Shares of Dollar Tree (DLTR, Financial) slipped by $0.64, closing near $98.80, amidst a mixed reaction in the options market. The trading volume was lighter than usual, with 24,000 contracts exchanged. Call options were more popular than puts, resulting in a put/call ratio of 0.3, significantly lower than the typical 5.83 ratio.

The implied volatility (IV30) for Dollar Tree decreased slightly by 0.19, now resting at 27.32, which is within the lowest 10% observed over the past year. This suggests an anticipated daily price movement of $1.70. Additionally, there was a steepening in the put-call skew, indicating a heightened interest in protective put options for potential downside risk.

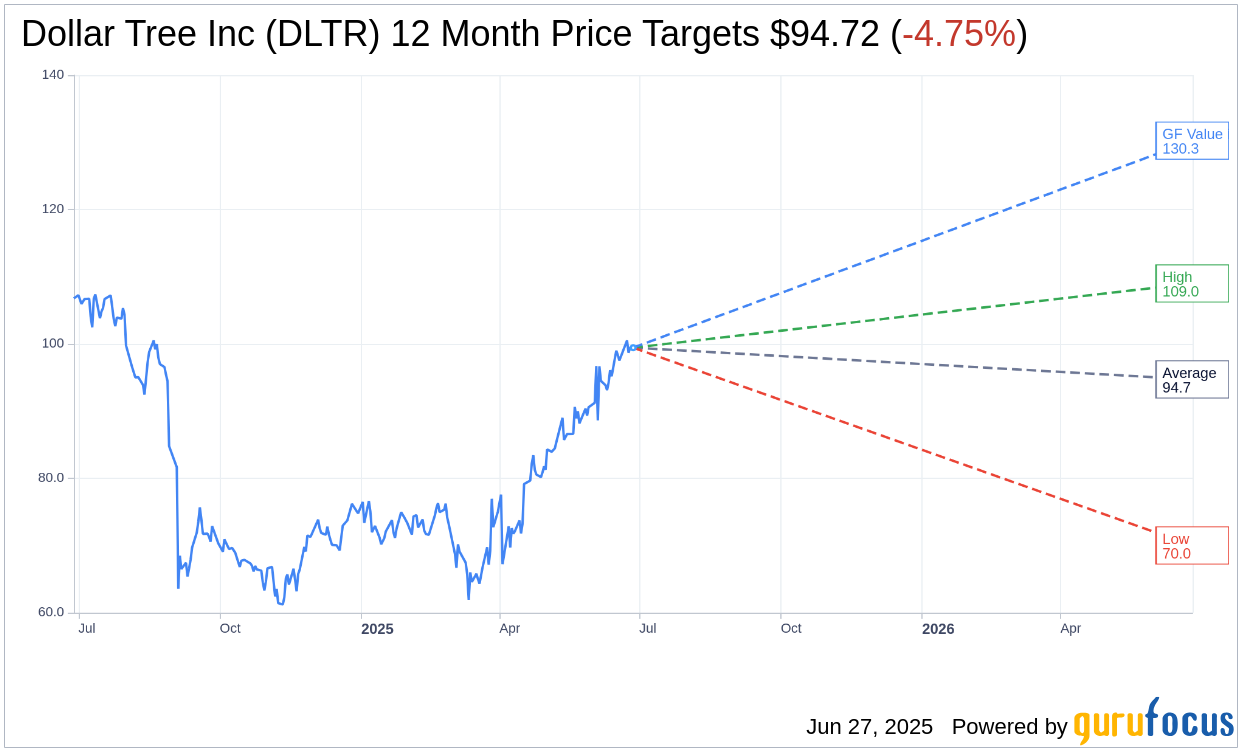

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Dollar Tree Inc (DLTR, Financial) is $94.72 with a high estimate of $109.00 and a low estimate of $70.00. The average target implies an downside of 4.03% from the current price of $98.70. More detailed estimate data can be found on the Dollar Tree Inc (DLTR) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Dollar Tree Inc's (DLTR, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dollar Tree Inc (DLTR, Financial) in one year is $130.25, suggesting a upside of 31.97% from the current price of $98.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dollar Tree Inc (DLTR) Summary page.

DLTR Key Business Developments

Release Date: June 04, 2025

- Revenue Growth: Increased by 11.3% year-over-year.

- Comparable Store Sales Growth: 5.4% increase.

- Adjusted EPS: $1.26, exceeding the outlook range of $1.10 to $1.25.

- Adjusted Operating Income: $388 million, a 1.4% increase from last year.

- Adjusted Operating Margin: Declined by 80 basis points.

- Gross Margin Improvement: Increased by 20 basis points.

- SG&A Rate: Increased by 100 basis points.

- Adjusted Net Income: $270 million compared to $268 million last year.

- Inventory: Increased by 10% to $2.7 billion.

- Cash and Cash Equivalents: $1 billion at the end of the quarter.

- Free Cash Flow: $130 million.

- Store Openings: Celebrated the opening of the 9,000th store.

- New Customers: Added 2.6 million new customers in Q1.

- Share Repurchases: Approximately 5.9 million shares for $437 million in Q1.

- Full Year Revenue Outlook: $18.5 billion to $19.1 billion.

- Full Year Adjusted EPS Outlook: $5.15 to $5.65.

- Capital Expenditures: Expected to be $1.2 billion to $1.3 billion for the year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dollar Tree Inc (DLTR, Financial) delivered strong first quarter results, exceeding expectations across key metrics, including comps and net sales.

- The company celebrated the opening of its 9,000th store, indicating continued expansion and growth potential.

- Dollar Tree Inc (DLTR) gained 2.6 million new customers in Q1, with a notable increase in higher-income customers, demonstrating broad appeal.

- The Multi-Price 3.0 stores continue to outperform other formats, contributing positively to traffic, ticket, and discretionary mix.

- The company effectively mitigated 90% of the initial tariff impact using strategic levers, showcasing operational agility.

Negative Points

- Dollar Tree Inc (DLTR) faces significant cost pressures from tariffs, with a $70 million impact expected in Q2, affecting short-term profitability.

- The company anticipates a 45% to 50% year-over-year decline in Q2 adjusted EPS due to tariff and cost pressures.

- SG&A expenses are expected to increase by 100 to 110 basis points year-over-year, driven by store payroll and depreciation.

- The timing mismatch of TSA-related income will negatively impact first half and full year profitability.

- The volatile tariff landscape presents ongoing challenges, requiring continuous adaptation and mitigation efforts.