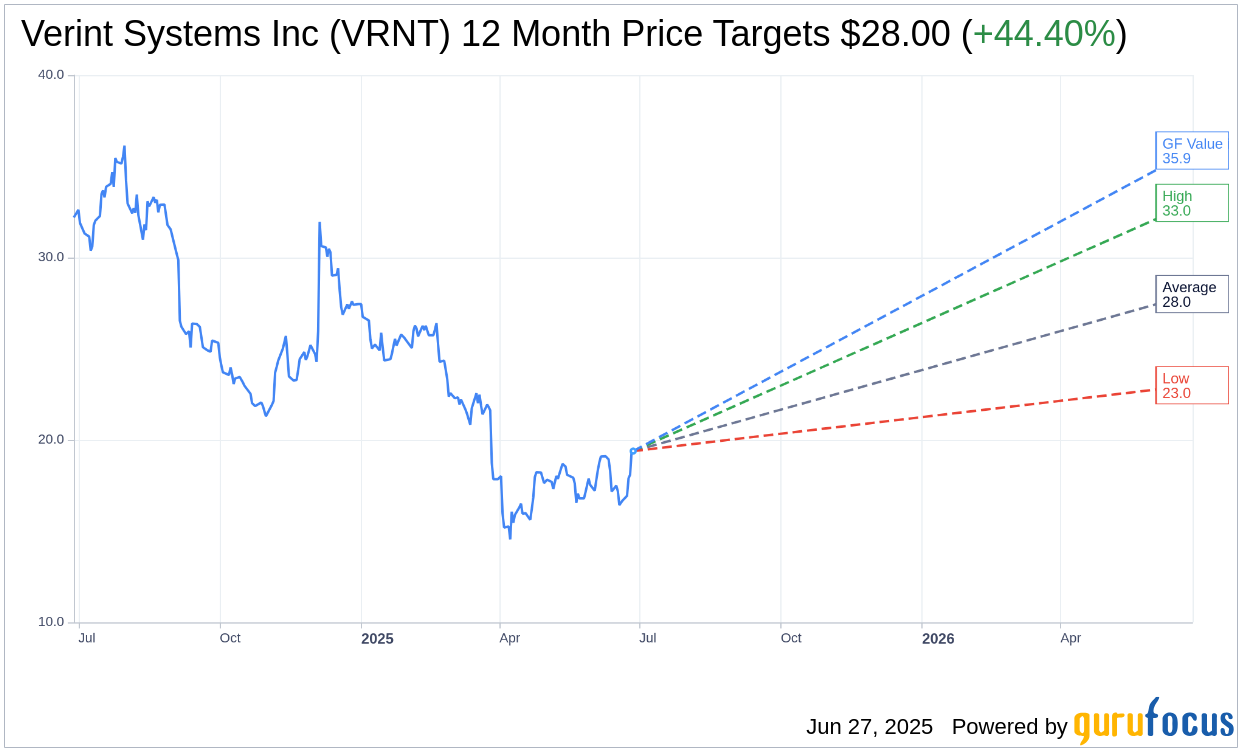

Based on the one-year price targets offered by 6 analysts, the average target price for Verint Systems Inc (VRNT, Financial) is $28.00 with a high estimate of $33.00 and a low estimate of $23.00. The average target implies an upside of 42.93% from the current price of $19.59. More detailed estimate data can be found on the Verint Systems Inc (VRNT) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Verint Systems Inc's (VRNT, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Verint Systems Inc (VRNT, Financial) in one year is $35.87, suggesting a upside of 83.1% from the current price of $19.59. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Verint Systems Inc (VRNT) Summary page.

VRNT Key Business Developments

Release Date: June 04, 2025

- Revenue: $208 million for Q1.

- ARR Growth: Accelerated to 6% year-over-year.

- Non-GAAP Diluted EPS: $0.29 for Q1.

- AI ARR Growth: Increased 24% year-over-year, reaching $354 million.

- Free Cash Flow Growth: Expected to increase approximately 12% to $145 million for the full year.

- Annual Revenue Guidance: Targeting $960 million with a range of plus/minus 3%.

- Annual Non-GAAP Diluted EPS Guidance: $2.93 at the midpoint.

- Q2 Revenue Expectation: Around $200 million.

- Q2 Diluted EPS Expectation: $0.26.

- Net Debt: One times last 12-month EBITDA.

- Stock Buybacks: Approximately 2.5 million common shares repurchased during the quarter.

- Revolver Size: Increased to $500 million, extended term to 2030.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Verint Systems Inc (VRNT, Financial) reported a strong start to the year with Q1 ARR growth accelerating to 6%, surpassing revenue and EPS guidance.

- The company achieved significant large deals, including a $13 million TCV order from an insurance company and a $14 million TCV order from a healthcare company, showcasing strong demand for their AI solutions.

- AI ARR increased by 24% year-over-year, reaching $354 million, indicating robust growth in AI adoption.

- Verint Systems Inc (VRNT) is targeting an 8% ARR growth and double-digit free cash flow growth by the end of the year, demonstrating confidence in their financial outlook.

- The company's hybrid cloud model allows customers to layer AI-powered bots on existing infrastructure, facilitating quick AI deployments and scalability, which is a key differentiator in the market.

Negative Points

- Despite strong growth, Verint Systems Inc (VRNT) faces challenges with customer caution due to previous negative experiences with AI bots from other vendors.

- The market's adoption of AI is still in its early stages, with customers being cautious and requiring proven value before committing to larger investments.

- There is significant competition from both well-funded software players and start-ups in the AI space, which could impact Verint's market share.

- The company's quarterly revenue is heavily influenced by the timing of unbundled SaaS renewals, which introduces volatility in financial performance.

- Verint Systems Inc (VRNT) needs to continuously innovate and maintain differentiation in a rapidly evolving AI market to sustain its growth trajectory.