Key Takeaways:

- SiteOne Landscape Supply faces potential challenges due to BrightView Holdings' reduced sales forecast.

- Despite economic pressures, SiteOne maintains its earnings guidance.

- Analysts project an upside potential for SiteOne, with promising price targets and GF Value estimates.

SiteOne Landscape Supply (NYSE: SITE) is navigating potential headwinds as BrightView Holdings (NYSE: BV), a significant client, recently adjusted its annual sales forecast downward by approximately 3%. This move by BrightView highlights ongoing economic pressures. However, in a show of resilience, SiteOne remains committed to maintaining its current earnings guidance, suggesting confidence in its operational strategy.

Wall Street Analysts' Forecasts for SiteOne

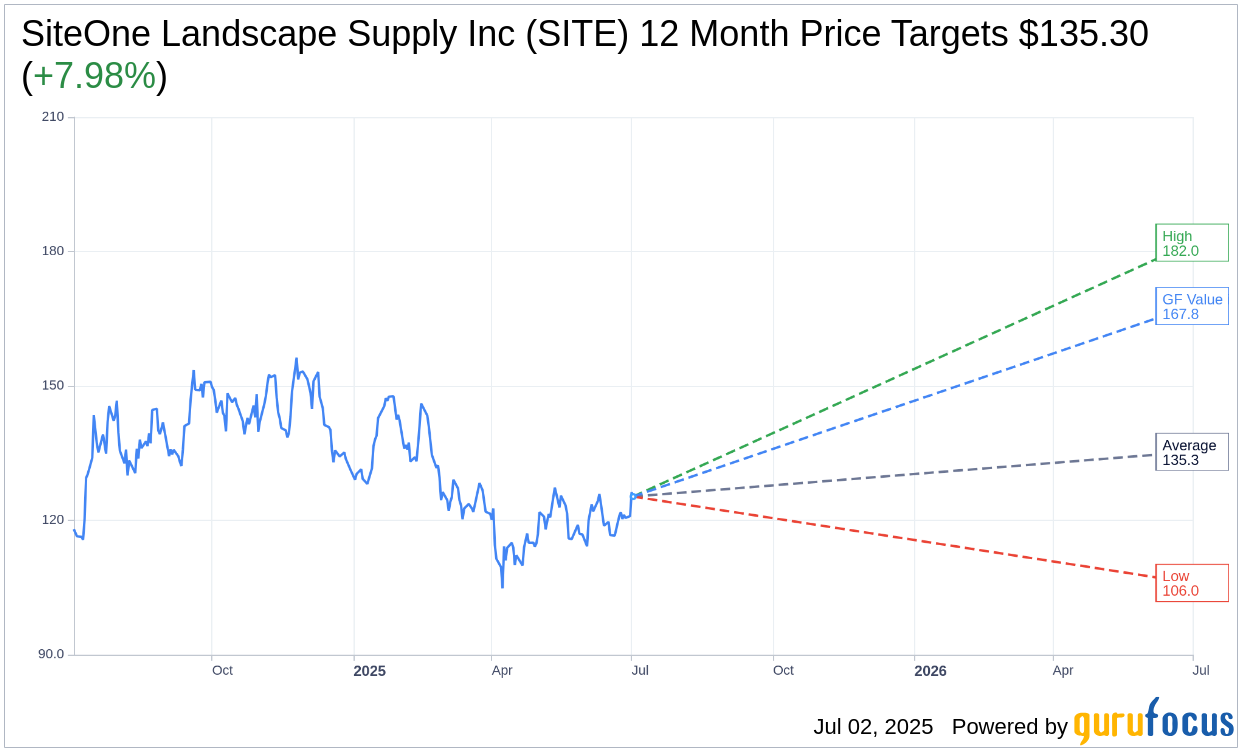

SiteOne Landscape Supply Inc. (SITE, Financial) has garnered attention from 10 analysts who have set their sights on the company's future performance. The consensus average target price stands at $135.30, with high and low estimates stretching from $182.00 to $106.00, respectively. This average target indicates a potential upside of 7.98% from its current trading price of $125.30. For further insights and detailed projections, investors can explore the SiteOne Landscape Supply Inc (SITE) Forecast page.

Market Position and Broker Recommendations

The investment community, represented by 11 brokerage firms, has positioned SiteOne Landscape Supply Inc. (SITE, Financial) with an average brokerage recommendation rating of 2.4. This rating aligns with an "Outperform" status on a scale where 1 is a Strong Buy, and 5 indicates a Sell. It reflects a generally optimistic sentiment towards SiteOne's market potential amid current challenges.

Understanding the GF Value and Upside Potential

According to GuruFocus estimates, SiteOne Landscape Supply Inc. (SITE, Financial) holds a projected GF Value of $167.84 within the next year, suggesting a substantial upside of 33.95% relative to its present price of $125.30. The GF Value metric is a calculated estimate of the fair market value of a stock, considering historical trading multiples, past growth patterns, and anticipated future business performance. Investors keen on deeper detail can visit the SiteOne Landscape Supply Inc (SITE) Summary page for comprehensive data.

In summary, while SiteOne Landscape Supply faces external economic challenges, the strong support from analyst forecasts and positive GF Value assessments suggest that the company holds promising potential for investors seeking growth in this sector.