Key Takeaways:

- Intercontinental Exchange (ICE, Financial) experienced significant growth in trading volumes and open interest in June.

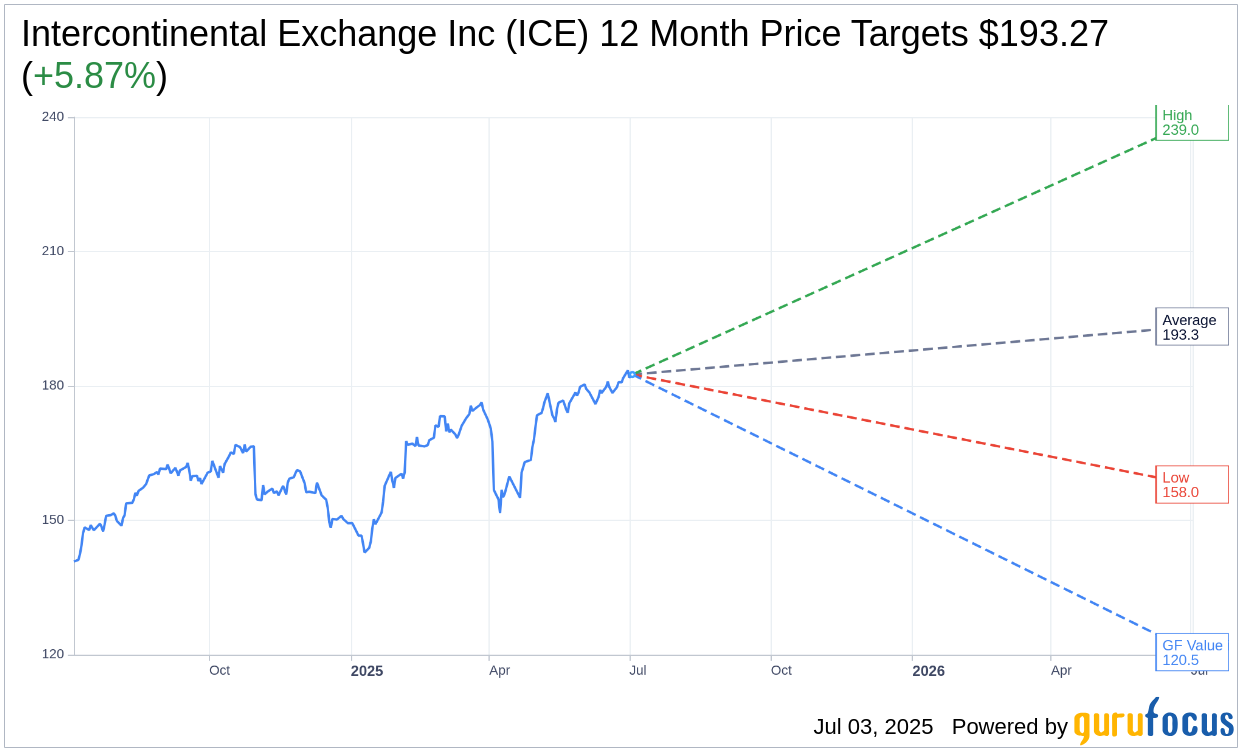

- Analysts predict a moderate upside for ICE, with an average price target suggesting a 5.87% increase.

- GuruFocus estimates indicate a potential downside, highlighting a disconnect with analyst optimism.

Intercontinental Exchange's Impressive Trading Volume Surge

Intercontinental Exchange (ICE) showcased robust performance with a remarkable 21% increase in June's average daily volume (ADV) compared to the previous year. This was complemented by a 9% rise in open interest. The second quarter was especially strong, witnessing a 26% year-over-year increase in ADV. Energy ADV was a standout, jumping 28% in June, underlining the continued strength in this sector.

Wall Street Analysts' Forecast for Intercontinental Exchange

According to 15 analysts covering Intercontinental Exchange Inc (ICE, Financial), the one-year price targets range from a low of $158.00 to a high of $239.00, with an average target price of $193.27. This average target hints at a potential upside of 5.87% from the current trading price of $182.55. For further details, explore the Intercontinental Exchange Inc (ICE) Forecast page.

The brokerage sentiment around ICE remains positive, with a consensus recommendation of 2.0 from 19 brokerage firms, categorizing the stock as "Outperform." This rating falls within a scale where 1 represents a Strong Buy, and 5 indicates a Sell position.

GuruFocus Valuation Insights

GuruFocus provides a distinct perspective with its GF Value estimate, pegging the stock's fair value at $120.55 in one year's time. This estimate suggests a potential downside of 33.96% from the current price of $182.55. The GF Value is derived from historical trading multiples, past growth metrics, and future business performance forecasts. For a comprehensive view of these insights, visit the Intercontinental Exchange Inc (ICE, Financial) Summary page.

While analysts remain optimistic about ICE's near-term prospects, the contrast with GuruFocus's valuation presents an intriguing narrative for investors to consider when assessing potential risks and rewards.