- Alpha and Omega Semiconductor resolves a regulatory issue with a $4.25 million settlement.

- Current stock evaluations show a minor downside risk according to analysts.

- GuruFocus metrics indicate potential for modest future gains.

Alpha and Omega Semiconductor (AOSL, Financial) has reached a significant milestone by agreeing to a $4.25 million settlement with the U.S. Department of Commerce. This settlement addresses the company's previous exportation of items to Huawei, which breached existing regulations. It marks the end of an extensive government investigation, and reassuringly, Alpha's core business operations remain robust and unaffected.

Wall Street Analysts Forecast

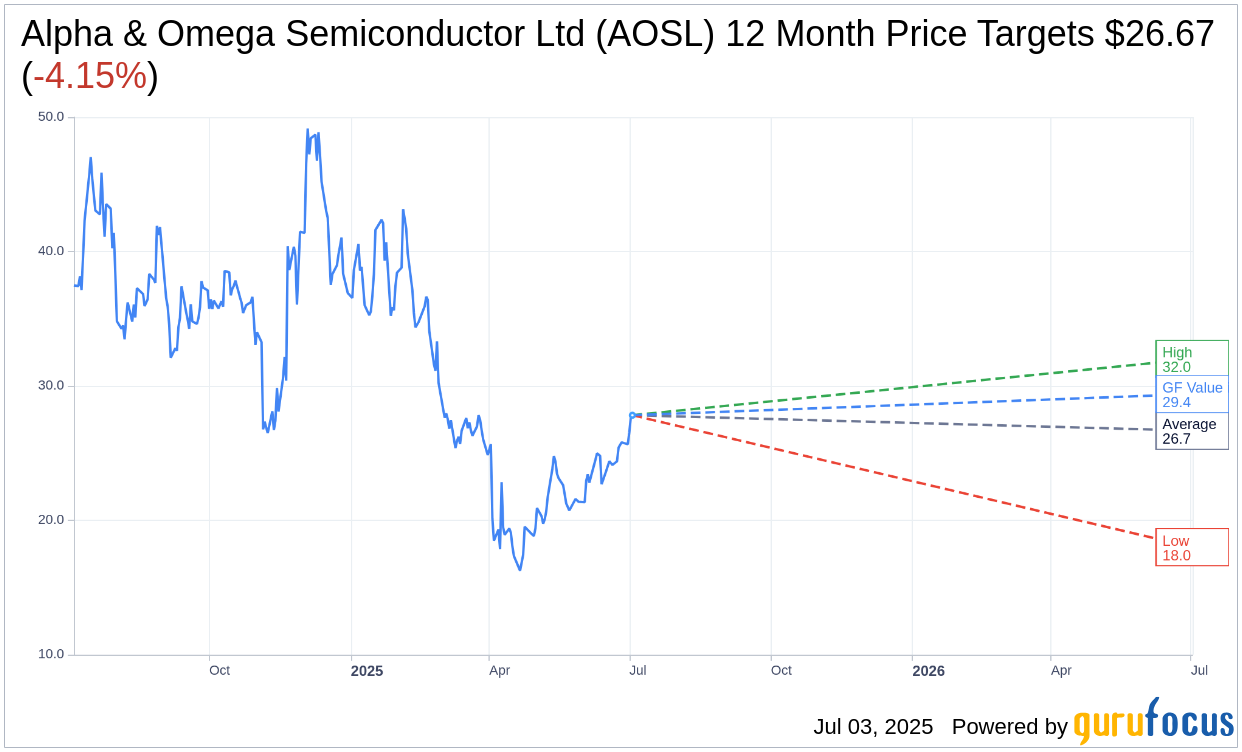

Diving into the market predictions for Alpha & Omega Semiconductor Ltd (AOSL, Financial), we find that three analysts have set a one-year average target price at $26.67. The projections vary, with a high estimate reaching $32.00 and a low bottoming out at $18.00. This average target indicates a potential downside of 4.15% from the current trading price of $27.82. For further detailed projections, investors are encouraged to visit the Alpha & Omega Semiconductor Ltd (AOSL) Forecast page on GuruFocus.

Currently, Alpha & Omega Semiconductor Ltd's (AOSL, Financial) consensus from three brokerage firms reflects a "Hold" status with an average recommendation score of 3.0. This rating scale spans from 1, indicating a Strong Buy, to 5, suggesting a Sell.

Examining the GF Value provided by GuruFocus, Alpha & Omega Semiconductor Ltd (AOSL, Financial) is estimated to reach $29.39 in the coming year, which suggests a potential upside of 5.64% from the current price of $27.82. The GF Value offers a fair value estimation based on historical trading multiples, previous business growth, and projected future performance. For a comprehensive analysis, visit the Alpha & Omega Semiconductor Ltd (AOSL) Summary page.