Meta Platforms (META, Financial) has received a rating upgrade from Needham, an analyst firm renowned for its comprehensive market insights. The analyst, Laura Martin, has revised her previous rating from "Underperform" to "Hold" as of July 3, 2025. This adjustment reflects a change in the company's perceived market performance.

Despite the lack of specified price targets, both current and prior, the upgrade indicates a shift in confidence towards Meta's potential stability and performance in the market. The move from "Underperform" to "Hold" suggests that the company is now expected to maintain its market position without significant risk of decline, according to the analyst's assessment.

Investors and market participants may find this change noteworthy as it points towards a more optimistic outlook for Meta Platforms (META, Financial), although it stops short of a more bullish "Buy" rating. With no changes to the price target outlined, stakeholders are left to interpret the upgrade in the context of broader market trends and Meta's strategic initiatives moving forward.

As the tech giant continues to innovate and expand its digital presence, the adjusted rating from Needham reflects an evolving view of its market position. Stakeholders should remain attentive to further analyst insights and Meta Platforms' strategic announcements which might influence future performance evaluations.

Wall Street Analysts Forecast

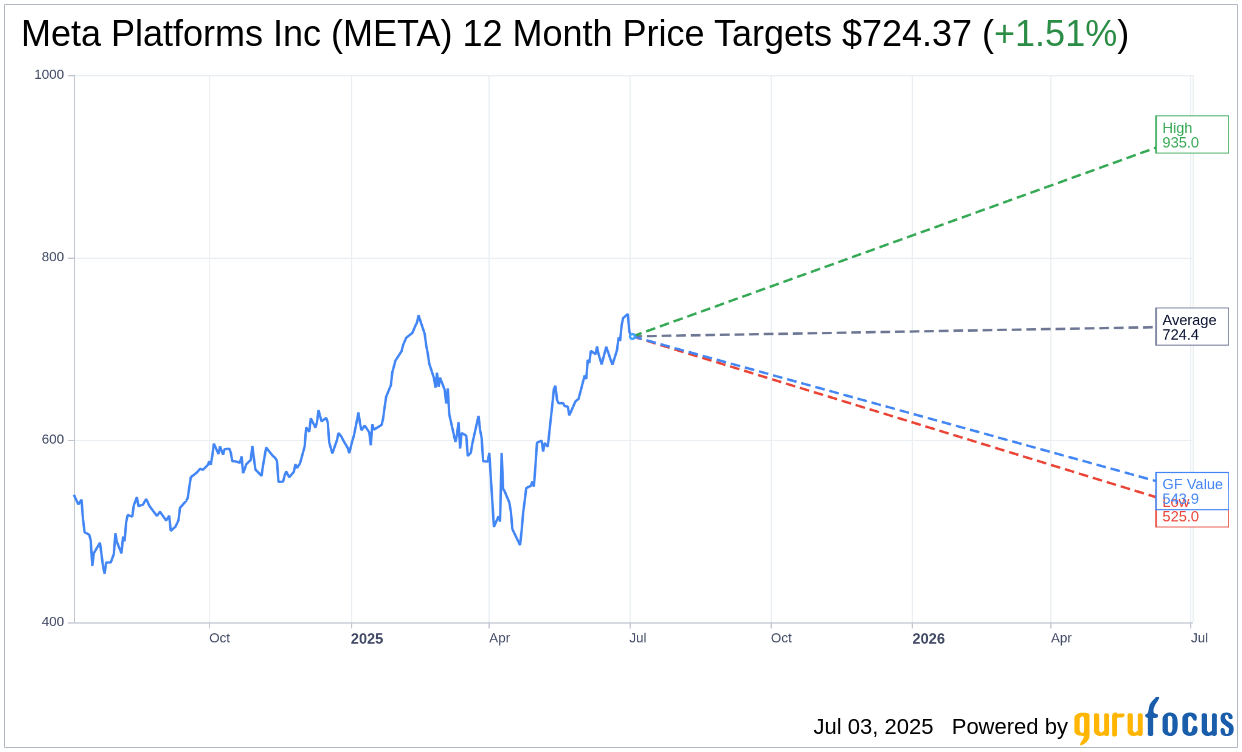

Based on the one-year price targets offered by 61 analysts, the average target price for Meta Platforms Inc (META, Financial) is $724.37 with a high estimate of $935.00 and a low estimate of $525.00. The average target implies an upside of 1.51% from the current price of $713.57. More detailed estimate data can be found on the Meta Platforms Inc (META) Forecast page.

Based on the consensus recommendation from 71 brokerage firms, Meta Platforms Inc's (META, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Meta Platforms Inc (META, Financial) in one year is $543.89, suggesting a downside of 23.78% from the current price of $713.57. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Meta Platforms Inc (META) Summary page.