On July 1, 2025, TechTarget Inc (TTGT, Financial) released its 8-K filing detailing preliminary results for the first quarter of 2025. The company, a prominent player in the B2B technology sector, reported revenues of $104 million, marking a 77% increase over the prior year's reported revenues. However, on a Combined Company basis, revenues declined by approximately 6% year-on-year.

Company Overview and Strategic Focus

TechTarget Inc is a business-to-business (B2B) accelerator that informs and influences technology buyers and sellers. The company leverages its B2B first-party data and a comprehensive portfolio of data-driven solutions to service the full B2B product lifecycle, from messaging and content development to in-market activation and sales enablement.

Financial Performance and Challenges

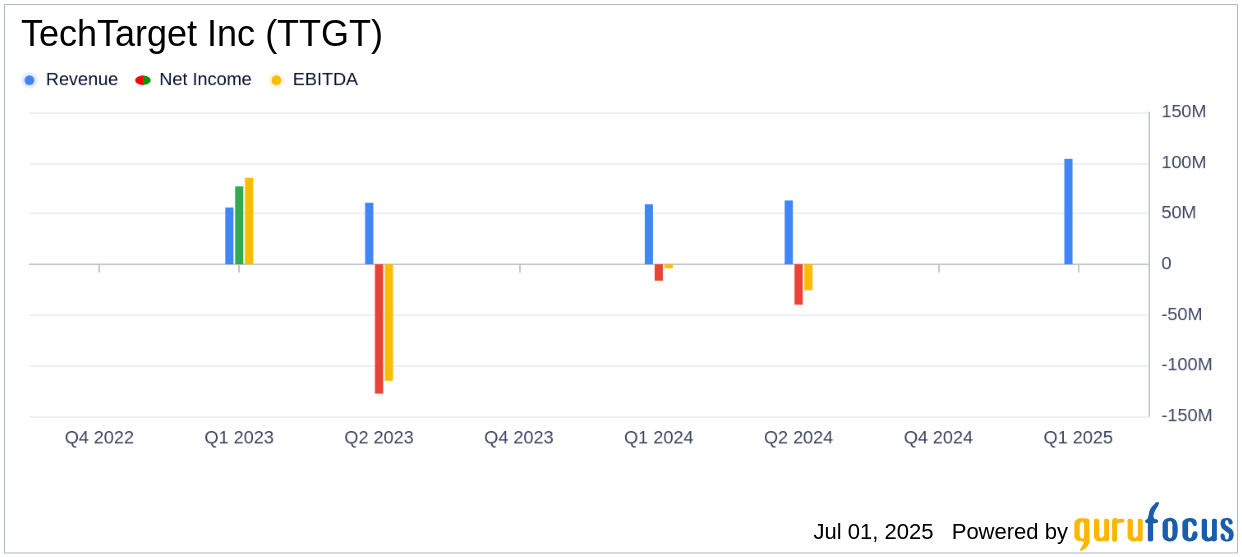

The company's Q1 performance was in line with expectations, despite a challenging market environment. The revenue increase of 77% compared to the previous year highlights the company's growth trajectory. However, the 6% decline on a Combined Company basis reflects ongoing market challenges. The preliminary net loss for Q1 is expected to be between $513 million and $545 million, significantly higher than the $32 million loss reported for the Combined Company in the prior year period. This increase is attributed to acquisition and integration costs, as well as a substantial non-cash impairment due to market capitalization discrepancies.

Financial Achievements and Industry Implications

Despite the net loss, TechTarget's adjusted EBITDA for Q1 was $3 million, a notable improvement from the prior year's zero adjusted EBITDA. This achievement underscores the company's focus on operational efficiency and cost synergies, which are crucial in the software industry where margins can be tight.

Key Financial Metrics

| Metric | Q1 2025 | Q1 2024 | Growth |

|---|---|---|---|

| Revenue | $104 million | $59 million | 77% |

| Net Loss | $(513) - $(545) million | $(32) million | 1503% - 1603% |

| Adjusted EBITDA | $3 million | $0 million | 902% |

Analysis and Outlook

TechTarget's strategic focus on combining its legacy businesses and enhancing operational efficiencies is evident in its Q1 results. The company has made significant progress in integrating teams and systems, which is expected to yield long-term benefits. The reaffirmation of full-year expectations for adjusted EBITDA growth indicates confidence in the company's strategic direction.

Despite the current market challenges, TechTarget's efforts to consolidate its product portfolio and focus on core growth opportunities, such as the CyberSecurity sector, position it well for future growth. The company's ability to leverage its extensive first-party data and expand its market reach will be critical in navigating the evolving B2B technology landscape.

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from TechTarget Inc for further details.