Transaction Overview

On June 20, 2025, ESL PARTNERS, L.P. (Trades, Portfolio) executed a significant transaction involving AutoNation Inc. The firm reduced its holdings in AutoNation by 528,463 shares, marking a change of -18.90%. This adjustment reflects a strategic decision by the firm, which now holds 2,267,503 shares of AutoNation, representing 6.00% of its holdings in the traded stock. The transaction was executed at a price of $196.58 per share, and it had no significant impact on the firm's overall portfolio, with the current position ratio remaining at 0.

About ESL PARTNERS, L.P. (Trades, Portfolio)

ESL PARTNERS, L.P. (Trades, Portfolio) is a well-regarded investment firm known for its strategic investment philosophy. Although specific details about the firm's investment strategies are not provided, ESL PARTNERS, L.P. (Trades, Portfolio) has established a reputation for making calculated investment decisions that align with its long-term objectives. The firm’s approach often involves a deep analysis of market conditions and company fundamentals to identify opportunities that offer potential for growth and value.

AutoNation Inc. Overview

AutoNation Inc., trading under the symbol AN, is the second-largest automotive dealer in the United States. In 2024, the company reported revenue of approximately $27 billion. AutoNation operates over 240 dealerships and 52 collision centers, with a strong presence in Sunbelt metropolitan areas. The company also manages 26 AutoNation USA used-vehicle stores, a captive lender, four auction sites, and three parts distributors across 20 states. Founded in the 1990s by Wayne Huizenga, AutoNation has successfully implemented a rollup acquisition strategy in auto retailing.

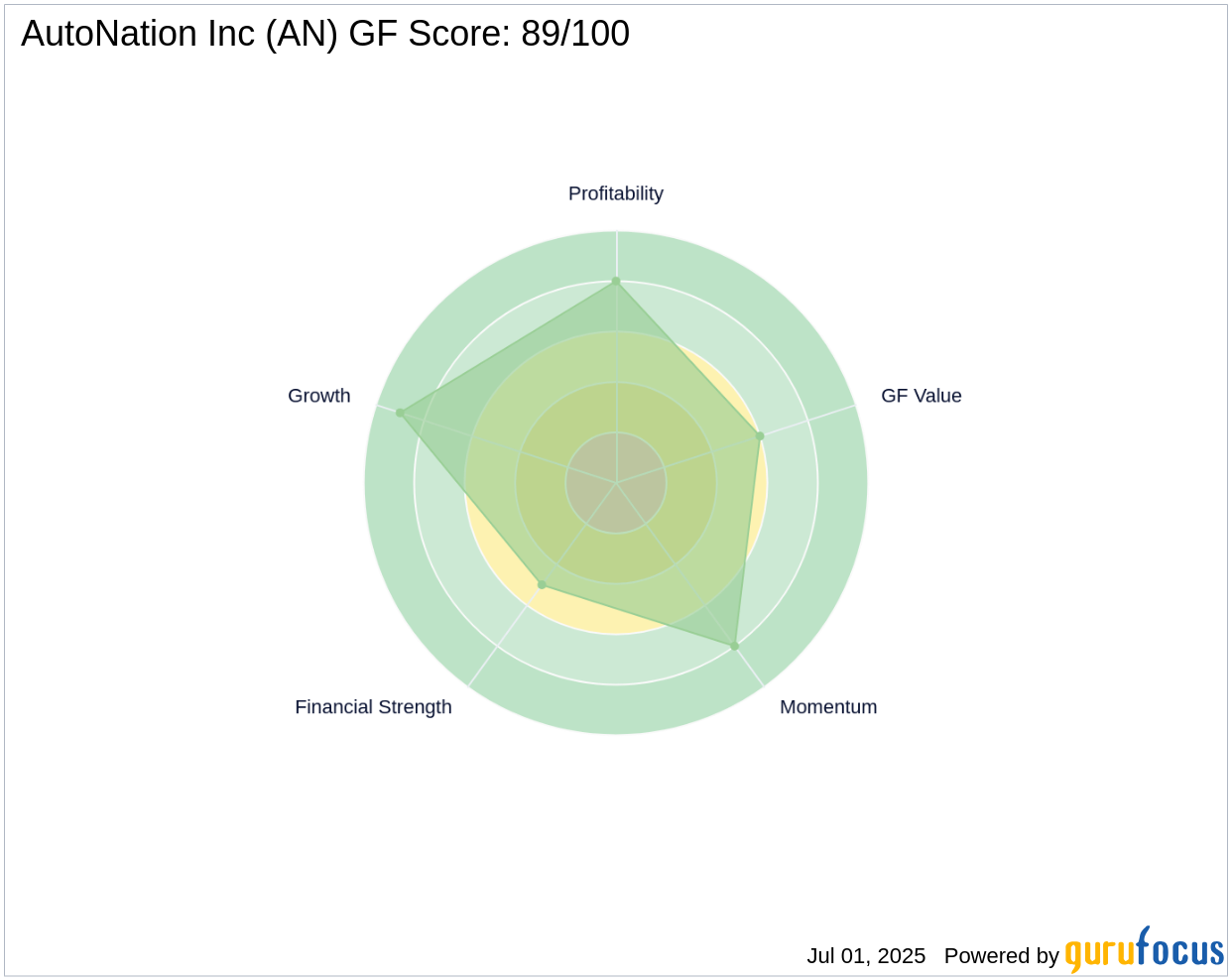

Financial Metrics and Valuation

AutoNation's market capitalization stands at $7.49 billion, with a current stock price of $198.65. The stock is considered fairly valued, with a GF Value of $184.42 and a Price to GF Value ratio of 1.08. The company has a GF Score of 89/100, indicating good outperformance potential. AutoNation has demonstrated a 23.80% revenue growth over the past three years, with a profitability rank of 8/10. These metrics suggest a robust financial position and a promising outlook for future growth.

Performance and Growth Indicators

AutoNation has shown strong performance and growth indicators, with a Growth Rank of 9/10. The company's operating margin growth is 4.70%, and it has a Z Score of 3.23, indicating financial stability. The Piotroski F-Score is 2, and the interest coverage ratio is 2.69, reflecting the company's ability to meet its financial obligations. These indicators highlight AutoNation's potential for sustained growth and profitability.

Impact of the Transaction

The recent transaction by ESL PARTNERS, L.P. (Trades, Portfolio) had no significant impact on the firm's portfolio, maintaining a current position ratio of 0. Despite the reduction in shares, the firm continues to hold a substantial stake in AutoNation, with 2,267,503 shares. This move aligns with the firm's strategic investment approach, allowing it to optimize its portfolio while maintaining exposure to AutoNation's growth potential.

Other Notable Investors in AutoNation Inc.

Brave Warrior Advisors, LLC is the largest guru holding shares in AutoNation. Other notable investors include Mario Gabelli (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio). These investors' involvement underscores the confidence in AutoNation's business model and growth prospects, further validating the company's position in the automotive industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.