- Strategic Move: Banzai International (BNZI, Financial) announces a reverse stock split to boost share price.

- Analyst Insights: Wall Street analysts predict a substantial upside potential for BNZI stock.

- Performance Rating: BNZI holds an "Outperform" recommendation from brokerage firms.

Banzai International (BNZI) has initiated a strategic move with its declaration of a one-for-ten reverse stock split for both its class A and B common stocks, aiming to elevate the share price to meet Nasdaq's listing requirements. This adjustment will decrease the share count to approximately 2.24 million class A shares and 231,113 class B shares.

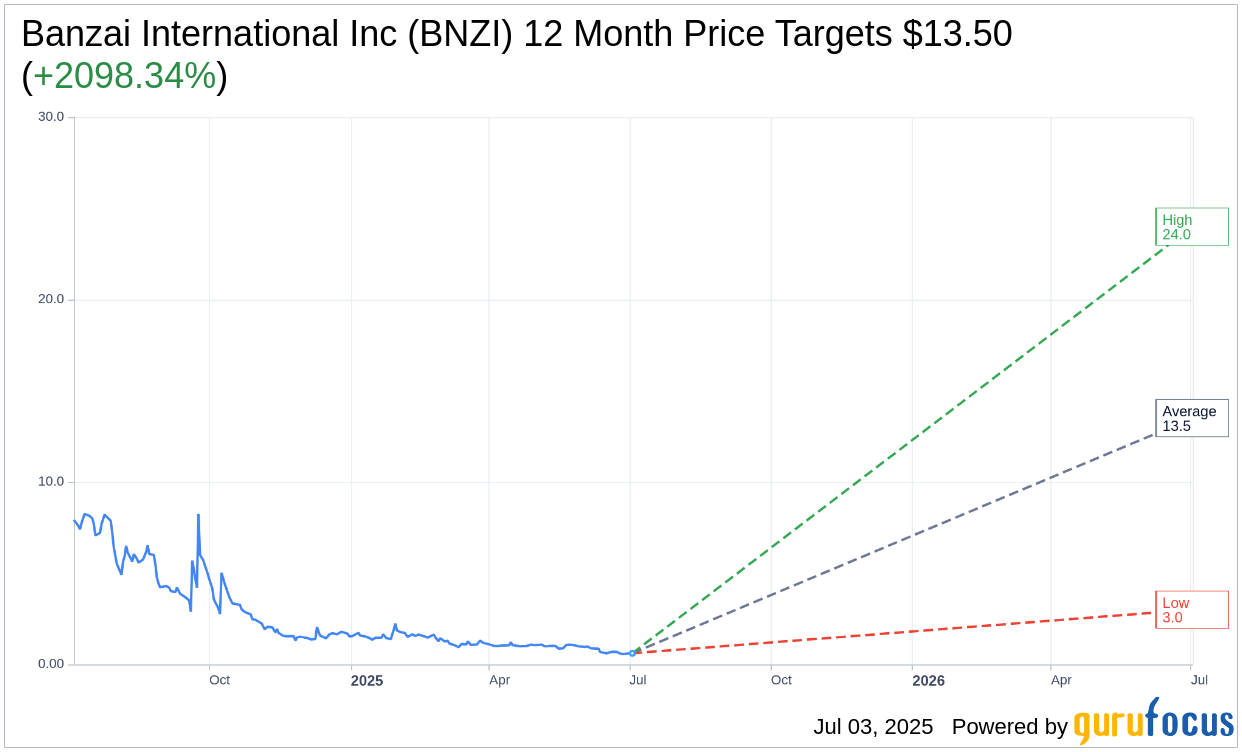

Wall Street Analysts Forecast

According to projections from two Wall Street analysts, Banzai International Inc (BNZI, Financial) is poised for notable growth. The average one-year price target is set at $13.50, with a high forecast of $24.00 and a low of $3.00. This average target suggests an impressive potential upside of 2,098.34% from BNZI's current market price of $0.61. For more comprehensive details, visit the Banzai International Inc (BNZI) Forecast page.

The consensus among brokerage firms rates Banzai International Inc (BNZI, Financial) with an average recommendation of 2.0, signaling an "Outperform" status. This rating is derived from a scale where 1 represents Strong Buy and 5 indicates Sell, highlighting investor expectations for the stock's performance.