- Seagate Technology (STX, Financial) achieved impressive growth, outperforming industry and market benchmarks in the second quarter.

- Analysts provide a mixed outlook on STX, with price targets suggesting potential downside from current levels.

- GF Value estimates indicate that STX may be overvalued, highlighting caution for potential investors.

Seagate Technology (STX) showcased remarkable growth during the second quarter, bolstered by robust demand within the Semiconductor & Semiconductor Equipment industry. This sector experienced an impressive growth of over 41%, propelling Seagate Technology to soar nearly 70% in value. In comparison, the Technology Select Sector SPDR Fund (XLK) climbed more than 21%, significantly outpacing the S&P 500's modest 10% gain, affirming Seagate's status as a standout performer.

Wall Street Analysts Forecast

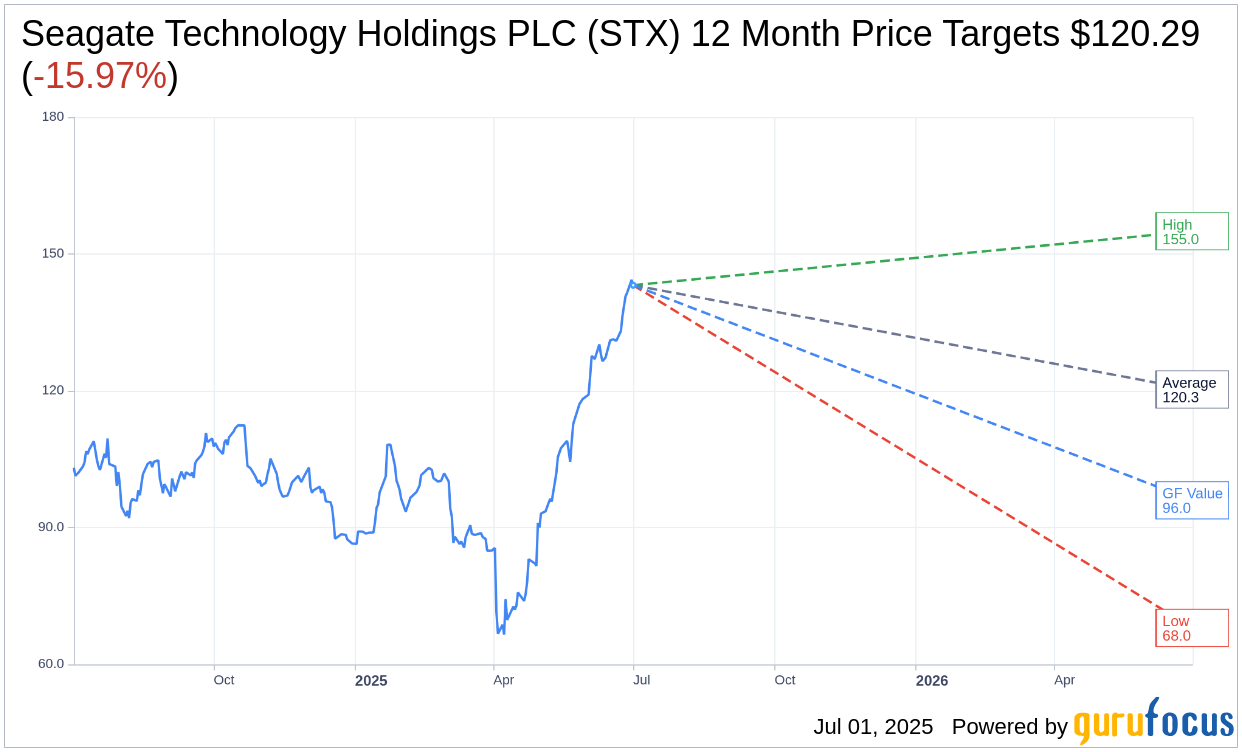

A comprehensive analysis of projections from 19 analysts reveals an average one-year price target of $120.29 for Seagate Technology Holdings PLC (STX, Financial). The price estimates range from a high of $155.00 to a low of $68.00, indicating a potential downside of 15.97% from the current price of $143.15. For further insights, visit the Seagate Technology Holdings PLC (STX) Forecast page.

The current consensus from 24 brokerage firms rates Seagate Technology Holdings PLC (STX, Financial) at an average of 2.2, indicating an "Outperform" status. This recommendation uses a scale from 1 to 5, where 1 represents a Strong Buy, and 5 suggests a Sell.

According to GuruFocus estimates, the GF Value for Seagate Technology Holdings PLC (STX, Financial) in a year is projected at $95.99. This suggests a potential downside of 32.94% from its current trading price of $143.15. The GF Value reflects GuruFocus' assessment of a stock's fair trading value, derived from historical trading multiples, past business growth, and future performance projections. More detailed analysis is available on the Seagate Technology Holdings PLC (STX) Summary page.