The AZEK Company (AZEK, Financial) has received approval from its shareholders for the proposed merger with James Hardie Industries. During a special meeting, shareholders voted in favor of all related proposals. Once finalized, the agreement stipulates that each AZEK share will convert into $26.45 in cash along with 1.0340 shares of James Hardie, which will be listed on the New York Stock Exchange.

AZEK CEO, Jesse Singh, emphasized the strategic benefits the merger will bring, highlighting the combined strengths and shared dedication to innovation, sustainability, and delivering long-term value. This partnership is expected to enhance customer offerings and drive future growth through expanded capabilities and innovation.

The transaction is anticipated to be completed around July 1, 2025, pending the fulfillment of all closing conditions specified in the merger agreement.

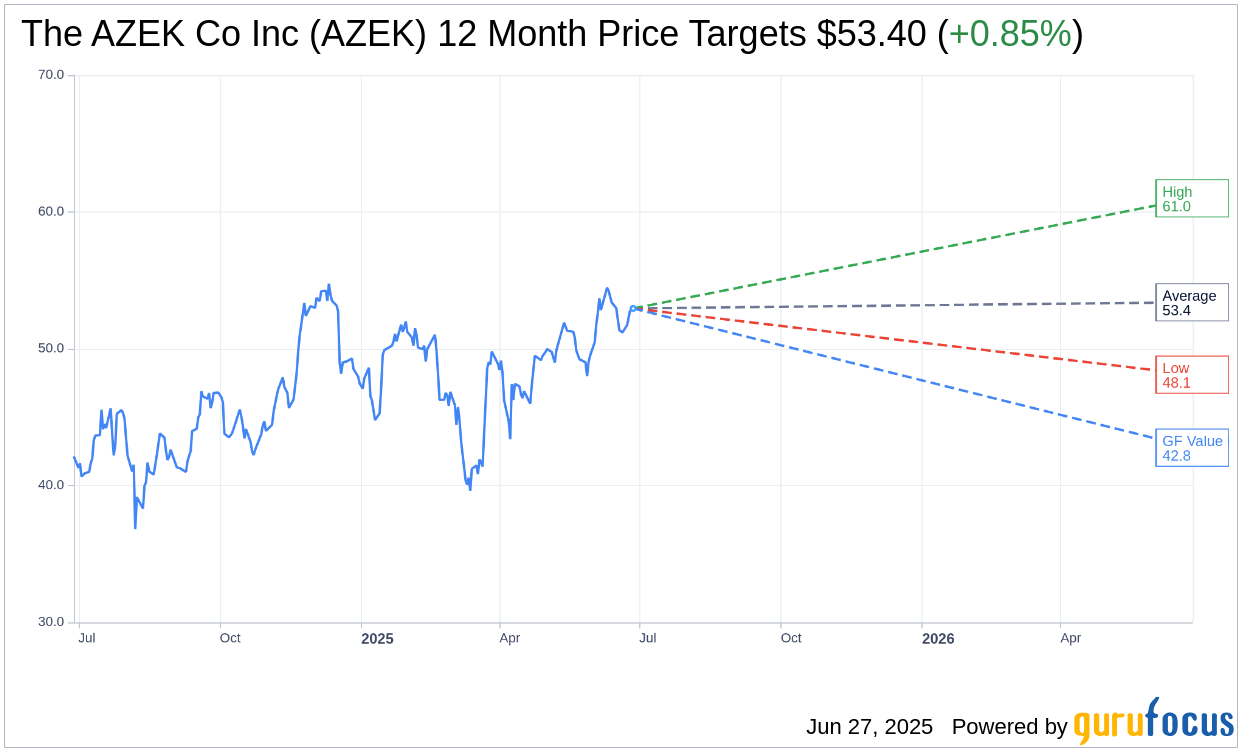

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for The AZEK Co Inc (AZEK, Financial) is $53.40 with a high estimate of $61.00 and a low estimate of $48.11. The average target implies an downside of 2.66% from the current price of $54.86. More detailed estimate data can be found on the The AZEK Co Inc (AZEK) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, The AZEK Co Inc's (AZEK, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The AZEK Co Inc (AZEK, Financial) in one year is $42.77, suggesting a downside of 22.04% from the current price of $54.86. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The AZEK Co Inc (AZEK) Summary page.

AZEK Key Business Developments

Release Date: May 06, 2025

- Residential Segment Net Sales Growth: 9% year-over-year in Q2 2025.

- Deck, Rail & Accessories Net Sales Growth: 11% year-over-year.

- Exteriors Net Sales Growth: 2% year-over-year.

- Adjusted EBITDA Margin: Expanded by 40 basis points year-over-year to 27.5%.

- Residential Segment Adjusted EBITDA Growth: 11% year-over-year.

- Residential Segment Adjusted EBITDA Margin: Expanded by 60 basis points year-over-year to 28%.

- Consolidated Net Sales: $452 million, an increase of 8% year-over-year.

- Gross Profit: $168 million, an increase of $11 million year-over-year.

- Gross Margin: 37.1%.

- Adjusted Gross Profit: $171 million, an increase of $10 million year-over-year.

- Adjusted Gross Profit Margin: 37.8%.

- Adjusted EBITDA: $124 million, an increase of 10% year-over-year.

- Net Income: Increased by $5 million to $54 million or $0.37 per share.

- Adjusted Net Income: Increased by $7 million to $66 million.

- Adjusted Diluted EPS: Increased $0.06 year-over-year to $0.45 per share.

- Commercial Segment Net Sales: $15 million, down 4% year-over-year.

- Commercial Segment Adjusted EBITDA: $1.9 million, a decrease of $1 million year-over-year.

- Cash and Cash Equivalents: $147 million at the end of the quarter.

- Net Debt: $392 million, with a net leverage ratio of 1x.

- Net Cash from Operating Activities: $47 million, an increase of $62 million year-over-year.

- Free Cash Flow: $1 million, an increase of $35 million year-over-year.

- Full Year 2025 Guidance - Consolidated Net Sales: $1.52 billion to $1.55 billion, representing 5% to 8% year-over-year growth.

- Full Year 2025 Guidance - Consolidated Adjusted EBITDA: $403 million to $418 million, representing an increase of 6% to 10% year-over-year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The AZEK Co Inc (AZEK, Financial) achieved 9% year-over-year growth in its residential segment, driven by mid-single-digit residential sell-through growth and channel expansion.

- Deck, Rail & Accessories net sales grew 11% year-over-year, with each product line experiencing high single-digit to double-digit growth.

- The company expanded its adjusted EBITDA margin by 40 basis points year-over-year to 27.5%, while continuing to invest in long-term growth initiatives.

- The proposed merger with James Hardie is expected to unlock $125 million in cost synergies and $500 million in incremental sales synergies.

- The AZEK Co Inc (AZEK) was named to Barron's 100 Most Sustainable US Companies list for the first time, highlighting its commitment to sustainability.

Negative Points

- The Exteriors segment experienced only 2% year-over-year growth, indicating relative stability but slower performance compared to other segments.

- The commercial segment saw a 4% year-over-year decline in net sales, primarily due to weaker demand in the Scranton Products business.

- GAAP SG&A expenses increased by $5 million year-over-year, driven by acquisition-related expenses due to the proposed merger with James Hardie.

- The company faces macroeconomic uncertainty, with contractors and dealers expressing concerns about the potential impact on future customer behavior.

- Tariffs on internationally sourced materials are expected to have a $4 million to $6 million impact in the fiscal year, though the company plans to offset this with pricing actions.