In a recent development, Knight-Swift (KNX, Financial), one of the leading transportation companies, has been reinstated with an "Outperform" rating by analyst Daniel Moore from Baird. This rating reflects a positive outlook on the company's performance and potential in the stock market.

Alongside the rating, Baird has announced a price target of $55.00 USD for Knight-Swift (KNX, Financial). This price target suggests a favorable growth trajectory for the company's stock, which could be of interest to investors and stakeholders.

The announcement, made on July 1, 2025, did not include any previous price target comparisons as it marks a fresh analysis by the firm. The positive rating and the above market price target underline Baird's confidence in Knight-Swift's (KNX, Financial) operational and financial capabilities.

Investors are encouraged to note the date of the report and the currency in which the price target is set. This fresh rating and price target by Baird are important for stockholders and potential investors in assessing the viability of including Knight-Swift (KNX, Financial) in their portfolios.

Wall Street Analysts Forecast

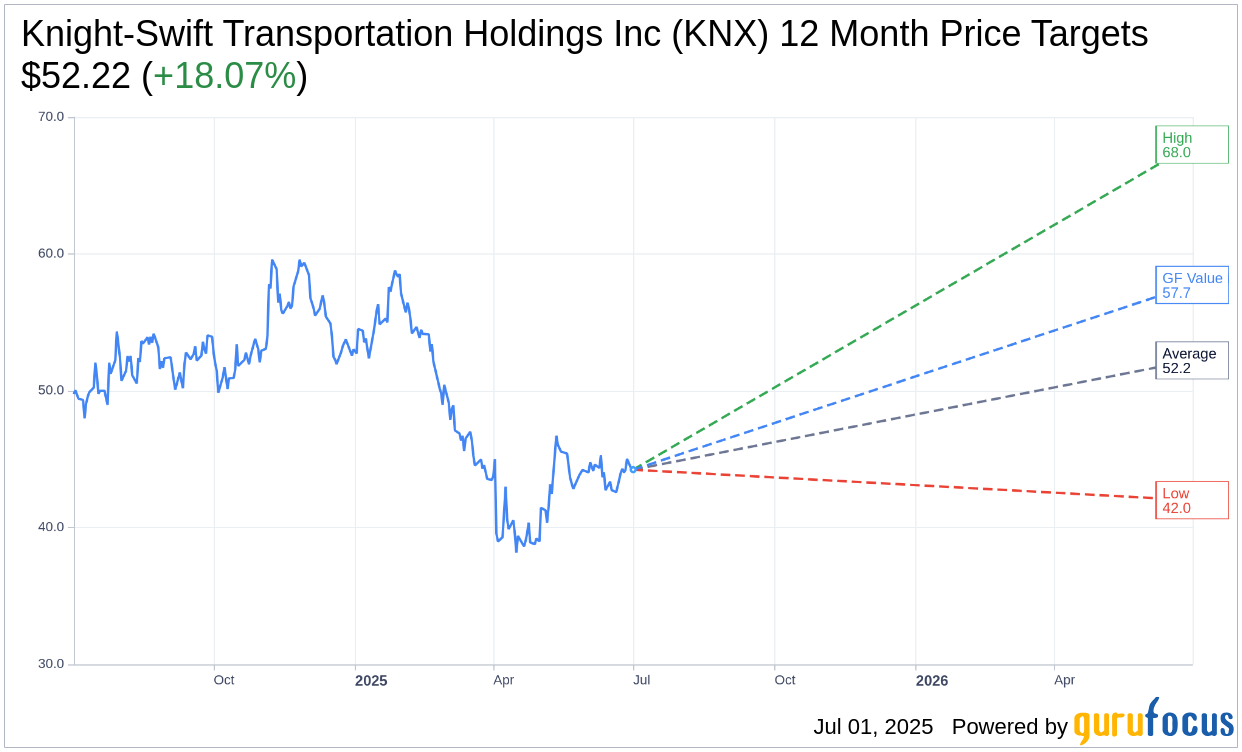

Based on the one-year price targets offered by 19 analysts, the average target price for Knight-Swift Transportation Holdings Inc (KNX, Financial) is $52.22 with a high estimate of $68.00 and a low estimate of $42.00. The average target implies an upside of 18.07% from the current price of $44.23. More detailed estimate data can be found on the Knight-Swift Transportation Holdings Inc (KNX) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Knight-Swift Transportation Holdings Inc's (KNX, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Knight-Swift Transportation Holdings Inc (KNX, Financial) in one year is $57.74, suggesting a upside of 30.54% from the current price of $44.23. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Knight-Swift Transportation Holdings Inc (KNX) Summary page.