Key Takeaways:

- Kroger (KR, Financial) is spotlighted by Evercore ISI for a potential 11% total shareholder return, influenced by strategic initiatives.

- Analyst price targets suggest a modest upside, while GuruFocus GF Value implies a downside risk.

- Wall Street ratings reflect an "Outperform" consensus, adding credence to Kroger's growth prospects.

Kroger's Strategic Positioning

Evercore ISI has positioned Kroger (KR) on its Best Core Ideas list, underscoring the company as a robust investment choice with the potential for an 11% total shareholder return. As the second-largest grocer in the U.S., Kroger is poised for growth through strategic alliances and favorable market dynamics, promising enhancements in identical-store sales and margin expansion.

Wall Street Analysts Forecast

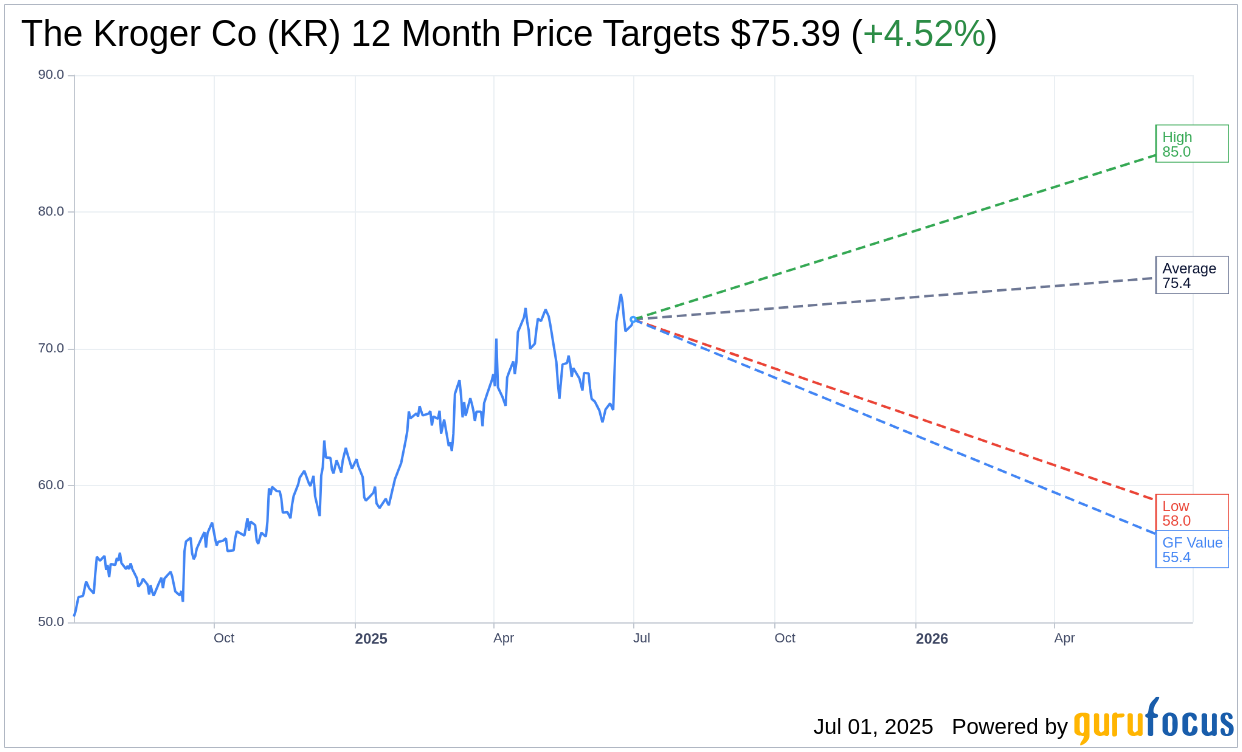

Current analysis by 18 analysts sets the one-year price target for The Kroger Co (KR, Financial) at an average of $75.39, with forecasts ranging from $58.00 to $85.00. This suggests a potential upside of 4.69% from Kroger's present share price of $72.02. For further insights, visit the The Kroger Co (KR) Forecast page.

The consensus from 24 brokerage firms classifies Kroger (KR, Financial) with an average recommendation rating of 2.3, which translates to an "Outperform" status. This rating uses a scale where 1 represents a Strong Buy, and 5 indicates a Sell.

Understanding GuruFocus GF Value

According to GuruFocus estimates, the projected GF Value for The Kroger Co (KR, Financial) in a year is set at $55.36. This estimation suggests a potential downside of 23.13% from the current price of $72.02. The GF Value is calculated considering historical trading multiples, past business growth, and future performance estimates. Additional data is available on the The Kroger Co (KR) Summary page.