Summary:

- Microsoft Corp (MSFT, Financial) is making strategic layoffs within its King division, impacting 200 positions.

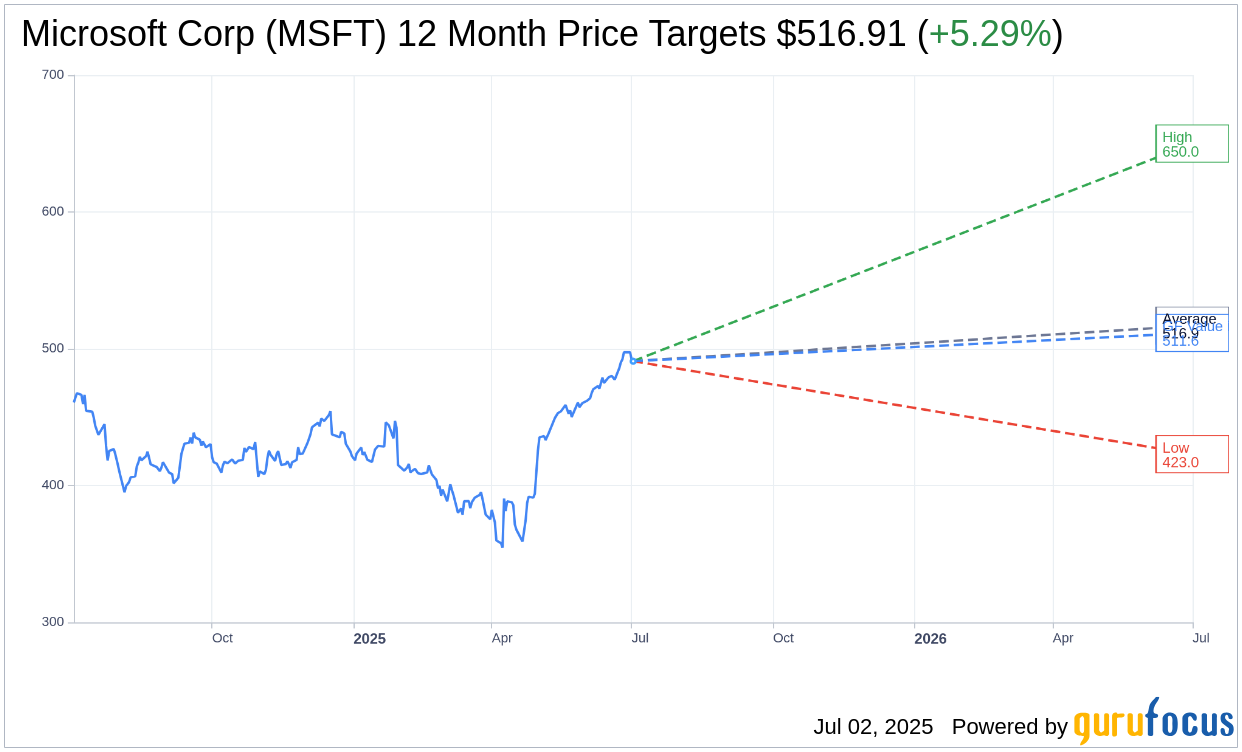

- Analyst predictions reveal a modest potential upside for MSFT stock with a target price of $516.91.

- The company's stock is currently rated as "Outperform" by consensus.

Microsoft's Strategic Workforce Adjustments

Microsoft (MSFT) has announced a strategic 10% reduction in its workforce, affecting approximately 200 employees in its King division based in Barcelona, recognized for developing the popular game Candy Crush. This move forms part of a wider strategy of layoffs that spans across Microsoft's European offices, including ZeniMax, with anticipation building for further details concerning adjustments within the U.S. gaming sector.

Wall Street Analysts' Insights

According to comprehensive analyses by 49 industry experts, Microsoft Corp (MSFT, Financial) is predicted to reach a one-year average target price of $516.91. Projections range from a high of $650.00 to a low of $423.00, indicating a potential upside of 5.29% from the current share price of $490.94. For further insights and detailed estimates, visit the Microsoft Corp (MSFT) Forecast page.

Furthermore, Microsoft's stock is currently rated as "Outperform" according to a consensus recommendation from 62 brokerage firms, with an average brokerage recommendation of 1.8 on a scale where 1 suggests Strong Buy and 5 indicates Sell.

GuruFocus Valuation Metrics

Per the estimates provided by GuruFocus, Microsoft Corp (MSFT, Financial) has a projected GF Value of $511.57 within the next year. This reflects a 4.2% potential upside from its existing price of $490.94. The GF Value represents GuruFocus' assessment of the stock's intrinsic worth, calculated using the historical multiples at which the stock has traded, its past growth trajectory, and future business performance forecasts. Explore more detailed data on the Microsoft Corp (MSFT) Summary page.