- Qualcomm's stock maintains momentum with recent gains and strategic acquisitions.

- Analyst reviews suggest potential growth, with diverse target price predictions.

- GuruFocus metrics indicate Qualcomm is slightly undervalued.

Qualcomm (NASDAQ: QCOM) continues its upward trajectory, marking a seven-day winning streak with shares closing at $159.40, a modest 0.09% increase as of Tuesday. Year-to-date, Qualcomm's stock has appreciated nearly 3%, amidst mixed analyst ratings predominantly advocating a "Hold." Notably, Qualcomm's strategic acquisition of Alphawave IP is poised to bolster its artificial intelligence capabilities, reflecting a forward-thinking approach to innovation.

Wall Street Analysts' Insights

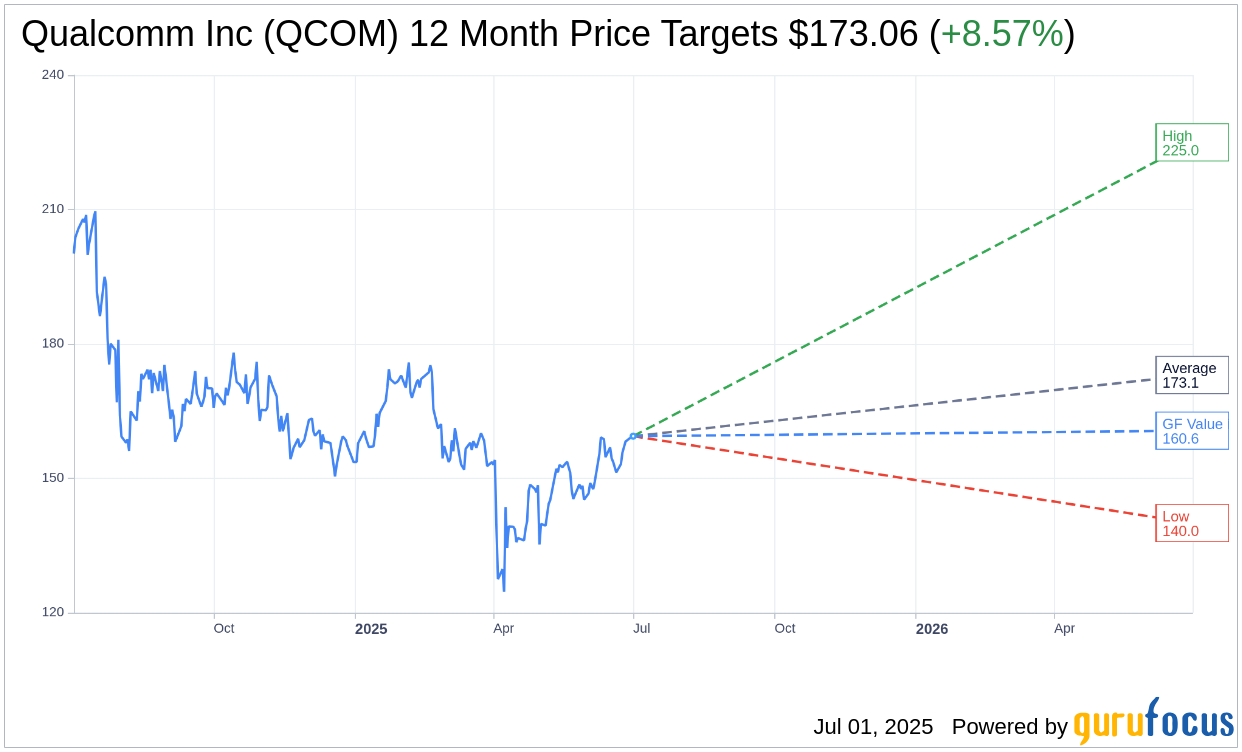

Analysts have set varied one-year price targets for Qualcomm Inc. (QCOM, Financial), averaging at $173.06, with estimates ranging from a low of $140.00 to a high of $225.00. This reflects a potential upside of 8.57% from the current share price of $159.40. Investors seeking detailed projections can explore more on the Qualcomm Inc (QCOM) Forecast page.

In terms of brokerage consensus, Qualcomm garners an average recommendation of 2.4 from 42 firms, indicating an "Outperform" status. This rating, which spans from 1 (Strong Buy) to 5 (Sell), suggests cautious optimism among analysts.

Evaluating Qualcomm's Valuation

According to GuruFocus estimates, Qualcomm's GF Value projects the stock's fair value at $160.63 within a year, hinting at a nominal upside of 0.77% from its current market price. This metric evaluates fair value by considering Qualcomm's historical trading multiples, as well as past growth trajectories and future performance projections. For further analysis, visit the Qualcomm Inc (QCOM, Financial) Summary page.