On June 27, 2025, Clear Street analyst Bill Maughan announced a downgrade for CRISPR Therapeutics (CRSP, Financial), a significant player in the biotechnology sector. The analyst adjusted the rating from a previous "Buy" to a current "Hold."

Alongside this downgrade, Clear Street also revealed the current price target for CRSP, setting it at $45.00 USD. This announcement did not reference a prior price target, indicating a fresh evaluation by the analyst.

Investors in CRSP should note these recent changes in both analyst ratings and the newly set price target, as they may impact the stock's performance and market perception in the coming period.

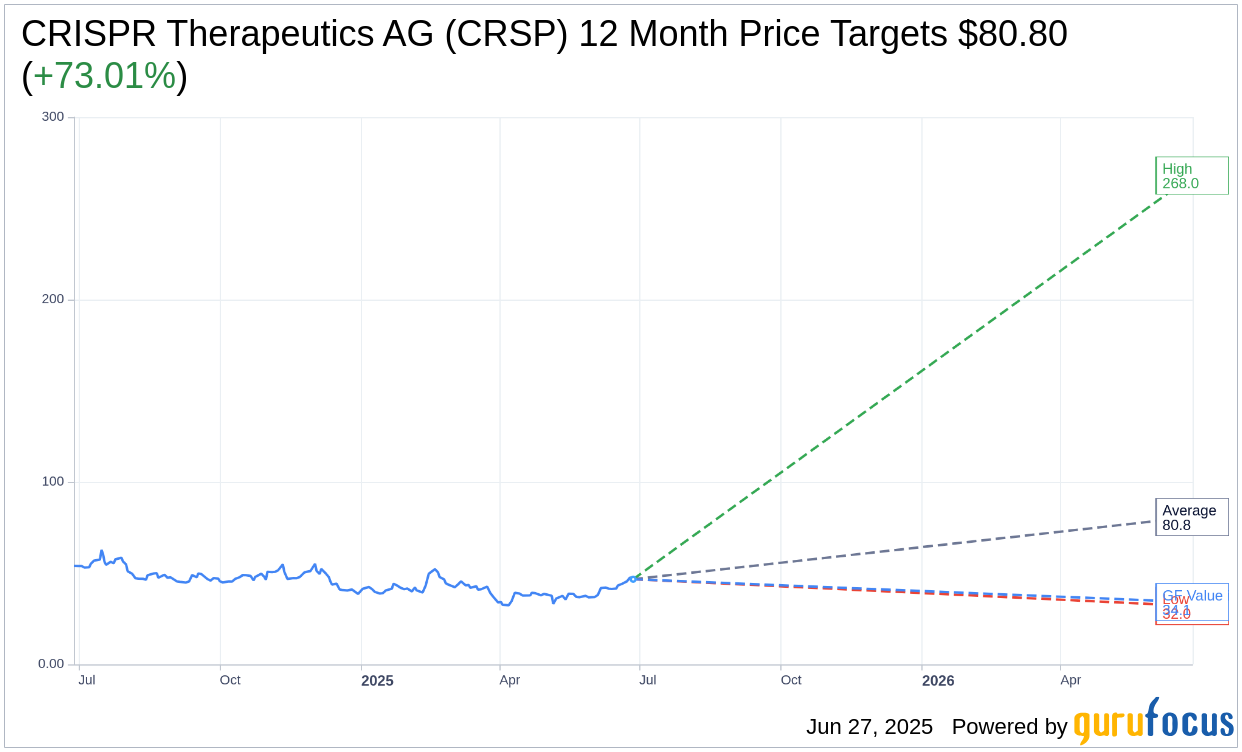

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for CRISPR Therapeutics AG (CRSP, Financial) is $80.80 with a high estimate of $268.00 and a low estimate of $32.00. The average target implies an upside of 72.13% from the current price of $46.94. More detailed estimate data can be found on the CRISPR Therapeutics AG (CRSP) Forecast page.

Based on the consensus recommendation from 29 brokerage firms, CRISPR Therapeutics AG's (CRSP, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CRISPR Therapeutics AG (CRSP, Financial) in one year is $34.19, suggesting a downside of 27.16% from the current price of $46.94. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CRISPR Therapeutics AG (CRSP) Summary page.