Key Takeaways:

- LTC Properties (LTC, Financial) maintains a steady monthly dividend with a robust forward yield.

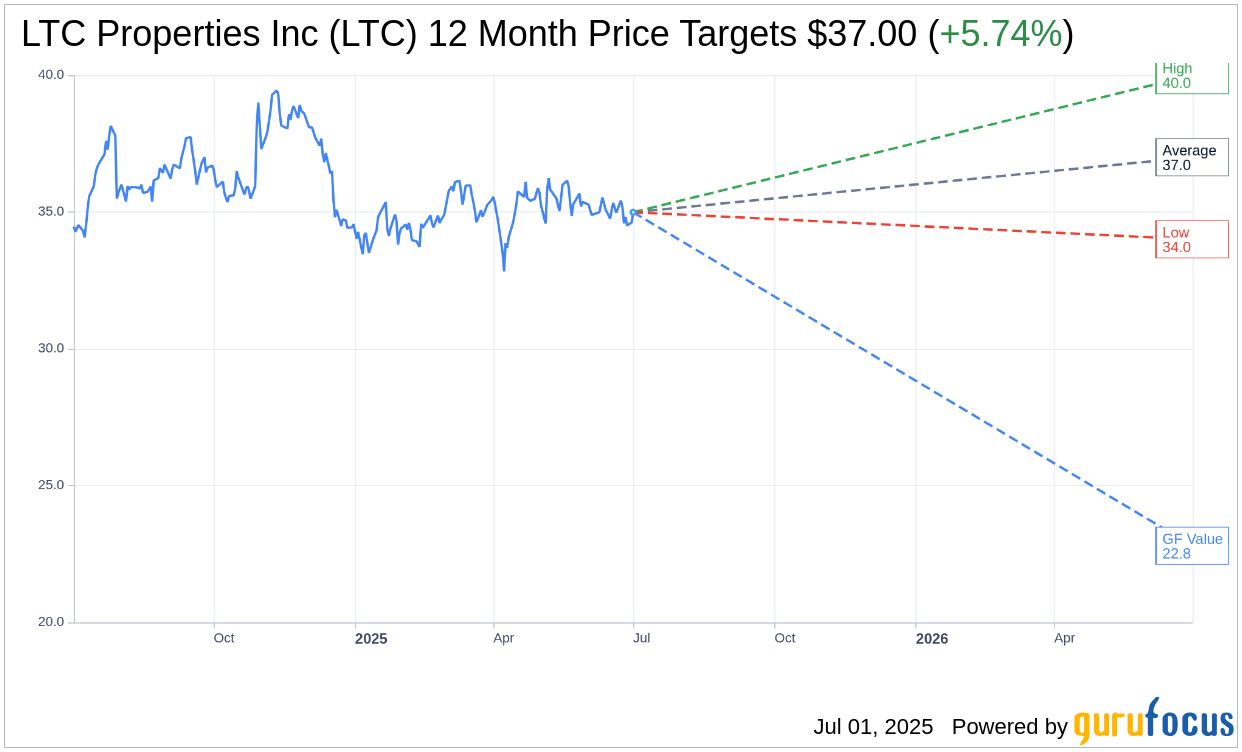

- Analysts predict a modest upside in stock price, but the GF Value suggests potential overvaluation.

- The stock holds a "Hold" recommendation from brokerage firms, reflecting mixed sentiment.

LTC Properties' Dividend Insights

LTC Properties Inc. (LTC) has declared a consistent monthly dividend payout of $0.19 per share, reflecting stability in its distribution strategy. The forward yield currently stands at an attractive 6.53%. Shareholders can expect payments to be disbursed on July 31, August 29, and September 30, with respective record dates of July 23, August 21, and September 22. This consistency in dividends makes LTC Properties an appealing choice for income-focused investors.

Wall Street Analysts' Projections

According to the insights from 7 analysts, the average price target for LTC Properties Inc. (LTC, Financial) over the next year is pegged at $37.00. Price expectations range from a low of $34.00 to a high of $40.00. This average target represents a potential upside of 5.74% from the current trading price of $34.99. For more comprehensive estimate data, investors can visit the LTC Properties Inc (LTC) Forecast page.

Brokerage Recommendations and Market Insight

The average brokerage recommendation for LTC Properties Inc. (LTC, Financial) is currently placed at 2.8, indicating a "Hold" status. This consensus stems from evaluations by 8 brokerage firms and uses a rating scale that stretches from 1 (Strong Buy) to 5 (Sell). This mixed sentiment suggests a cautious approach among analysts and reflects the broader market's uncertainty regarding the stock's immediate future.

Valuation Assessment via GuruFocus Metrics

According to GuruFocus estimates, LTC Properties Inc.'s (LTC, Financial) projected GF Value in a year's time is $22.80, suggesting a potential downside of 34.84% from its current price of $34.99. The GF Value serves as GuruFocus' calculated approximation of a stock's fair trading value, derived from historical trading multiples, past business growth, and future business performance estimates. Investors seeking deeper insights can explore more data on the LTC Properties Inc (LTC) Summary page.