On July 1, 2025, Nathan Manning, Vice President and President, Americas of Johnson Controls International PLC (JCI, Financial), sold 1,422 shares of the company. Following this transaction, the insider now owns 141,860.46 shares of the company. The details of this transaction can be found in the SEC Filing.

Johnson Controls International PLC (JCI) is a global leader in building technology and solutions. The company provides products, services, and solutions to optimize energy and operational efficiencies of buildings. Its portfolio includes HVAC equipment, building management systems, and security systems.

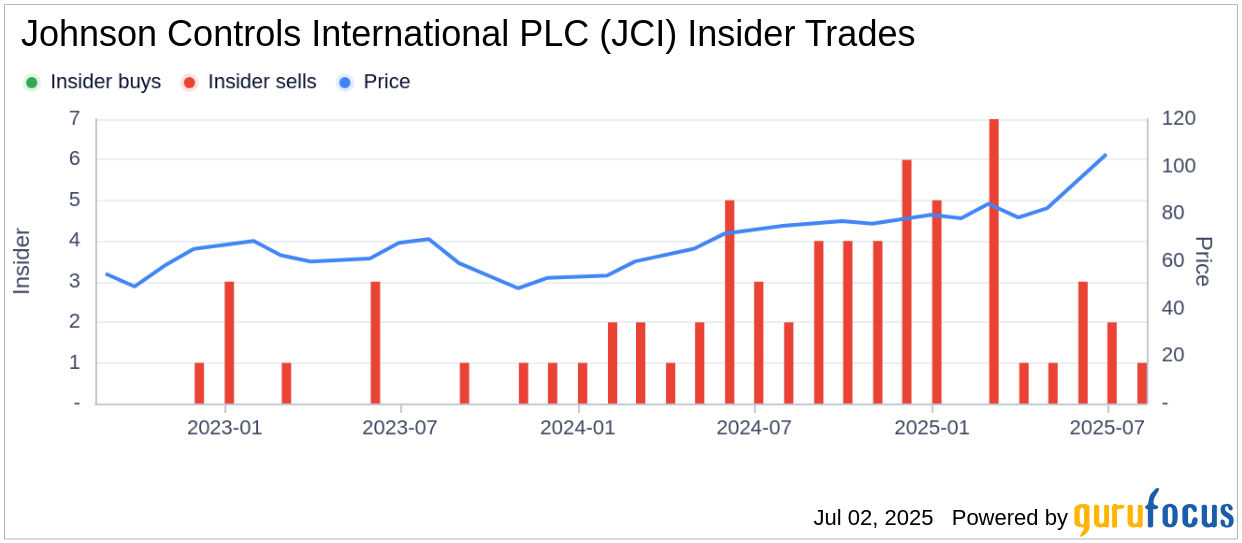

Over the past year, Nathan Manning has sold a total of 12,443 shares and has not purchased any shares. The insider transaction history for Johnson Controls International PLC shows that there have been no insider buys in total over the past year, while there have been 40 insider sells during the same period.

Over the past year, Nathan Manning has sold a total of 12,443 shares and has not purchased any shares. The insider transaction history for Johnson Controls International PLC shows that there have been no insider buys in total over the past year, while there have been 40 insider sells during the same period.

On the day of the recent sale, shares of Johnson Controls International PLC were trading at $104.82, giving the stock a market cap of $68,825.170 million. The company's price-earnings ratio is 27.89, which is higher than the industry median of 16.6 and also higher than the company’s historical median price-earnings ratio.

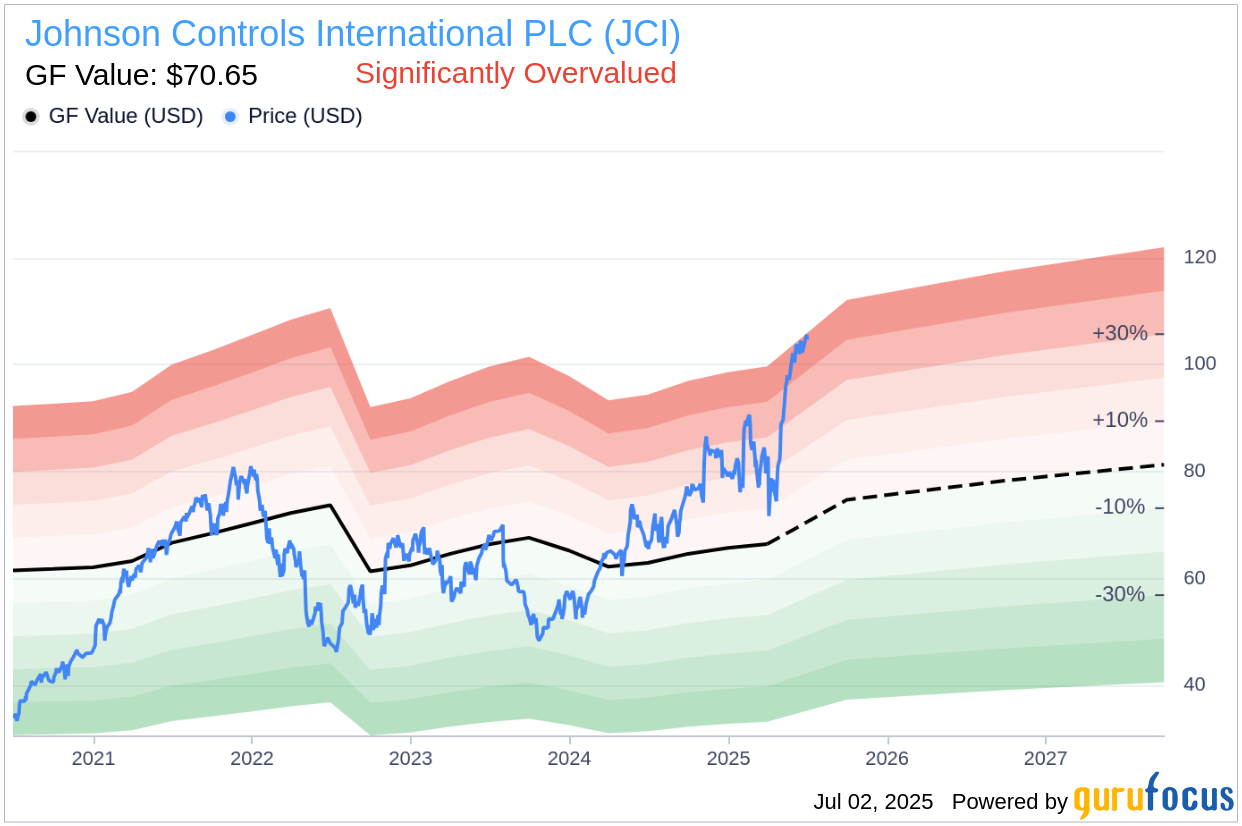

With a price of $104.82 and a GF Value of $70.65, Johnson Controls International PLC has a price-to-GF-Value ratio of 1.48, indicating that the stock is significantly overvalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

On the day of the recent sale, shares of Johnson Controls International PLC were trading at $104.82, giving the stock a market cap of $68,825.170 million. The company's price-earnings ratio is 27.89, which is higher than the industry median of 16.6 and also higher than the company’s historical median price-earnings ratio.

With a price of $104.82 and a GF Value of $70.65, Johnson Controls International PLC has a price-to-GF-Value ratio of 1.48, indicating that the stock is significantly overvalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.