- Juniper Networks' shares surged 8% following the settlement of an antitrust lawsuit.

- Analysts provide a consistent price target of $40.00, indicating an upside potential.

- Current valuation insights suggest a downside in the stock's trading price.

Juniper Networks (JNPR, Financial) shares experienced an impressive 8% rise after the U.S. Department of Justice resolved its antitrust lawsuit concerning Hewlett Packard Enterprise's substantial $14 billion acquisition of Juniper. The agreement mandates divestment of HPE’s Instant On unit and requires licensing Juniper’s Mist AI software. This settlement bypasses a trial, addressing and alleviating competition worries effectively.

Analysts' Insights and Forecast

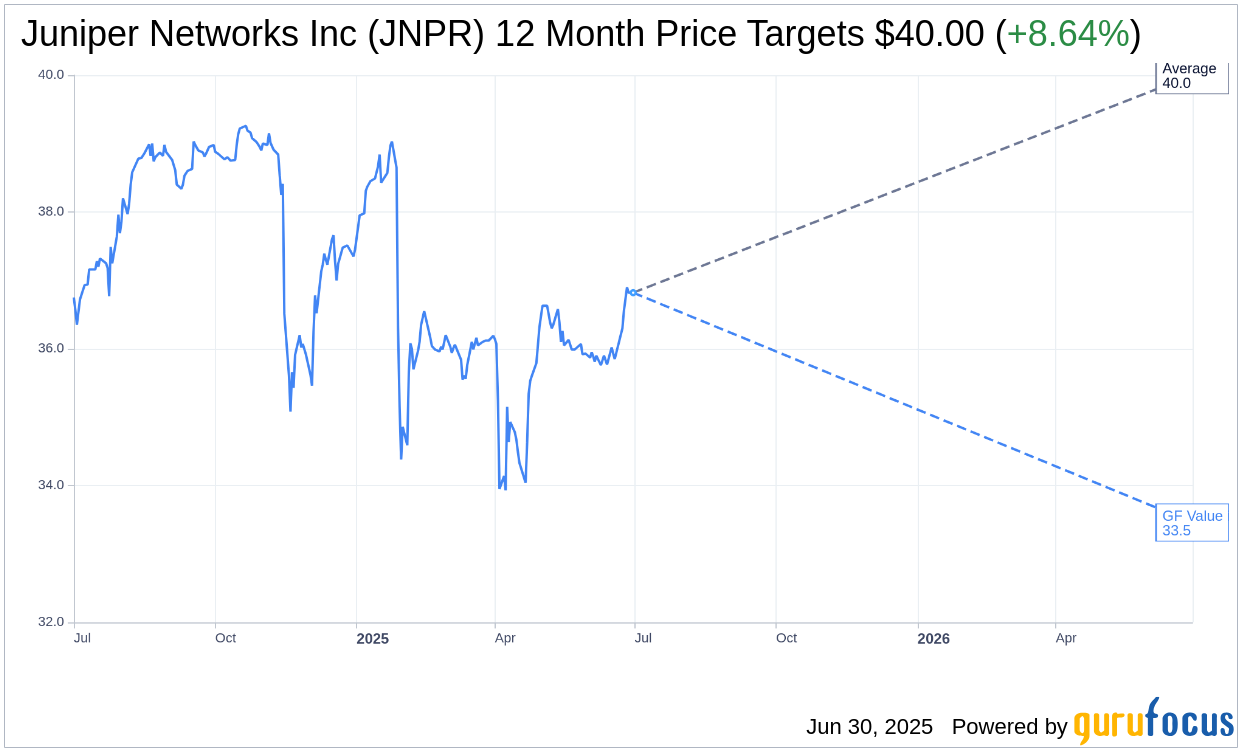

According to the consolidated one-year price targets provided by eight analysts, Juniper Networks Inc (JNPR, Financial) has an average target price set at $40.00. This valuation aligns uniformly across all estimates, with both high and low projections at $40.00. At this price target, there is an implied upside of 8.64% from the present trading price of $36.82. For an in-depth look at these estimates, refer to the Juniper Networks Inc (JNPR) Forecast page.

The consensus from ten brokerage firms places Juniper Networks Inc (JNPR, Financial) at an average brokerage recommendation of 2.9, which corresponds to a "Hold" rating. This rating scale spans from 1 (Strong Buy) to 5 (Sell), providing a broad overview of the stock's market sentiment.

Valuation and Investment Considerations

GuruFocus provides an estimated GF Value for Juniper Networks Inc (JNPR, Financial) at $33.46 over the next year, suggesting a potential downside of 9.13% from the current trading price of $36.82. The GF Value represents GuruFocus' fair value estimate, calculated based on historical trading multiples, past growth metrics, and anticipated future business performance. For comprehensive valuation data, visit the Juniper Networks Inc (JNPR) Summary page.