- Cboe Global Markets demonstrates robust growth with notable trading metric achievements for June 2025.

- Analyst consensus indicates a "Hold" on CBOE with marginal downside potential from current pricing.

- GuruFocus metrics project a significant deviation from the current market valuation.

Cboe Global Markets (CBOE, Financial) has reported remarkable expansion in its trading metrics for June 2025. A standout achievement includes the S&P 500 Index options reaching a new quarterly average daily volume of 3.7 million contracts. Furthermore, the SPX zero-days-to-expiry options have set a monthly record with 2.2 million contracts, underscoring the company’s strong market presence and investor engagement.

Wall Street Analysts Forecast

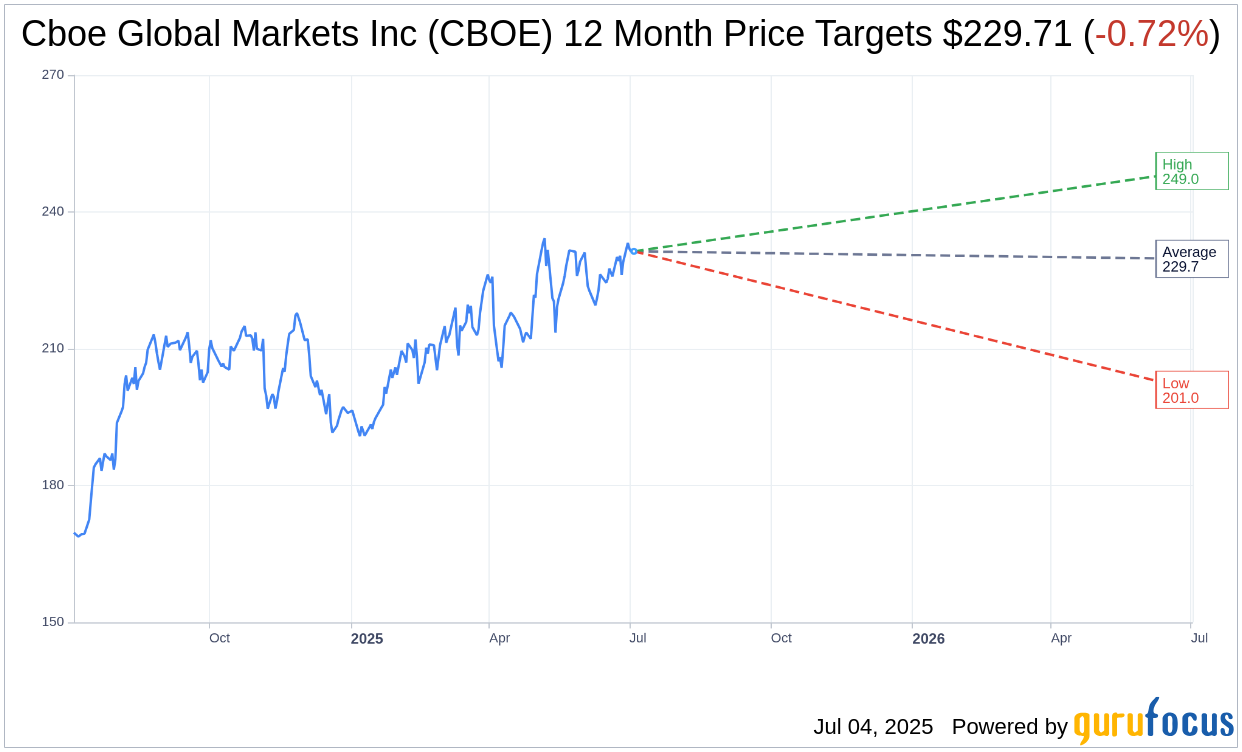

With insights from 14 analysts, the average one-year price target for Cboe Global Markets Inc (CBOE, Financial) stands at $229.71. This includes a high projection of $249.00 and a low of $201.00, suggesting a minor downside of 0.72% from the current price of $231.37. For a more in-depth analysis, visit the Cboe Global Markets Inc (CBOE) Forecast page.

Collected recommendations from 19 brokerage firms place Cboe Global Markets Inc's (CBOE, Financial) average rating at 2.9, categorizing it as a "Hold." This rating falls within a scale of 1 to 5, where 1 corresponds to Strong Buy and 5 to Sell, reflecting investor sentiment on the stock.

According to GuruFocus estimates, the projected GF Value for Cboe Global Markets Inc (CBOE, Financial) after a year is $105.33. This indicates a potential downside of 54.48% from the current trading price of $231.37. The GF Value represents GuruFocus' assessment of the stock's fair trade value, derived from historical trading multiples, past business growth, and future business performance forecasts. For further details, explore the Cboe Global Markets Inc (CBOE) Summary page.