- Nvidia's strategic acquisition of AI startup CentML enhances its leadership in AI technology.

- Analyst consensus points towards a promising upside potential for Nvidia (NVDA, Financial) stock.

- GuruFocus metrics suggest Nvidia's stock may be undervalued, with significant growth potential.

Nvidia's Strategic Expansion: Acquiring CentML

Nvidia (NVDA) has recently made a strategic move by acquiring AI startup CentML, located in Toronto. This acquisition is part of Nvidia's ongoing efforts to bolster its capabilities in the artificial intelligence sector. Following the acquisition, CentML's CEO, Gennady Pekhimenko, is set to join Nvidia as a senior director, alongside several of his team members transitioning to the tech giant. Prior to its acquisition, CentML successfully secured $30.9 million in venture funding.

Wall Street Analysts' Forecast and Recommendations

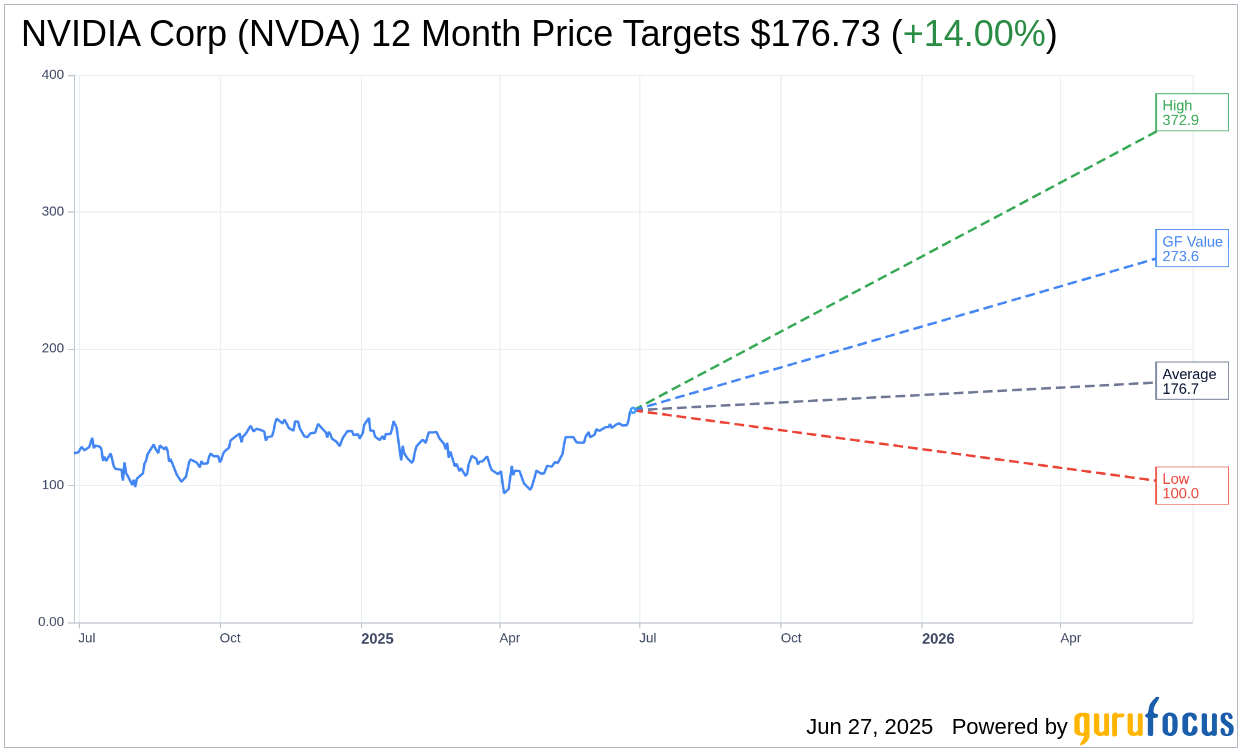

Analysts remain optimistic about Nvidia Corp (NVDA, Financial), with 52 experts offering one-year price targets. The average target stands at $176.73, with estimates ranging between a high of $372.87 and a low of $100.00. This implies a potential upside of 12.19% from the prevailing stock price of $157.52. For further insights into these projections, visit the NVIDIA Corp (NVDA) Forecast page.

The general consensus from 65 brokerage firms presents an average rating of 1.8 for NVIDIA Corp's stock, translating to an "Outperform" status. The rating scale spans from 1 (Strong Buy) to 5 (Sell), underscoring positive sentiment among analysts.

GuruFocus Valuation Insights

According to GuruFocus estimates, the projected GF Value of Nvidia stands at $274.32 in one year. This estimation hints at a substantial upside of 74.15% from the current stock price of $157.5201. The GF Value is derived from historical trading multiples, past business growth, and anticipated future performance metrics. For more comprehensive data, explore the NVIDIA Corp (NVDA, Financial) Summary page.