Key Takeaways:

- STMicroelectronics (STM, Financial) sees a 1% increase in premarket trade on positive signals from J.P. Morgan.

- Analysts anticipate STM may surpass earnings forecasts for the September quarter.

- The average price target suggests a potential 3.84% downside from the current stock price.

Positive Momentum for STMicroelectronics

STMicroelectronics (STM) experienced a noteworthy 1% increase in premarket trading following its inclusion in J.P. Morgan's positive catalyst watch. Analysts are optimistic that STM could outperform earnings expectations for the September quarter. This optimism is fueled by the easing concerns over microcontroller inventory, which may unlock avenues for revenue growth.

Analyst Price Targets and Recommendations

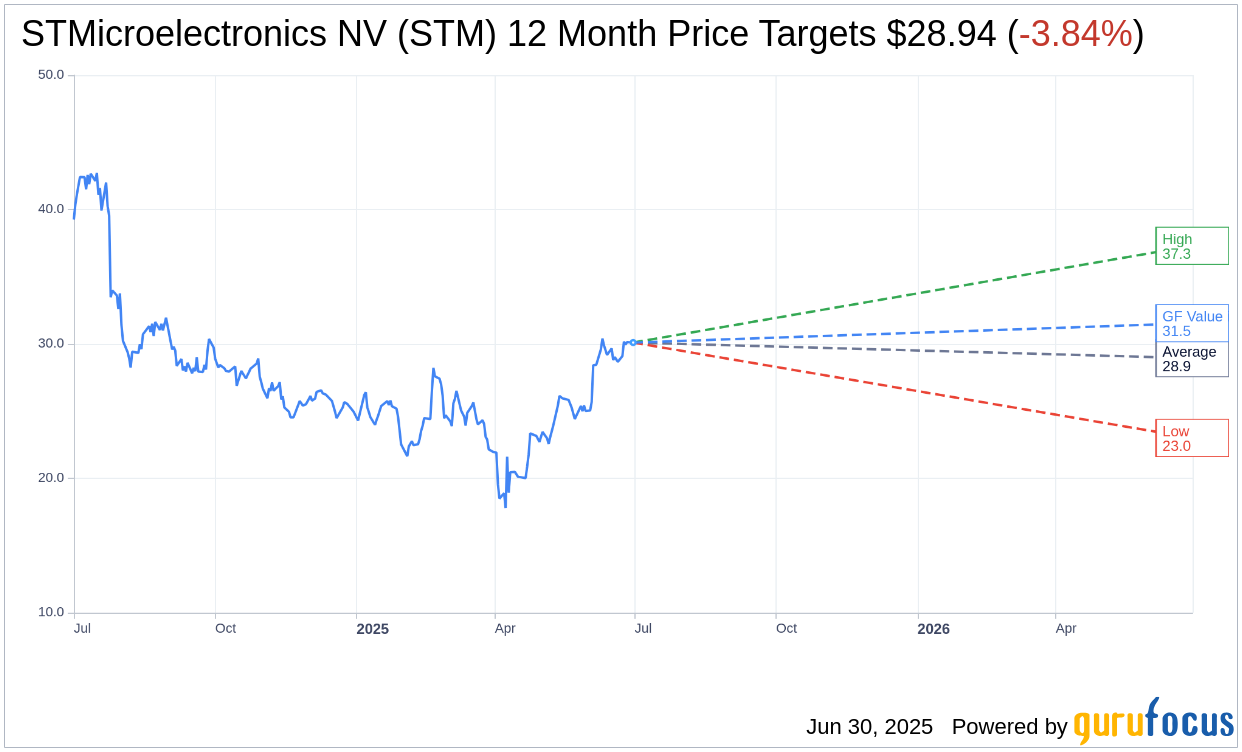

According to one-year price targets set by 12 analysts, STMicroelectronics NV (STM, Financial) has an average target price of $28.94. The projections include a high estimate of $37.30 and a low of $23.00. Currently, this average target suggests a potential downside of 3.84% from STM's present price of $30.10. More detailed forecast data is accessible on the STMicroelectronics NV (STM) Forecast page.

In terms of analyst recommendations, STMicroelectronics NV (STM, Financial) holds an average brokerage recommendation of 2.7. This positions the stock in the "Hold" category on a scale where 1 signifies a Strong Buy and 5 denotes a Sell. This rating is derived from consensus data across 13 brokerage firms.

GuruFocus' GF Value Estimations

Utilizing GuruFocus' metrics, the estimated GF Value for STMicroelectronics NV (STM, Financial) in one year stands at $31.54. This estimate points to a potential upside of 4.78% from the current price of $30.10. The GF Value represents GuruFocus' fair value estimate, calculated based on the stock's historical trading multiples, past business growth, and future business performance forecasts. Investors can explore more detailed insights on the STMicroelectronics NV (STM) Summary page.