- GE HealthCare Technologies (GEHC, Financial) declares a consistent quarterly dividend, offering stability for income-focused investors.

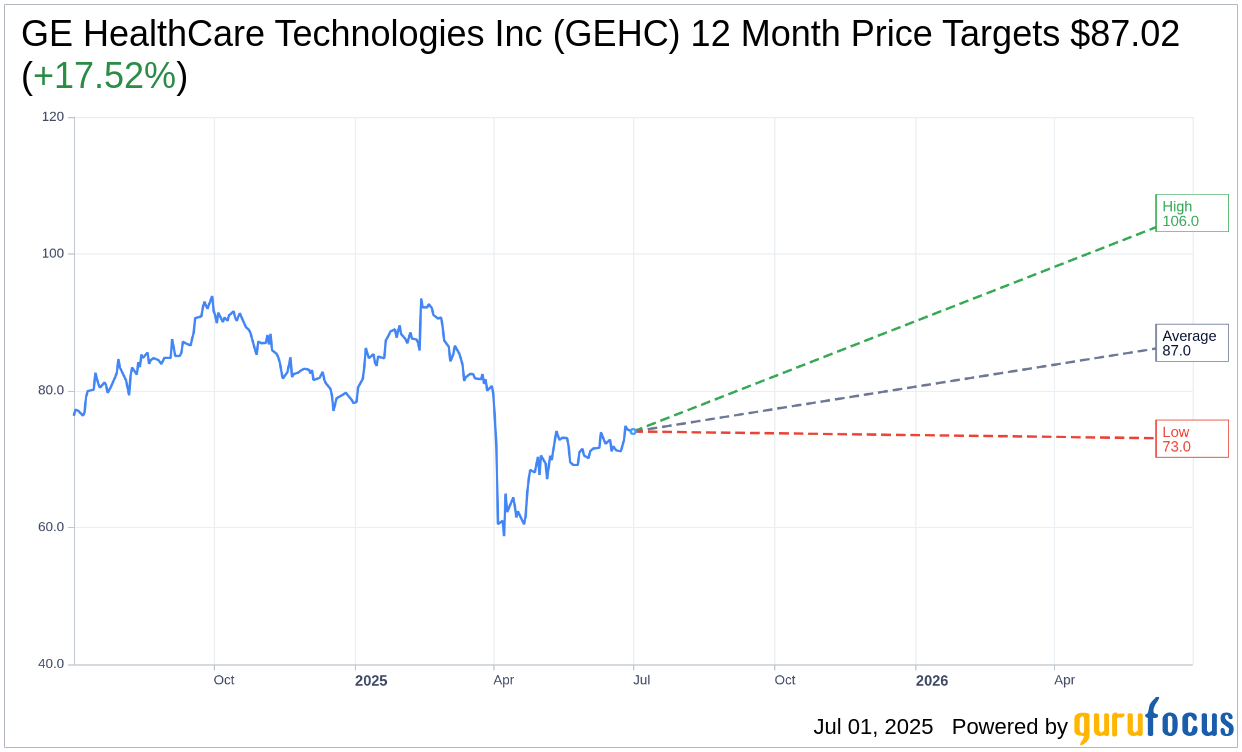

- Wall Street analysts predict a potential upside of approximately 17.52% for GE HealthCare Technologies' stock.

- The average brokerage recommendation suggests an "Outperform" status, showcasing positive sentiment towards GEHC.

Dividend Announcement: Consistency Amidst Market Fluctuations

GE HealthCare Technologies (NYSE: GEHC) has confirmed a steady quarterly dividend of $0.035 per share, adhering to its previous payout strategy. With a forward yield at 0.19%, dividends are set for disbursement on August 15 to shareholders listed by July 25, aligning with the ex-dividend date. This move underscores the company's commitment to providing consistent returns to its investors.

Wall Street's Insight: Analyst Projections on GEHC

According to projections from 18 financial analysts, GE HealthCare Technologies Inc (GEHC, Financial) holds an average one-year target price of $87.02. The high and low target estimates stand at $106.00 and $73.00, respectively. This suggests a potential stock value increase of 17.52% above the present price of $74.05. For a comprehensive breakdown of these estimates, visit the GE HealthCare Technologies Inc (GEHC) Forecast page.

Market Recommendation: Outperformance Expected

The consensus recommendation from 20 brokerage firms for GE HealthCare Technologies Inc (GEHC, Financial) averages at 2.0, indicating an "Outperform" status. This rating is derived from a scale where 1 represents a Strong Buy and 5 signifies a Sell, reflecting confidence among analysts regarding the company's future performance.