Key Takeaways:

- 4D Molecular Therapeutics initiates a significant workforce reduction aimed at enhancing operational efficiency.

- Analyst consensus forecasts substantial upside potential for FDMT stock, with a notable average price target.

- GuruFocus estimates indicate a promising future value for the company's shares.

4D Molecular Therapeutics (FDMT) recently announced a strategic decision to cut its workforce by 25%. This restructuring is part of an effort to optimize operations and accelerate the development of its 4D-150 4FRONT phase 3 program, focused on treating wet age-related macular degeneration. While the move will incur a cost of $3 million, it is projected to result in annual savings of $15 million, effectively extending the company's financial runway into 2028.

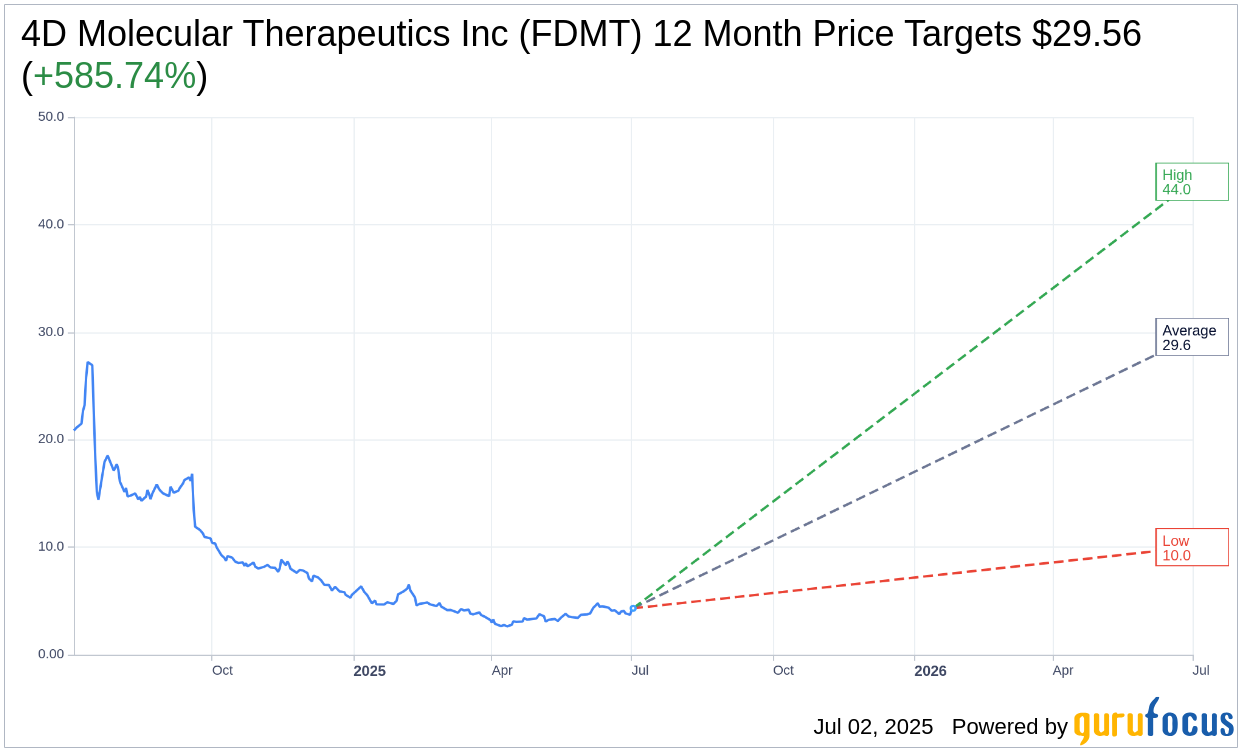

Wall Street Analysts Forecast

Analysts have provided one-year price targets for 4D Molecular Therapeutics Inc (FDMT), with an average target price of $29.56. This includes a high estimate of $44.00 and a low estimate of $10.00. This range suggests an impressive upside potential of 585.74% from the current price of $4.31. For more detailed projections, please visit the 4D Molecular Therapeutics Inc (FDMT, Financial) Forecast page.

According to the consensus from 11 brokerage firms, 4D Molecular Therapeutics Inc's (FDMT, Financial) average brokerage recommendation stands at 2.1, indicating an "Outperform" status. This recommendation scale ranges from 1, indicating a Strong Buy, to 5, denoting a Sell.

GuruFocus Valuation Insights

Based on GuruFocus estimates, the anticipated GF Value for 4D Molecular Therapeutics Inc (FDMT, Financial) in one year is $9.09. This suggests a potential upside of 110.9% from the current share price of $4.31. The GF Value is GuruFocus' fair value assessment for the stock, derived from historical trading multiples, past business growth, and future performance estimates. For a more comprehensive analysis, visit the 4D Molecular Therapeutics Inc (FDMT) Summary page.