Key Takeaways:

- Oppenheimer assigns an Outperform rating to Camtek (CAMT, Financial) with a $100 price target.

- Camtek is poised for growth in the AI chip sector despite a recent 40% share price dip.

- Consensus from analysts shows a potential upside of 5.10% from current levels.

Oppenheimer recently initiated coverage on Camtek (CAMT), an innovative Israeli company specializing in semiconductor inspection equipment. The firm granted an Outperform rating and set a compelling $100 price target. Despite Camtek’s shares experiencing a significant 40% decline recently, analysts are optimistic. They emphasize the company's cutting-edge inspection tools, which are expected to fuel substantial growth, particularly within the burgeoning AI chip market.

Wall Street Analysts' Insights

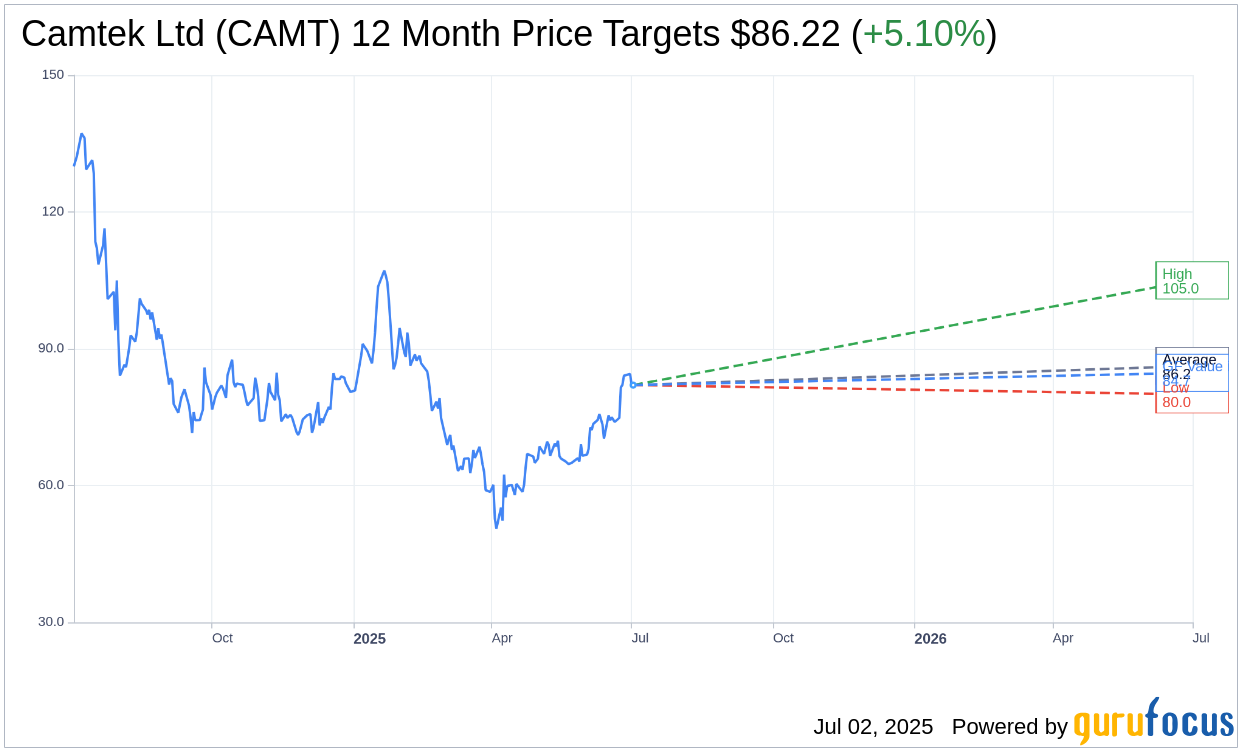

The one-year price targets from 9 seasoned analysts suggest an average target price of $86.22 for Camtek Ltd (CAMT, Financial). This includes a high estimate of $105.00 and a low of $80.00. The average target presents a potential upside of 5.10% from the current stock price of $82.04, reflecting a cautiously optimistic outlook. For more in-depth forecasts, visit the Camtek Ltd (CAMT) Forecast page.

The consensus recommendation from 9 brokerage firms rates Camtek Ltd (CAMT, Financial) at an average of 1.8, which aligns with an "Outperform" status. On the rating scale, 1 signifies a Strong Buy while 5 denotes a Sell. This rating indicates that analysts generally favor Camtek’s potential for future success.

Leveraging GuruFocus' estimates, the projected GF Value for Camtek Ltd (CAMT, Financial) in one year stands at $84.72. This suggests a modest upside of 3.27% from the current share price of $82.04. The GF Value method provides a fair value estimate by analyzing historical trading multiples, past business growth, and future performance forecasts. For a comprehensive overview, check the Camtek Ltd (CAMT) Summary page.