Summary:

- HP Enterprise (HPE, Financial) garners attention with inclusion on Raymond James' Favorite List.

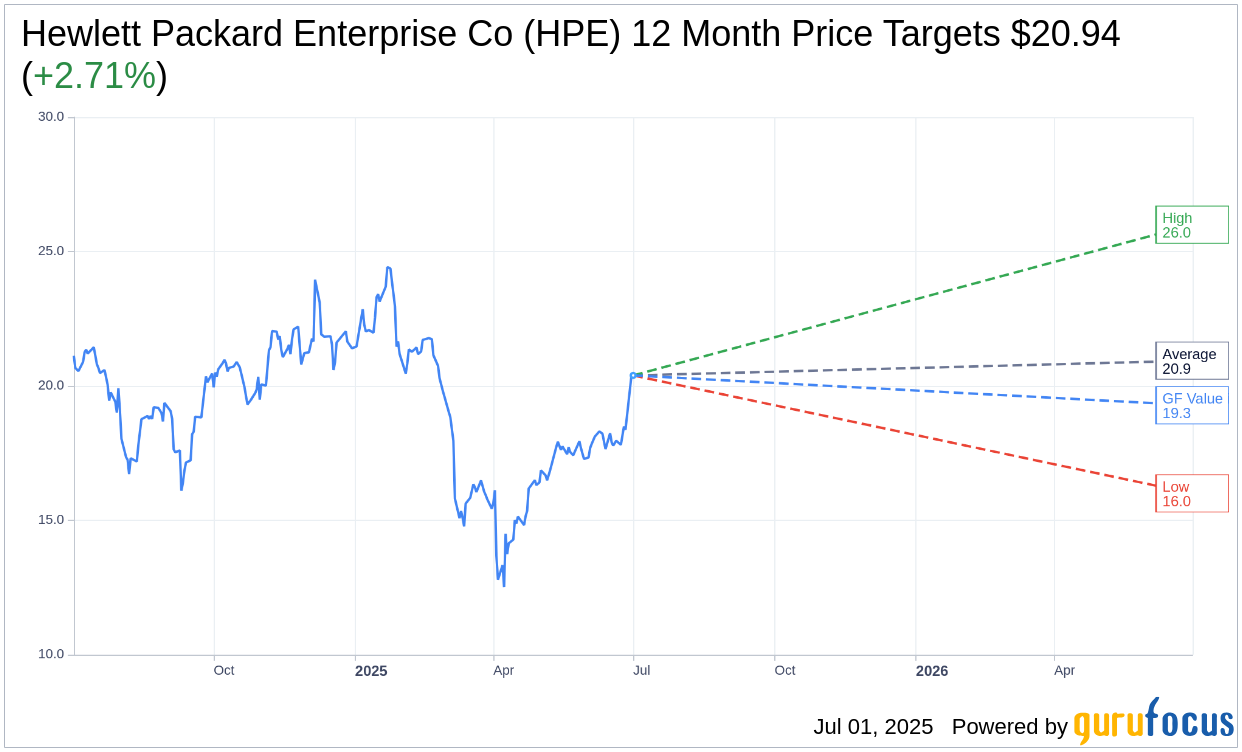

- Analysts set a high price target of $26 with an average upside of 2.71%.

- GuruFocus predicts a one-year GF Value estimate suggesting a potential downside.

Hewlett Packard Enterprise (HPE) experienced a minor decline of 1.3% in its stock price on Tuesday. This slip occurred amidst positive sentiment from renowned financial analyst firm, Raymond James, which recently added HPE to its esteemed Favorite List, replacing Lumentum. The addition to the list is attributed to HPE's robust second-quarter performance and significant strides in artificial intelligence. Despite the dip, Raymond James has reaffirmed its confidence in HPE with a Strong Buy rating and a price target of $26.

Wall Street Analysts' Projections

According to projections from 14 seasoned analysts, Hewlett Packard Enterprise Co (HPE, Financial) carries an average target price of $20.94 over the next year. The forecasts feature a high of $26.00 and a low of $16.00, implying a potential upside of 2.71% from the current stock price of $20.39. Investors can explore more intricate details on the Hewlett Packard Enterprise Co (HPE) Forecast page.

Currently, the consensus from 16 brokerage firms positions HPE with an average brokerage recommendation of 2.2, signaling an "Outperform" rating. This rating is part of a scale that ranges from 1 to 5, where 1 represents a Strong Buy and 5 indicates Sell.

Meanwhile, GuruFocus presents an estimated GF Value for HPE, projecting it at $19.28 in one year. This estimation reflects a potential downside of 5.44% from the present stock price of $20.39. The GF Value is a measure used by GuruFocus to assess what the fair trading value of the stock should be. This metric considers the historical price multiples of the stock, the company's past growth, and future performance forecasts. For a deeper dive, refer to the Hewlett Packard Enterprise Co (HPE, Financial) Summary page.