Logan Ridge Finance (LRFC, Financial) is proceeding with its merger into Portman Ridge Finance after receiving the necessary shareholder approvals. In a recent special meeting held on June 27, a significant 88% of Portman Ridge's voting shareholders endorsed the merger plan. Previously, on June 20, stockholders of Logan Ridge Finance had also given their approval to the merger. With these approvals secured, and pending standard closing conditions, the merger is anticipated to be finalized around July 15.

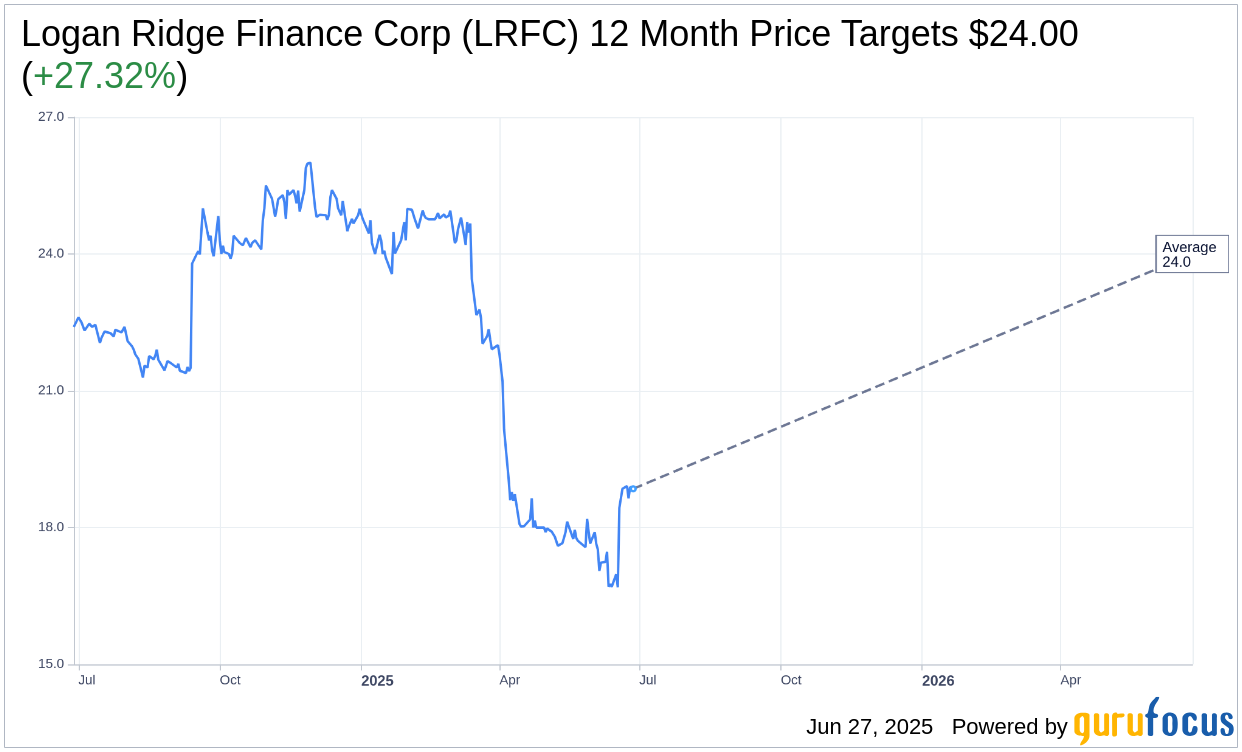

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Logan Ridge Finance Corp (LRFC, Financial) is $24.00 with a high estimate of $24.00 and a low estimate of $24.00. The average target implies an upside of 27.73% from the current price of $18.79. More detailed estimate data can be found on the Logan Ridge Finance Corp (LRFC) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Logan Ridge Finance Corp's (LRFC, Financial) average brokerage recommendation is currently 1.0, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

LRFC Key Business Developments

Release Date: May 09, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Logan Ridge Finance Corp (LRFC, Financial) successfully exited its second largest non-yielding equity investment, GA Communications, reducing its legacy equity portfolio to 10.8% of the total portfolio at fair value.

- The company achieved a net deployment of approximately $2.7 million during the quarter, indicating active portfolio management.

- 71.8% of the investment portfolio at fair value is now invested in assets originated by the BC Partners credit platform, up from 66.7% in the previous quarter.

- The debt investment portfolio represents 86.6% of the total portfolio at fair value, with a weighted average annualized yield of approximately 10.7%.

- Logan Ridge Finance Corp (LRFC) has $31.5 million of unused borrowing capacity available for new investments, providing flexibility for future growth.

Negative Points

- Logan Ridge Finance Corp (LRFC) reported a decrease in investment income to $4.6 million, down from $5.4 million in the previous quarter.

- The company's net asset value decreased by $6.3 million, or 7.4%, compared to the prior quarter, largely due to a $4.4 million write-down on the legacy investment in Sequoia.

- Net investment income for the first quarter of 2025 was $0.9 million, a decrease of $0.6 million compared to the fourth quarter of 2024.

- The equity portfolio was reduced to 12% from 10.8% of the portfolio on a cost and fair value basis, indicating a decrease in equity holdings.

- Four debt investments across three portfolio companies remain on non-accrual status, with an aggregate amortized cost and fair value of $17.2 million and $3.7 million, respectively.