- Amazon integrates Freevee app into Prime Video to streamline its services.

- Analysts see a potential 9.53% upside for Amazon stock.

- GuruFocus estimates suggest a 14.91% downside from the current price.

Amazon's Strategic Move: Freevee App Integration

Amazon (AMZN, Financial) is set to retire its Freevee standalone app this August, transitioning its content into the Prime Video platform within a newly designated "Watch for Free" section. This strategic move aims to enhance the user experience by streamlining Amazon's streaming services, following the original branding of IMDb after its acquisition in 1998.

Analyst Forecasts and Price Targets

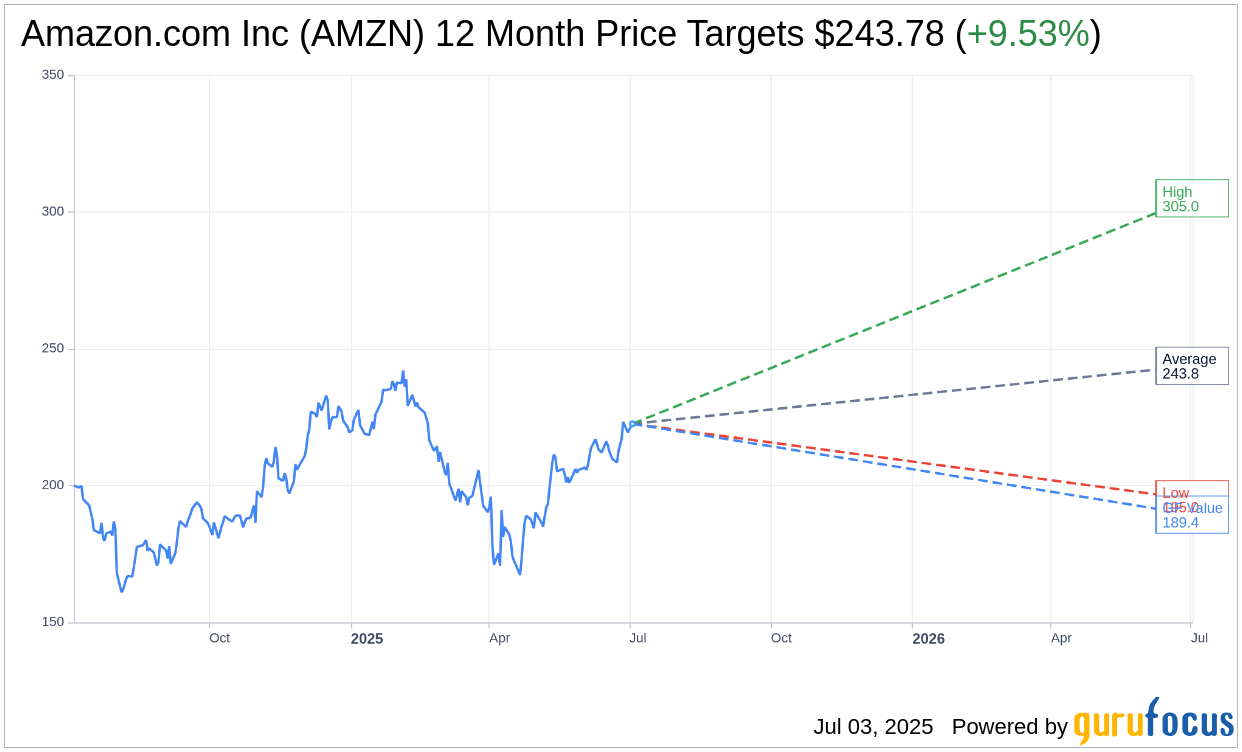

With insights from 67 analysts providing one-year price targets, the average target for Amazon.com Inc (AMZN, Financial) stands at $243.78. This encompasses a high estimate of $305.00 and a low estimate of $195.00. The average target suggests a potential upside of 9.53% from the current price of $222.57. For more comprehensive estimate data, please visit the Amazon.com Inc (AMZN) Forecast page.

Brokerage Recommendations

Among 73 brokerage firms, Amazon.com Inc's (AMZN, Financial) average recommendation is 1.7 on the rating scale, indicating an "Outperform" status. Within this scale, 1 represents a Strong Buy and 5 signifies a Sell, suggesting a generally positive outlook from analysts.

GuruFocus's GF Value Analysis

According to GuruFocus estimates, the projected GF Value for Amazon.com Inc (AMZN, Financial) over the next year is $189.39, indicating a potential downside of 14.91% from the current price of $222.57. The GF Value represents GuruFocus' fair value estimate, determined from historical trading multiples, past growth, and future business performance predictions. Detailed data and analysis can be found on the Amazon.com Inc (AMZN) Summary page.