Investment Highlights:

- POET Technologies leads as the only "buy-rated" small-cap semiconductor stock.

- Wall Street Analysts set a high potential target price, indicating significant upside.

- Contrastingly, GuruFocus estimates suggest a possible significant downside.

POET Technologies (NASDAQ: POET) stands out in the competitive semiconductor landscape as the sole "buy-rated" small-cap stock, boasting a notable Quant rating of 4.79 on Seeking Alpha. This positions POET Technologies distinctively, especially when juxtaposed against sector giants like Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO), which deliver more subdued assessments according to Renaissance Macro Research.

Wall Street Analysts' Forecast for POET Technologies

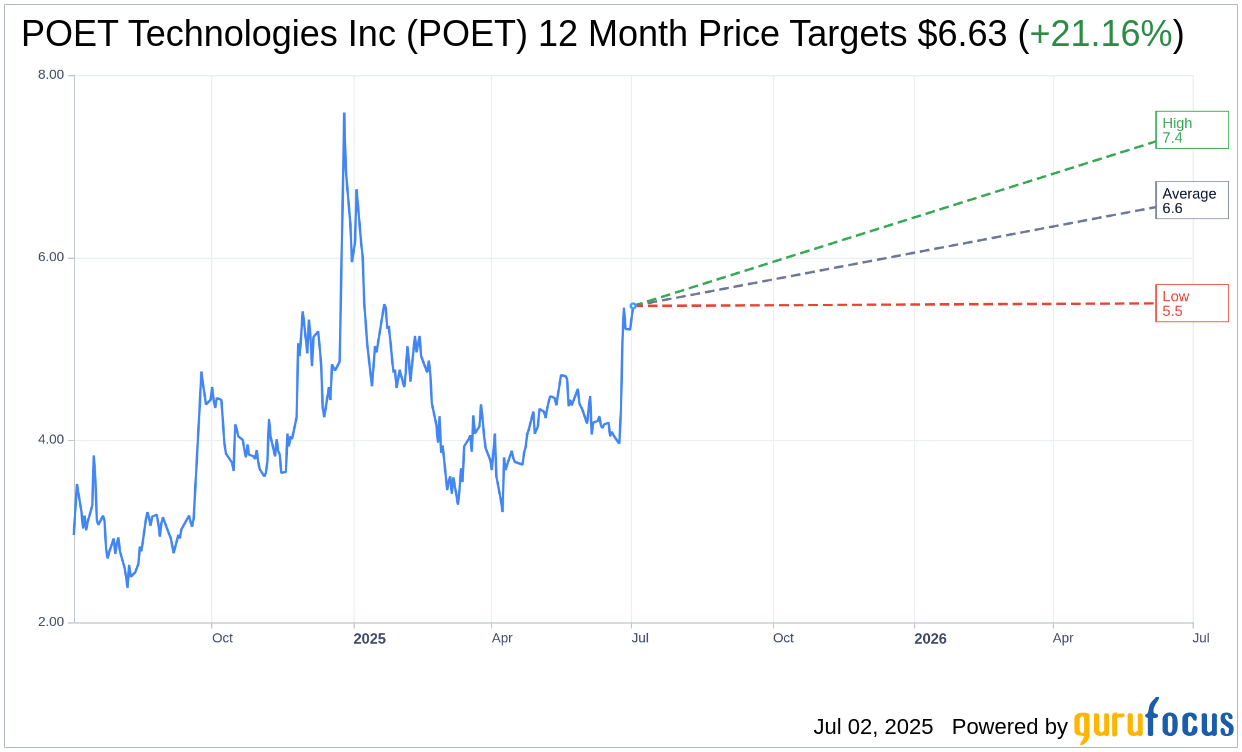

In analyzing one-year price projections from three analysts, POET Technologies Inc (NASDAQ: POET) holds an average target price of $6.63. This encompasses a high target reaching $7.40, and a low estimate at $5.50, collectively implying a notable upside of 21.16% from its current trading price of $5.48. For comprehensive insights, more detailed estimates are available on the POET Technologies Inc (POET, Financial) Forecast page.

Brokerage Recommendations

With regard to brokerage recommendations, POET Technologies Inc (POET, Financial) is presently accorded an "Outperform" status, reflected in an average brokerage recommendation of 2.0 on a scale where 1 symbolizes a Strong Buy, and 5 denotes a Sell. This indicates a positive outlook by the analysts.

Assessing GF Value and Market Implications

In contrast to optimistic brokerage forecasts, GuruFocus estimates present a divergent perspective. The estimated GF Value for POET Technologies Inc (NASDAQ: POET) in the upcoming year is projected at $0.73. This suggests a potential downside of 86.67% from its current market price of $5.475. The GF Value represents GuruFocus' calculated fair value, derived from historical trading multiples, past business growth, and future performance forecasts. Investors can access additional detailed data on the POET Technologies Inc (POET, Financial) Summary page.

In conclusion, while POET Technologies shows a promising quantitative edge highlighted by Wall Street, the stark contrast with GuruFocus insights serves as a reminder for investors to exercise diligence when considering the varied projections and inherent risks associated with small-cap semiconductor stocks.