Aytu BioPharma (AYTU, Financial) has received a new 'Buy' rating from Ascendiant Capital, as announced by analyst Edward Woo on June 30, 2025. This development marks the initiation of coverage by the investment firm on Aytu BioPharma's stock.

The target price set by Ascendiant Capital for Aytu BioPharma (AYTU, Financial) is $12.00 USD. This target price reflects Ascendiant Capital's positive outlook on the company's future performance in the market.

Edward Woo, the analyst behind the coverage, has provided an optimistic projection for Aytu BioPharma (AYTU, Financial), which has been well-noted by investors and market observers. This new rating may influence investor sentiment and trading patterns for the company's stock.

The absence of a previous rating or price target implies a fresh perspective from Ascendiant Capital, potentially offering a new investment opportunity for those interested in Aytu BioPharma (AYTU, Financial).

As Aytu BioPharma (AYTU, Financial) continues to be monitored by analysts, any updates regarding financial performance or strategic decisions will be watched closely by both current and prospective investors.

Wall Street Analysts Forecast

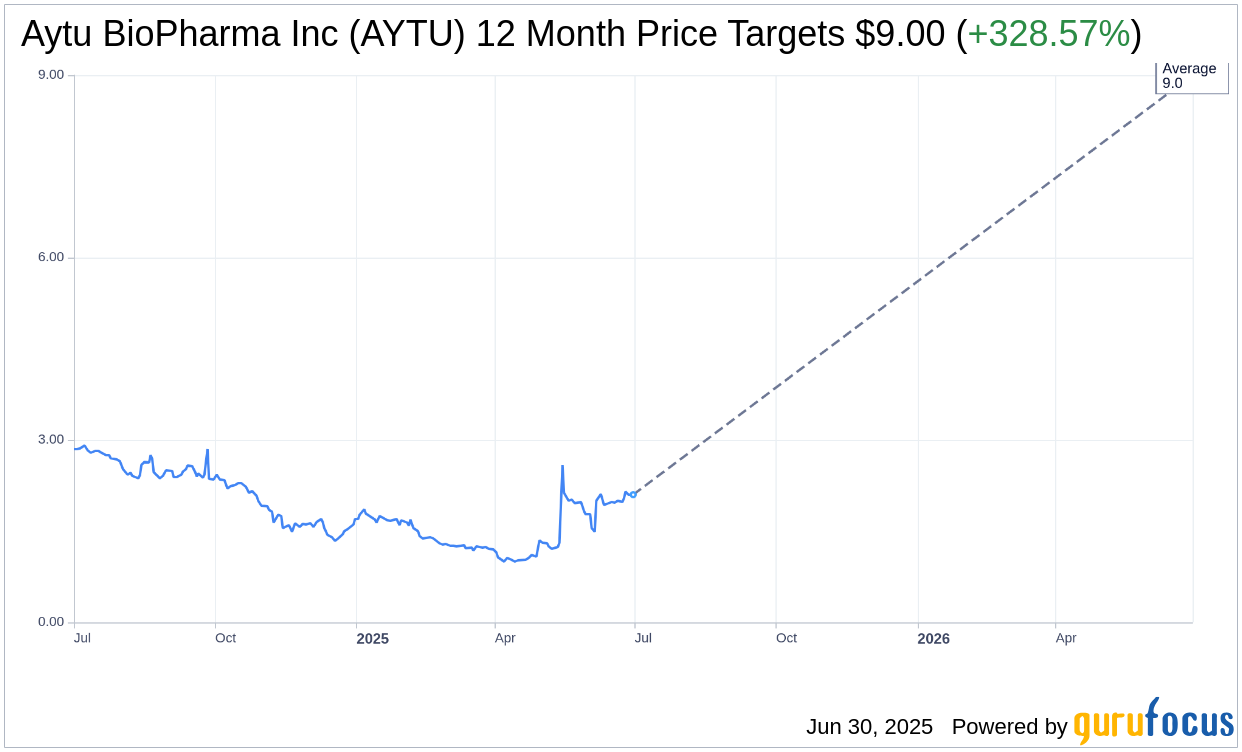

Based on the one-year price targets offered by 1 analysts, the average target price for Aytu BioPharma Inc (AYTU, Financial) is $9.00 with a high estimate of $9.00 and a low estimate of $9.00. The average target implies an upside of 328.57% from the current price of $2.10. More detailed estimate data can be found on the Aytu BioPharma Inc (AYTU) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Aytu BioPharma Inc's (AYTU, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Aytu BioPharma Inc (AYTU, Financial) in one year is $0.84, suggesting a downside of 60% from the current price of $2.1. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Aytu BioPharma Inc (AYTU) Summary page.