Nvidia (NVDA, Financial) shares experienced a 2.13% drop to $154.63, breaking a six-day rally where the stock climbed over 9%. While Nvidia's recent performance has outshone the S&P 500, there are growing concerns regarding its valuation, impending tariffs, and competition, prompting analysts to remain vigilant.

- Nvidia’s stock has recently outperformed the S&P 500, but faces challenges ahead.

- Analysts offer a cautious view amidst valuation and competition concerns.

- GuruFocus metrics suggest significant potential upside for Nvidia's stock.

Wall Street Analysts Forecast

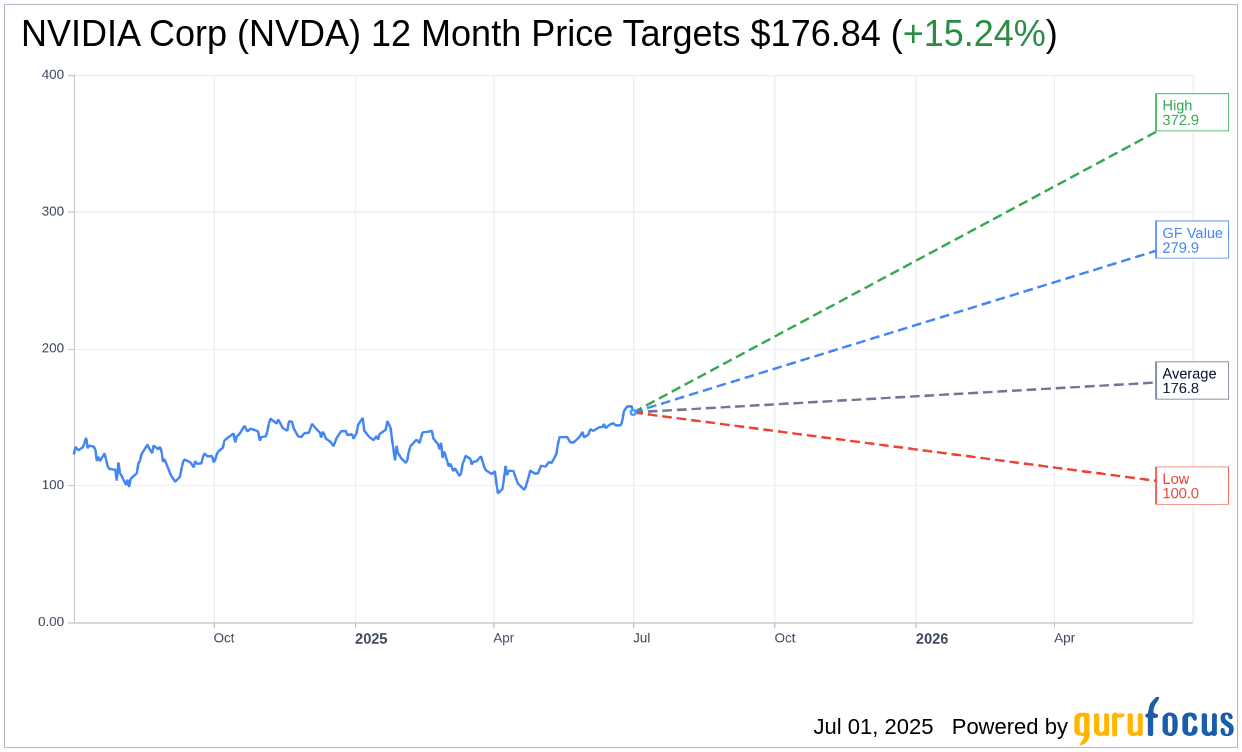

Among the 52 analysts offering a one-year price target for NVIDIA Corp (NVDA, Financial), the average target price stands at $176.84, with projections ranging from a high of $372.87 to a low of $100.00. This average target indicates a potential upside of 15.24% from the current trading price of $153.46. For more comprehensive estimate data, visit the NVIDIA Corp (NVDA) Forecast page.

The consensus recommendation from 65 brokerage firms rates NVIDIA Corp's (NVDA, Financial) stock at an average of 1.8, reflecting an "Outperform" status. The rating system utilizes a scale from 1 to 5, where 1 represents Strong Buy, and 5 indicates a Sell.

GuruFocus Metrics and Valuation Insights

According to GuruFocus estimates, the projected GF Value for NVIDIA Corp (NVDA, Financial) over the next year is anticipated to be $279.87. This suggests a remarkable upside of 82.38% from the current price of $153.455. The GF Value is GuruFocus' assessment of the stock's fair trading value, determined by analyzing historical trading multiples, past business growth, and future performance estimates. For further data, explore the NVIDIA Corp (NVDA) Summary page.