- Salesforce's new pricing strategy is projected to boost subscription revenue significantly in fiscal years 2027 and 2028.

- Analyst consensus indicates a strong "Outperform" recommendation for Salesforce stock, with an estimated price target offering a potential upside of over 31%.

- GuruFocus's GF Value assessment suggests a potential 12.3% gain from the current stock price.

Salesforce's Strategic Price Adjustment

In a strategic move anticipated to bolster revenue, Salesforce (CRM, Financial) has adjusted its pricing for its Enterprise and Unlimited tiers. Set to take effect in August, this price increase is expected to prompt notable subscription upgrades from some of Salesforce's largest clients, according to Morgan Stanley. This development could significantly enhance subscription revenue in the fiscal years 2027 and 2028.

Wall Street Analysts' Optimistic Outlook

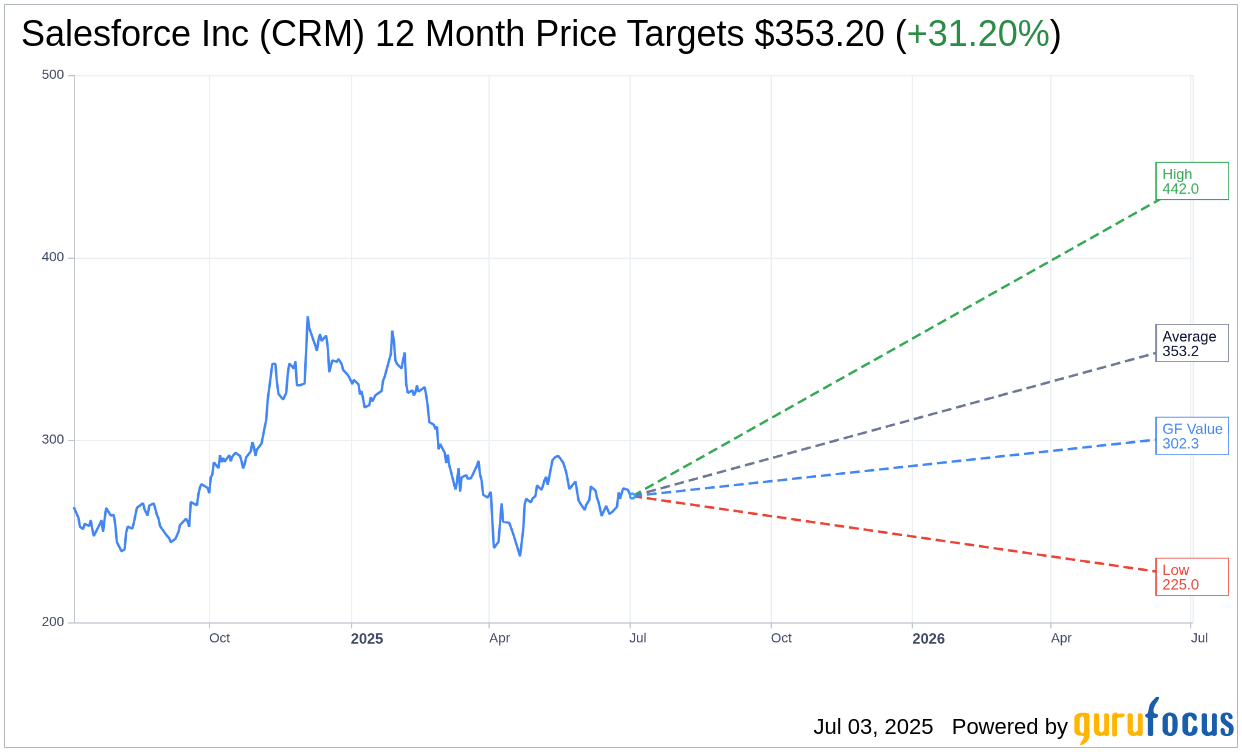

Wall Street analysts maintain a positive outlook on Salesforce, with 49 experts offering an average one-year price target of $353.20. This forecast includes a high estimate of $442.00 and a low of $225.00, suggesting a potential upside of 31.20% from the current trading price of $269.21. Investors can explore more in-depth estimates on the Salesforce Inc (CRM, Financial) Forecast page.

Brokerage Recommendations and Ratings

The consensus among 55 brokerage firms supports a "2.0" rating for Salesforce, categorizing the stock as "Outperform." This consensus highlights a favorable view of Salesforce's market position, with a rating scale that ranges from 1 (Strong Buy) to 5 (Sell).

GuruFocus GF Value Estimates

According to GuruFocus estimates, Salesforce's projected GF Value in one year is $302.32. This suggests a potential upside of 12.3% from the current price of $269.21. The GF Value reflects the calculated fair value at which Salesforce should trade, based on historical trading multiples, past growth, and future business performance estimates. For more comprehensive data, investors are encouraged to visit the Salesforce Inc (CRM, Financial) Summary page.