- XPENG (XPEV, Financial) achieves an impressive 224% increase in vehicle deliveries for June 2025, with a total of 34,611 units.

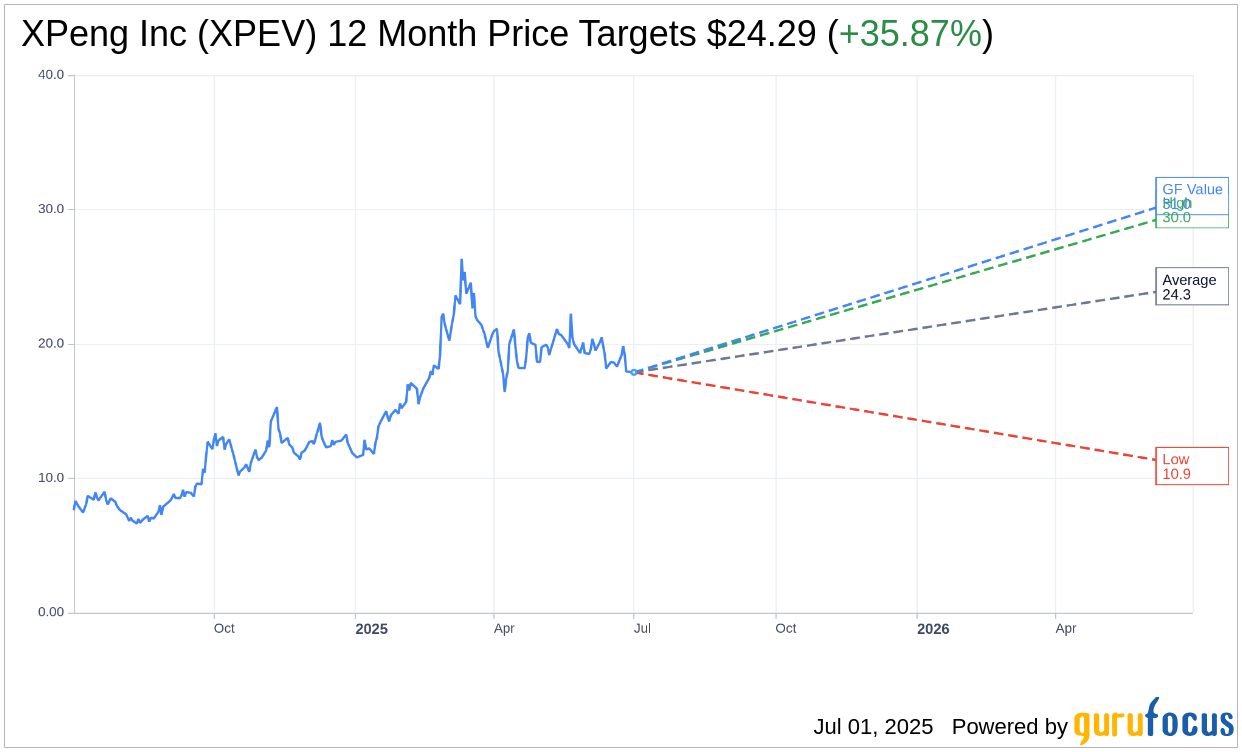

- Analysts project a potential 35.87% upside, with a target price of $24.29, based on current valuations.

- GuruFocus estimates suggest a substantial 73.38% potential upside in value for XPeng Inc stock.

XPENG (XPEV) continues to accelerate in the electric vehicle market, reporting a remarkable 224% surge in vehicle deliveries for June 2025. The company reached an impressive total of 34,611 units, maintaining its momentum for the eighth consecutive month with over 30,000 deliveries. Significantly, XPENG's second-quarter deliveries soared to 103,181 Smart EVs, already surpassing the entire full-year 2024 figures within just the first half of 2025.

Wall Street Analysts Forecast

The outlook for XPeng Inc (XPEV, Financial) looks promising, with 25 Wall Street analysts offering one-year price targets. The consensus average target price is set at $24.29, with a high estimate hovering at $30.02 and a low estimate at $10.91, suggesting a potential upside of 35.87% from the current price of $17.88. Investors seeking more detailed forecast data can explore further on the XPeng Inc (XPEV) Forecast page.

In terms of brokerage recommendations, 25 firms currently rate XPeng Inc's (XPEV, Financial) average brokerage recommendation at 2.1, signaling an "Outperform" status. This rating scale spans from 1, indicating a Strong Buy, to 5, denoting a Sell, positioning XPENG favorably among its peers.

Moreover, according to GuruFocus estimates, the projected GF Value for XPeng Inc (XPEV, Financial) in one year is anticipated to be $31.00. This estimation suggests an impressive 73.38% upside from the current trading price of $17.88. The GF Value represents GuruFocus' calculated fair value, derived from historical trading multiples, past business growth, and future business performance projections. Investors can access more detailed insights on the XPeng Inc (XPEV) Summary page.