- Willis Towers Watson (WTW, Financial) teams up with Verisk to enhance its Radar analytics tool, integrating ISO Electronic Rating Content.

- WTW shares show a slight pre-market increase, and analysts predict a potential 18.66% upside.

- Despite a strong "Outperform" recommendation, GuruFocus estimates suggest a potential downside.

Willis Towers Watson (WTW), in collaboration with Verisk (VRSK), has embarked on a mission to elevate its Radar analytics tool. By integrating the ISO Electronic Rating Content, this partnership is poised to revolutionize how users respond to market fluctuations. Notably, WTW's shares saw a slight pre-market uptick of 0.19%, reaching $304.15.

Wall Street Analysts Forecast

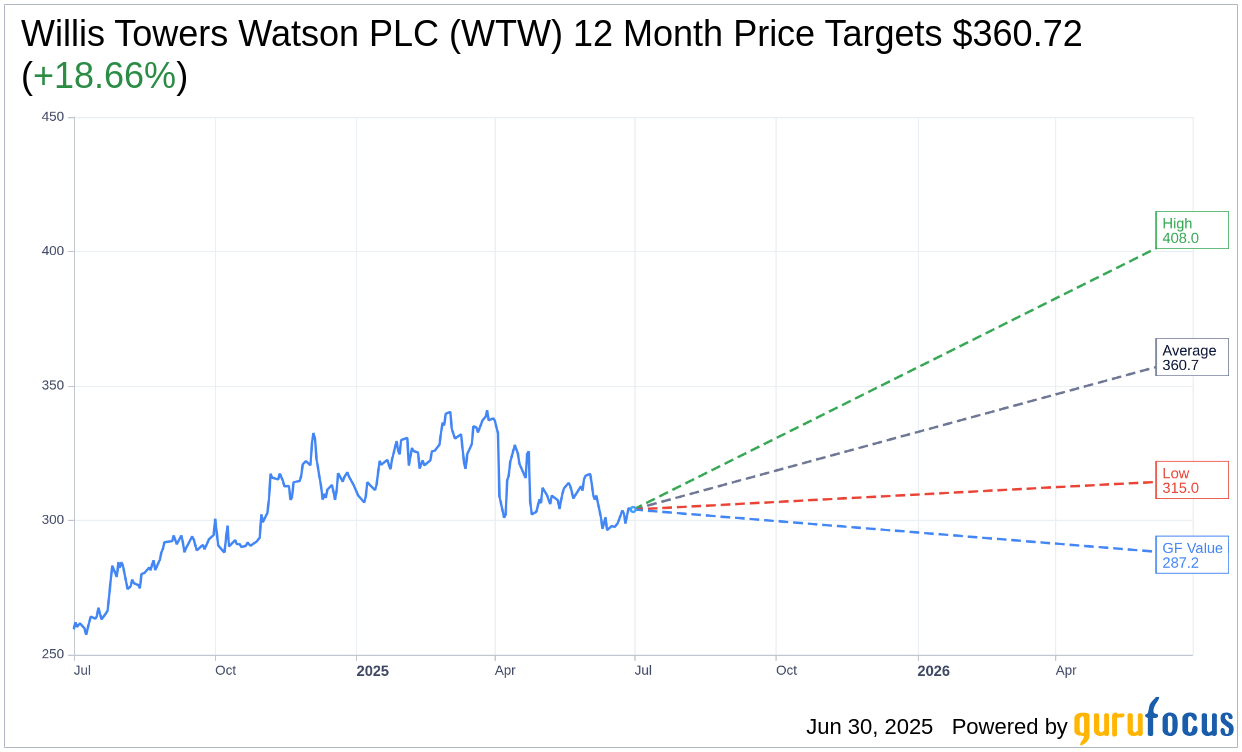

Seventeen seasoned analysts have set a one-year price target for Willis Towers Watson PLC (WTW, Financial), with an average prediction of $360.72, a high of $408.00, and a low of $315.00. This average target hints at an upside potential of 18.66% from the present stock price of $304.00. For a more in-depth analysis, we invite you to visit the Willis Towers Watson PLC (WTW) Forecast page.

Gathering insights from 20 brokerage firms, the consensus positions Willis Towers Watson PLC (WTW, Financial) with an average brokerage recommendation of 2.2, categorizing it as "Outperform." This rating is based on a scale where 1 indicates a Strong Buy, and 5 suggests a Sell.

However, according to GuruFocus's proprietary estimates, the projected GF Value for Willis Towers Watson PLC (WTW, Financial) in a year is $287.21, implying a potential downside of 5.52% from its current price of $303.995. This estimate reflects GuruFocus' calculated fair value, considering historical trading multiples, past business growth, and anticipated future performance. For further insights, visit the Willis Towers Watson PLC (WTW) Summary page.