- Microsoft plans a global workforce reduction of 9,000 positions amid organizational changes.

- Despite layoffs, the Azure division reports a 33% spike in revenue.

- Analysts project a moderate upside for Microsoft stock with strong "Outperform" ratings.

Microsoft (MSFT, Financial) is undertaking a significant reduction in its global workforce, with plans to cut approximately 9,000 jobs. These layoffs, which represent less than 4% of Microsoft's total employees, are part of a broader initiative to streamline its operations. Notably, the company's gaming division based in Barcelona, King, will experience a 10% reduction in its workforce. Despite this challenging news, Microsoft's cloud segment, Azure, continues to shine with an impressive 33% increase in revenue, underscoring the strength of its cloud business.

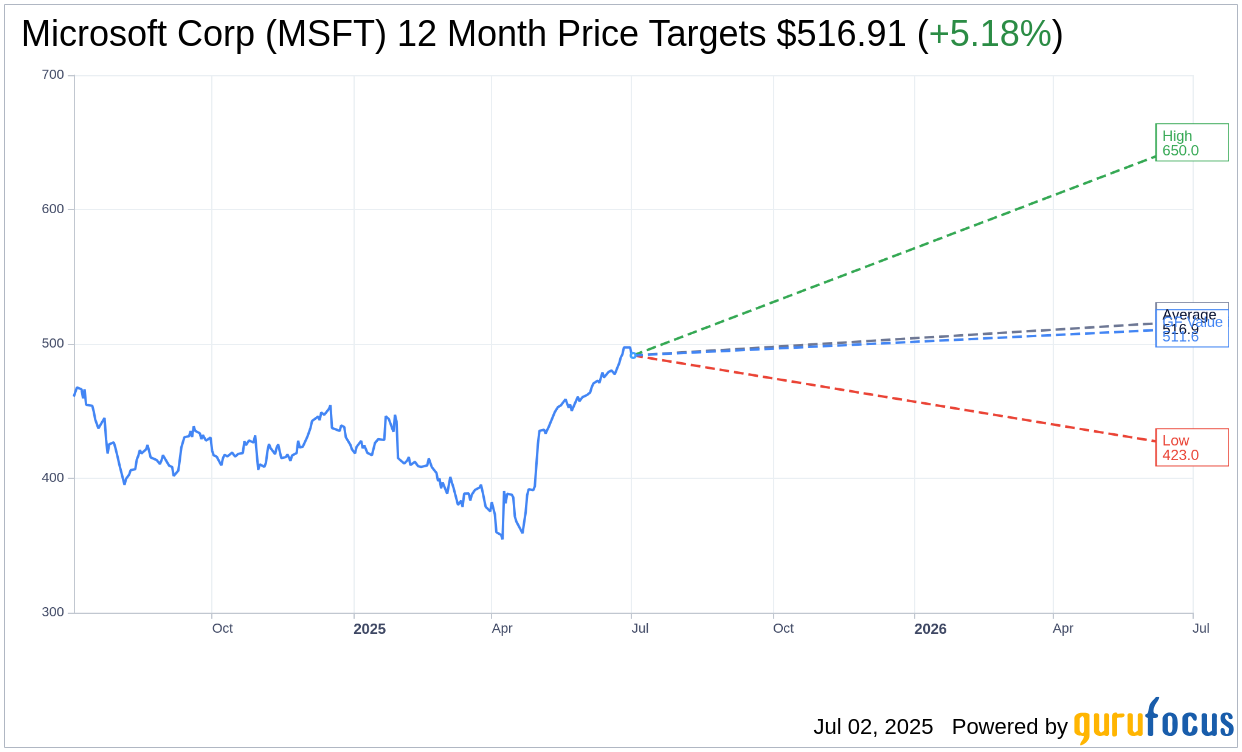

Wall Street Analysts Forecast

Turning to analyst projections, Microsoft's stock (MSFT, Financial) holds an average target price of $516.91 among 49 analysts. This target suggests a potential upside of 5.18% from the current trading price of $491.44. The highest price target is pegged at $650.00, while the lowest is $423.00. For a deeper dive into the estimates, visit the Microsoft Corp (MSFT) Forecast page.

The consensus from 62 brokerage firms rates Microsoft Corp (MSFT, Financial) at an average of 1.8, which translates to an "Outperform" recommendation. This rating operates on a scale from 1 to 5, with 1 representing a Strong Buy and 5 indicating a Sell.

According to estimates from GuruFocus, the projected GF Value for Microsoft in one year is $511.57. This forecast suggests a potential upside of 4.1% from the current price of $491.44. The GF Value is determined by assessing historical trading multiples, past business growth, and future performance projections. More information is available on the Microsoft Corp (MSFT, Financial) Summary page.