Key Insights:

- Nvidia (NVDA, Financial) is positioned for significant growth in late 2025, driven by AI technology investments.

- Wedbush Securities recommends Nvidia, forecasting a 10% rise in tech stocks with accelerated AI integration.

- Analyst consensus suggests a robust "Outperform" rating for Nvidia, with notable upside potential.

Nvidia's Promising Growth Outlook

Nvidia Corp (NVDA), a leader in the semiconductor industry, is poised for notable expansion in the latter half of 2025 as AI technologies continue to gain traction. According to insights from Wedbush Securities, Nvidia remains a prime choice, with expectations that tech stocks will witness over a 10% increase due to widespread AI adoption across various sectors.

Wall Street Analysts' Predictions

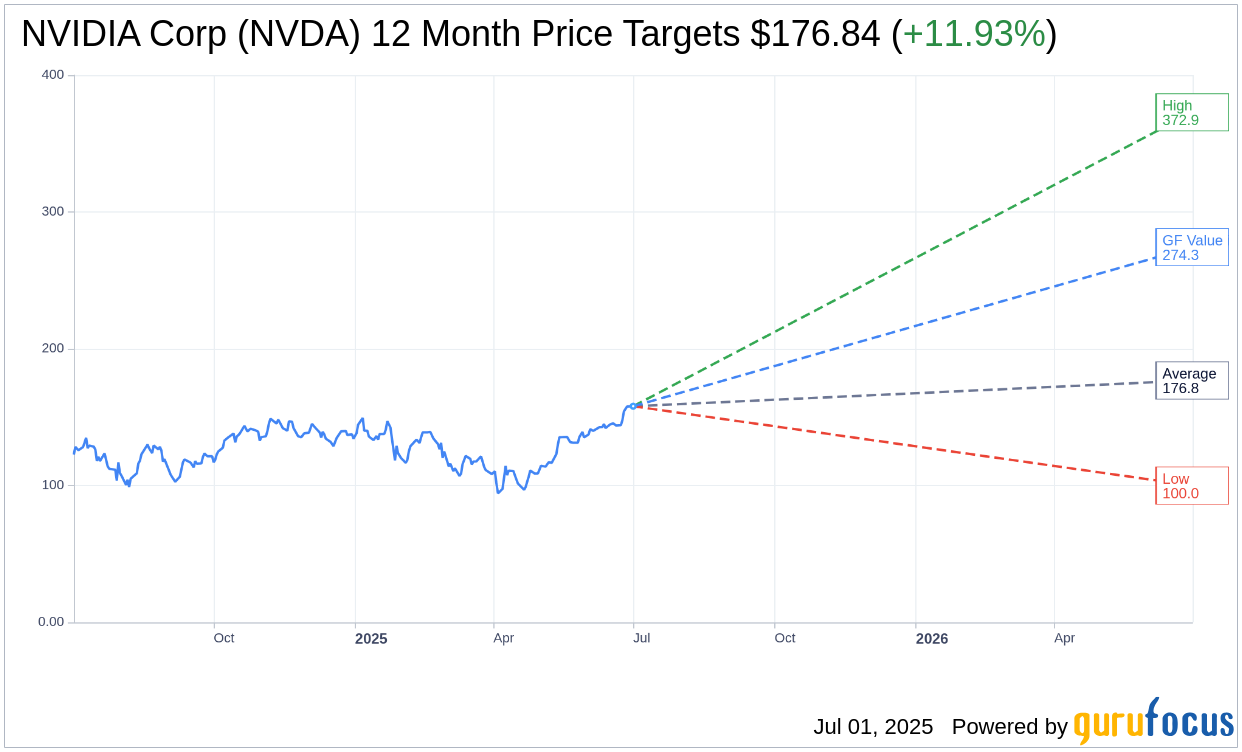

Analysts are forecasting a promising trajectory for Nvidia, with 52 experts setting an average one-year price target at $176.84. This target includes a high estimate of $372.87 and a low of $100.00. Currently, the average price target suggests a potential upside of 11.93% from its present trading price of $157.99. For further insights, visit the NVIDIA Corp (NVDA, Financial) Forecast page.

Brokerage Firm Recommendations

With input from 65 brokerage firms, Nvidia holds a commendable average recommendation of 1.8, signifying an "Outperform" status. On the rating scale of 1 to 5, a score of 1 indicates a "Strong Buy," while 5 suggests "Sell," positioning Nvidia favorably among analyst expectations.

GuruFocus Valuation

GuruFocus estimates place the GF Value for Nvidia at $274.32 in the next year, pointing to a potential upside of 73.63% from its current price of $157.99. The GF Value reflects GuruFocus' assessment of the stock's fair trading value, calculated from historical trading multiples, past business growth, and future performance forecasts. More extensive data can be explored on the NVIDIA Corp (NVDA, Financial) Summary page.