- Interactive Strength (TRNR, Financial) has filed a $250 million shelf registration, paving the way for potential future securities offerings.

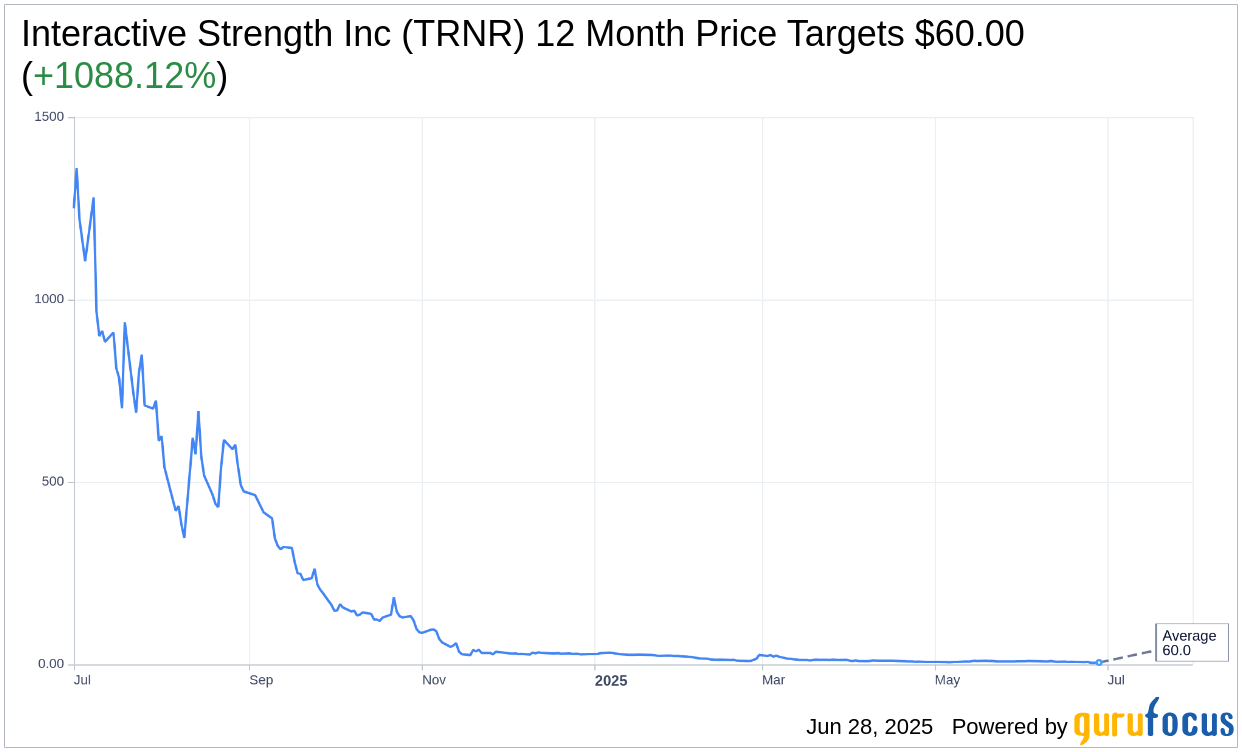

- Analysts provide a one-year price target of $60.00 for TRNR, representing a potential upside of over 1,088%.

- The current recommendation for TRNR is "Outperform" based on brokerage firm consensus.

Interactive Strength (TRNR) is taking strategic steps towards capital flexibility by filing a $250 million shelf registration with the SEC. This filing authorizes the company to offer a range of financial instruments, such as common and preferred stock, debt securities, warrants, rights, and units. These measures come in the wake of a recent 1-for-10 reverse stock split, signaling a phase of strategic realignment.

Analyst Insights on TRNR

According to insights from a single analyst, the one-year target price for Interactive Strength Inc (TRNR, Financial) stands at $60.00. This unanimous estimate, which covers both the highest and lowest projections, suggests a significant upside of 1,088.12% from the current trading price of $5.05. For further information on these projections, you can visit the Interactive Strength Inc (TRNR) Forecast page.

Current Market Sentiment

The consensus from one brokerage firm rates Interactive Strength Inc (TRNR, Financial) at an average recommendation of 2.0, categorizing it as "Outperform." This rating falls within a scale where 1 indicates a Strong Buy and 5 denotes a Sell, reflecting positive sentiment from the firm analyzing TRNR's market potential.

These developments, combined with the company's shelf registration, suggest Interactive Strength is strategically positioning itself for growth and increased investor interest. Investors keeping a close watch on TRNR can discern promising indications from current analyst forecasts and market sentiment.