- CME Group Inc achieves record quarterly average daily volume, signaling strong market engagement.

- Wall Street analysts maintain a "Hold" recommendation with a modest upside potential.

- GuruFocus' GF Value suggests a slight potential downside, highlighting valuation concerns.

CME Group Inc. (CME) has announced a record-breaking quarterly average daily volume of 30.2 million contracts, marking a substantial 15% surge from the previous year. Key performance drivers included a noteworthy Interest Rate ADV of 15.5 million and a remarkable 26% increase in Energy ADV to 3.1 million. Furthermore, the Cryptocurrency ADV saw an impressive 136% jump, reaching 190,000 contracts.

Wall Street Analysts' Forecast

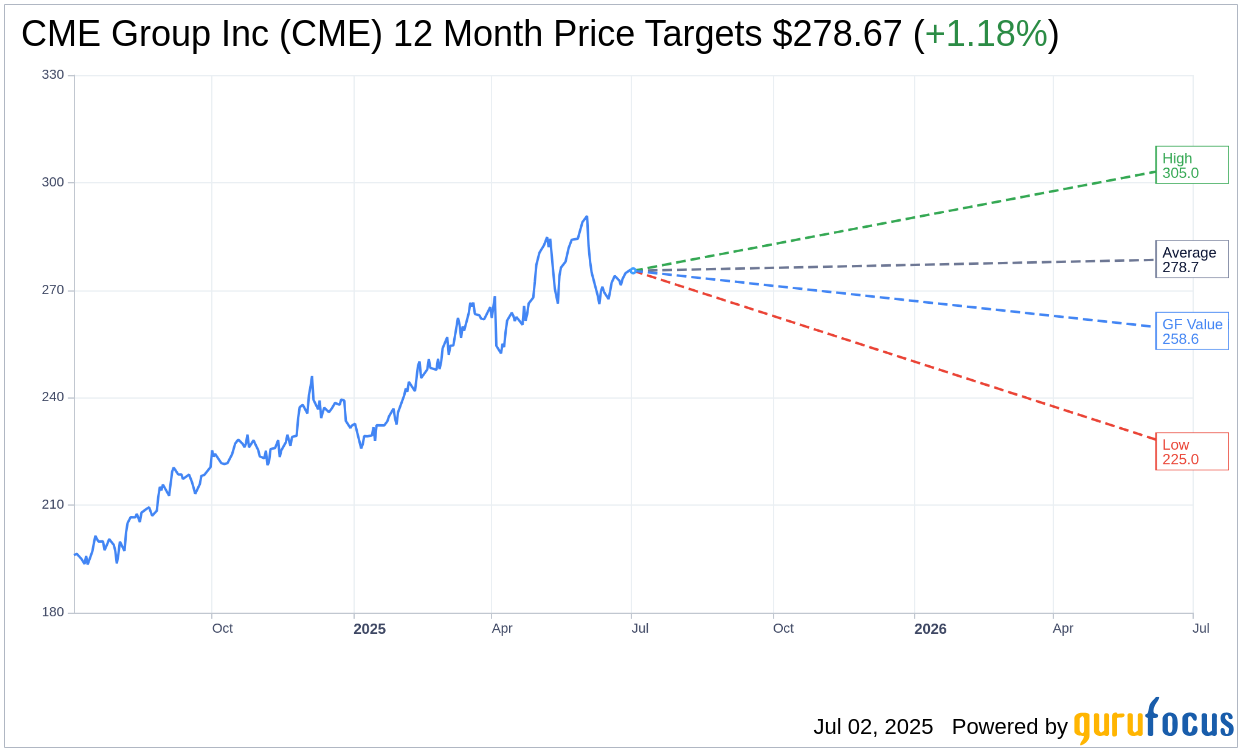

According to one-year price targets from 15 analysts, the average target price for CME Group Inc. remains at $278.67. Expectations vary with a high estimate of $305.00 and a low of $225.00. The current average target suggests a modest upside of 1.18% from the current price of $275.42. Investors seeking more detailed estimates can visit the CME Group Inc (CME, Financial) Forecast page.

The consensus recommendation from 18 brokerage firms rates CME Group Inc. as a 2.6 on a 5-point scale, indicating a "Hold" status. This rating scale ranges from 1 (Strong Buy) to 5 (Sell), providing a crucial reference point for investors evaluating the stock's future prospects.

GuruFocus Valuation

As per GuruFocus estimates, the one-year GF Value for CME Group Inc. stands at $258.64. This figure implies a potential downside of 6.09% from the current price of $275.42. The GF Value is an essential indicator, reflecting the estimated fair value based on historical trading multiples, prior business growth, and future performance forecasts. For a more comprehensive overview, visit the CME Group Inc (CME, Financial) Summary page.