- Amazon Web Services unveils DeviceLayout.jl for quantum integrated circuits design.

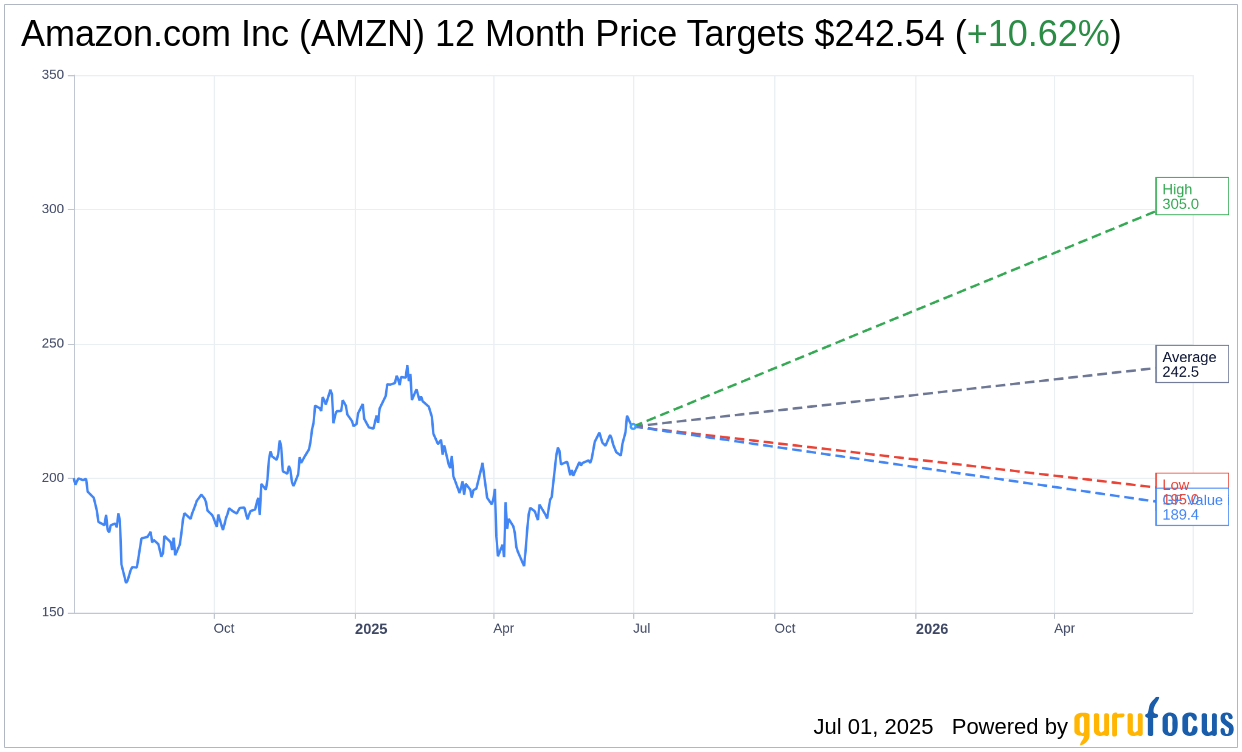

- Experts predict a 10.62% upside for Amazon stock based on average analyst price targets.

- GuruFocus estimates suggest a potential downside of 13.62% based on GF Value.

Amazon (AMZN, Financial) Web Services has introduced an innovative software, DeviceLayout.jl, aimed at revolutionizing computer-aided design specifically for quantum integrated circuits. This groundbreaking tool is set to optimize the design process, facilitating the advancement of superconducting quantum devices. Amidst these developments, Amazon shares experienced a slight dip during midday trading.

Wall Street Analysts Forecast

According to insights from 67 analysts, the average one-year price target for Amazon.com Inc (AMZN, Financial) stands at $242.54, with estimates ranging from a high of $305.00 to a low of $195.00. This average target suggests a potential upside of 10.62% from the current trading price of $219.26. For further detailed estimates, visit the Amazon.com Inc (AMZN) Forecast page.

The consensus recommendation from 73 brokerage firms rates Amazon.com Inc (AMZN, Financial) at an average score of 1.8, indicating an "Outperform" status. The rating system spans from 1 (Strong Buy) to 5 (Sell).

Utilizing GuruFocus estimates, the projected GF Value for Amazon.com Inc (AMZN, Financial) in the coming year is calculated at $189.39. This suggests a potential downside of 13.62% from the current trading price of $219.26. The GF Value represents GuruFocus' fair value estimation for the stock, derived from analyzing historical trading multiples, past business growth, and future business performance projections. For more in-depth information, view the Amazon.com Inc (AMZN) Summary page.